CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

CUSTOMER_CODE SMUDE

DIVISION_CODE SMUDE

EVENT_CODE OCTOBER15

ASSESSMENT_CODE MA0044_OCTOBER15

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

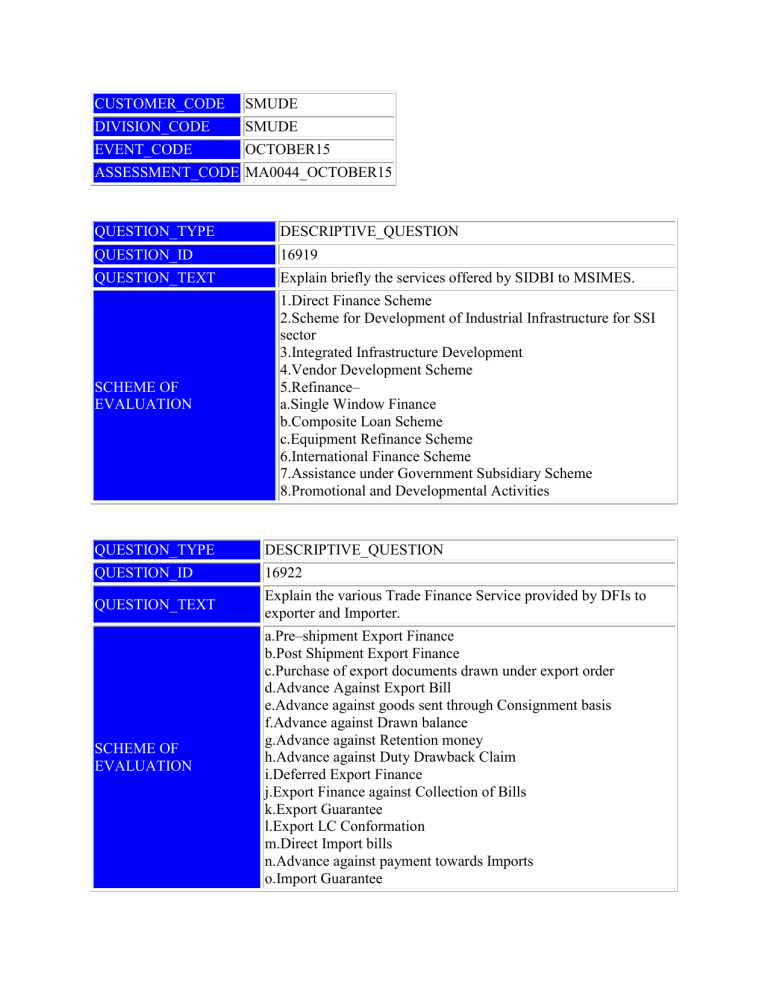

DESCRIPTIVE_QUESTION

16919

Explain briefly the services offered by SIDBI to MSIMES.

1.Direct Finance Scheme

2.Scheme for Development of Industrial Infrastructure for SSI sector

3.Integrated Infrastructure Development

4.Vendor Development Scheme

5.Refinance– a.Single Window Finance b.Composite Loan Scheme c.Equipment Refinance Scheme

6.International Finance Scheme

7.Assistance under Government Subsidiary Scheme

8.Promotional and Developmental Activities

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

DESCRIPTIVE_QUESTION

16922

Explain the various Trade Finance Service provided by DFIs to exporter and Importer. a.Pre–shipment Export Finance b.Post Shipment Export Finance c.Purchase of export documents drawn under export order d.Advance Against Export Bill e.Advance against goods sent through Consignment basis f.Advance against Drawn balance g.Advance against Retention money h.Advance against Duty Drawback Claim i.Deferred Export Finance j.Export Finance against Collection of Bills k.Export Guarantee l.Export LC Conformation m.Direct Import bills n.Advance against payment towards Imports o.Import Guarantee

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

DESCRIPTIVE_QUESTION

16923

Explain the Challenges faced by Commercial Banks.

1.Business Related Risk

2.Global Finance Turmoil

3.Operational Challenges

SCHEME OF EVALUATION 4.Globalization

5.Basel II Implementation

6.Outsourcing Risk

7.Application of Advanced Technology

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

DESCRIPTIVE_QUESTION

73644

Briefly explain the role of financial institutions in economic growth?

Financial institutions contribute to economic growth in the following ways:

1. Capital formation

2. Mobilization of savings

3. Infrastructural facilities

4. Balanced economic growth

5. Generation of employment

6. rapid industrialization

(Any five contributions, carrying 2 marks for each)

QUESTION_TYPE DESCRIPTIVE_QUESTION

QUESTION_ID 73648

QUESTION_TEXT Write a note on SIDBI.

SCHEME OF

EVALUATION

The first DFI set up in India, exclusively for the benefit of small industries is SIDBI. SIDBI is an apex financial institution. SIDBI was set as a wholly owned subsidiary of IDBI under an act of parliament in 1989 for providing finance, directly to MSMEs and indirectly through financial intermediaries namely, commercial as well as co-operation banks SFCs, NBECs etc. (3 marks)

Refinance by SIDBI (1 mark)

Important schemes of SIDBI

1. Composite loans

2. National equity fund scheme

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

3. Debt restructuring mechanism

4. Setting up/development of Industrial estates

5. SIDBI venture capital ltd

6. technology devt, modernization fund (6 marks)

DESCRIPTIVE_QUESTION

73650

Narrate the challenges faced by DFIs in financing large industries i. inadequacy of finance ii. debt recovery iii. long moratorium period iv. non performing asset v. timely financial support vi. lack of good governance vii. change in political scenario viii. exchange rate functions.