ENSO Business Planning and Project Appraisal

advertisement

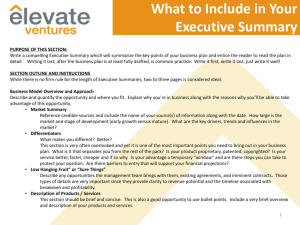

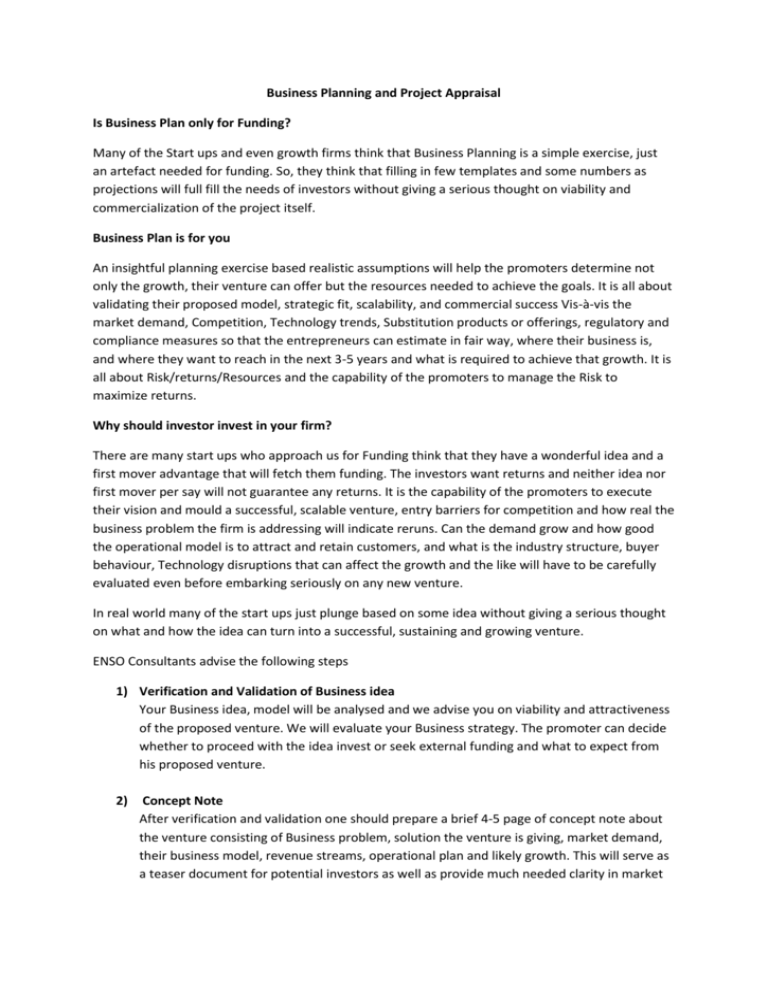

Business Planning and Project Appraisal Is Business Plan only for Funding? Many of the Start ups and even growth firms think that Business Planning is a simple exercise, just an artefact needed for funding. So, they think that filling in few templates and some numbers as projections will full fill the needs of investors without giving a serious thought on viability and commercialization of the project itself. Business Plan is for you An insightful planning exercise based realistic assumptions will help the promoters determine not only the growth, their venture can offer but the resources needed to achieve the goals. It is all about validating their proposed model, strategic fit, scalability, and commercial success Vis-à-vis the market demand, Competition, Technology trends, Substitution products or offerings, regulatory and compliance measures so that the entrepreneurs can estimate in fair way, where their business is, and where they want to reach in the next 3-5 years and what is required to achieve that growth. It is all about Risk/returns/Resources and the capability of the promoters to manage the Risk to maximize returns. Why should investor invest in your firm? There are many start ups who approach us for Funding think that they have a wonderful idea and a first mover advantage that will fetch them funding. The investors want returns and neither idea nor first mover per say will not guarantee any returns. It is the capability of the promoters to execute their vision and mould a successful, scalable venture, entry barriers for competition and how real the business problem the firm is addressing will indicate reruns. Can the demand grow and how good the operational model is to attract and retain customers, and what is the industry structure, buyer behaviour, Technology disruptions that can affect the growth and the like will have to be carefully evaluated even before embarking seriously on any new venture. In real world many of the start ups just plunge based on some idea without giving a serious thought on what and how the idea can turn into a successful, sustaining and growing venture. ENSO Consultants advise the following steps 1) Verification and Validation of Business idea Your Business idea, model will be analysed and we advise you on viability and attractiveness of the proposed venture. We will evaluate your Business strategy. The promoter can decide whether to proceed with the idea invest or seek external funding and what to expect from his proposed venture. 2) Concept Note After verification and validation one should prepare a brief 4-5 page of concept note about the venture consisting of Business problem, solution the venture is giving, market demand, their business model, revenue streams, operational plan and likely growth. This will serve as a teaser document for potential investors as well as provide much needed clarity in market and competitive positioning. What is important here is how well you pitch your Business story so that it makes sense and attracts investors. 3) Business Planning This is a detailed exercise to give a shape to your idea and how you can turn your idea into a successful venture and what is needed for that. You need to elaborate your Business Problem/Solution, Process, Customer segment, Market opportunity, Market Analysis, Competitors, positioning, Revenue streams, Growth potential, your organization structure, Technology, Resources, Infrastructure, Compliance, expansion plans, Capital needed, use of funds. The investors want a scalable business and an exit path in say 3-5 years time. The Risk/Returns and your differentiation compared to other players will be evaluated by potential investors. Hence care should be taken to analyze every function, Operational model and growth story and seeking the help of consultants or subject matter experts should be done to refine the plan and strategy. 4) Financial Plans Typically Investors want to see a 5 year projections on Revenues, Expenses, Profitability, P/L, Balance sheet, Cash flow, Functional plans (Sales, R&D etc) to determine how well the idea can turn into financial results and is it Realistic and achievable? Also they want to get an idea on business value to decide quantum of investments and likely returns they can expect. It is better to seek the help of professionals in this exercise as some fine tuning is always needed to match with the nature of funding like Debt/Equity/Seed/Angel/Friends/Crowd funding or sometimes internal generation. This will act as your Goal sheet to direct your energies and you will be able to draw your operational plans, Quarterly plans, short term loans, working capital and returns on assets. 5) Elevator Pitch This is a brief presentation of 12-15 slides in which you should be able to exactly describe your venture and present to investors. Only 5-10% of new start ups attract and get funding and you may just get 15 minutes to impress an investor. After the preparation of Business plan you may have to condense your story into a 15 slide pitch. When you complete the steps you can be fairly sure of your prospects of getting funded, how to position your business, key factors for success and how to deal with potential investors. Remember the Funding Process takes about 4-9 months depending on the project and the above is the first step. There will be Due Diligence, Personal interviews, Negotiations, Term Sheet, phases of funding and terms and conditions. So, it is important for your firm to understand the above process and seek external help wherever required.