Why VCs will continue to build successful global tech companies

advertisement

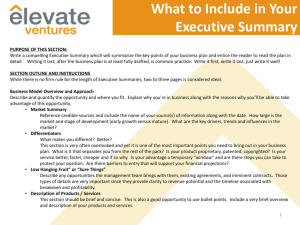

Moving forward in tough times - Why VC’s will continue to build successful global tech companies. Growing Galileo 2009 Brussels 28 January 2009 Georges H. Noël, EVCA Director About EVCA • Established in 1983 and based in Brussels • Represents the European private equity and venture capital industry (PE/VC) and promotes the asset class within Europe and throughout the World • 1,300 members in over 55 countries, representing more than 80% of European PE/VC Assets under Management PE/VC fund management companies Institutional investors (banks, pension funds, insurance companies, family offices, endowments, foundations...) Professional advisors (lawyers, auditors, placement agents, investment bankers...) National (European) Trade Associations • Activities: Professional Standards, Public & Regulatory Affairs, Research, Publications, Training, Conferences & Networking events • Team 40 people based in Brussels and Bucarest (Statistics) Agenda • • • • • • • About EVCA Mission of Venture Capital A few key data & recent developments Key success drivers to build global leaders What is the profile of target companies? What is the added value provided by VC’s? Conclusions A key “Mission” of Venture Capital is to finance companies developing emerging or breakthrough technologies and develop those companies over a longer term (up to 5-10 years) What has been achieved so far by European VC’s? During the 8 years from 2001-2008 €57bn equity has been invested into 21.320 technology companies e.g. an average of €2,7m per company Recent Developments on the VC Market I • In 2008 217 VC Funds raised $49bn worldwide (out of 768 PE funds raising $553bn) of which European VC’s raising some 7$bn • Currently in early 2009 483 VC’ funds are targeting $97bn • Despite the financial turmoil 29% of institutional investors intend to increase allocation to PE/VC and 67% to maintain current levels • Fundraising becomes growingly global: 2.600 active investors in PE/VC funds from 72 countries • Most of portfolio companies of VC funds continue to perform well Source: Prequin / EVCA Desk Research Recent Developments on the VC Market II 100% equity, zero debt and fast growth characterize our business and explain why VCs are much less affected by the financial crisis than other financial institutions. 3 Key challenges for VCs impacting also the tech companies: Fundraising: • • Extremely difficult in S2 of 2008 and expected to continue in 2009 Banks, some insurances and some pension funds are affected by liquidity squeezes. Rapid Internationalization (fund raising and portfolio level). e.g. Earlybird, Germany €130m, 2 lead investors Abu Dhabi Investment Authority, U.A.E. and Osaka Gas, Japan. Exits: • Industry challenged by market conditions with IPO markets closed and weak M&A market due to the financial turmoil. • Only exceptional trade sales delivering cash to investors • Holding periods have risen => pressure on reverves of funds built for 10 years life Lack of patient capital (from 10 years to 15 years): 8 to 15 years to build a business. Often imperatives for early returns, and premature exits as a barrier to reach maturity. Recent Developments on the VC Market III Investments: • Low entry prices which makes the outlook for investment excellent (Vintage years 2009 and 2010). • Trend to focus on larger & later stage investments. Pressure by LP’s on holding periods in order to realize cash returns • Funds which have closed in 2007/08: Focus on follow up investments on most promising companies in the portfolio. • Lack of patient capital (from 10 years to 15 years). 8 to 15 years to build a business. Often imperatives for early returns, and premature exits as a barrier to reach maturity. • EU VC firms have achieved some key successes: Skype, MySQL, Q.Cells, Ersol, CSR, etc. What is driving European Venture Capitalists over the next decade? • Core technology expertise • Global consumer markets • Large localized markets • Central & Eastern European development • Regulatory environment for VC ecosystem moving in the right direction • • Strong IPO market in “normal” years Global M&A opportunities Financial Markets Innovation Drivers Entrepreneurial Spirit • High profile successes • Entrepreneurial activity • Clusters • Serial entrepreneurship What are the key success drivers for building a global leader? Aspiration Experience Business model Access to networks Source: London Business School / EVCA Pyramid of Success: VC‘s and Entrepreneurs Reputation External Resources Experience • • • Investment experience Industry experience Entrepreneurial experience Aspiration • • Building scalable businesses Striving to grow international • • • Industry contacts Contacts to investors Other contacts, e.g. headhunters Business Model • • • • Funding strategy Investment preparation 100 day strategy Time allocation - 11 What are Venture Capitalists looking for? VC - focus on high growth potential companies only: Management team Market potential Industry and previous entrepreneurial experience Balanced management team with complementary skills Management experience Ability to develop an exit strategy & to grow the company towards it High growth, competitive products and services Accurate market size with real growth potential Company processes & status Good strategic and financial planning, or ready to implement it The right tools and information systems to provide management and investors with timely and relevant data transparent legal structure Source: EVCA Barometer May 2005 Satellite / Space related sample investments by VC’s • iOpener (D-NL - mapping real-world competitions): first VCbacked ESA spin-off by Triangle Venture Group - €4,1m – 2006 Galileo Masters Winner • 21Net (UK – broadband internet access to Thalys high-speed trains): Octopus Ventures - £1,5m • Ip.access (UK – 3G femtocell system ): Amadeus Capital Partners, Scottosh Equity Partners, Rothschild Gestion, Intel Capital, Cisco, Motorola Ventures, ADC - $10m What is the Added Value typically provided by a VC? • • • • • • • • • • • Partnership sharing risks and awards within the framework of a pre-negotiated contract Smart & patient capital to build global leaders Professional Corporate Governance standards Strategic advise and support through active board membership High-performance management standards Extended network Increased visibility and standard with investors, suppliers, clients, head-hunters, potential managers, co-investors Advise and support in times of crisis Assistance with subsequent financing transaction Definition of an exit strategy Alignment of interests between managers and VC So in conclusion why VC’s continue to be bullish in the macroeconomic backdrop? • Europe’s Innovation quality and world class technology • Growing strength of the European entrepreneurial base • Growing maturity of the European VC Ecosystem • Europe’s VC industry has sufficient dry-powder available • Lesson from the past: down-cycles are producing the best historical vintage years) Thank you! For more information: www.evca.eu or georges.noel@evca.eu