View Presentation

advertisement

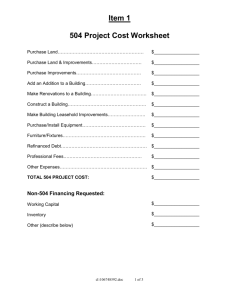

SBA Loan Programs for Small Businesses Mark Morales Vice President – SBA Division Pacific Mercantile Bank viimmm@ca.rr.com www.pmbank.com Small Business Administration (SBA) Loan Programs Designed to help small businesses meet their short term and cyclical working capital needs, export financing, long term capital needs and fixed asset purchases. SBA Loan Benefits An SBA Loan is simply a commercial loan to a business that is unable to obtain financing on a reasonable term through conventional channels. The SBA allows commercial lenders the flexibility and ability to be a little more creative or put another way approve a loan they would normally decline without the SBA guaranty. SBA Loan Program Targets • Exporters • Professionals (Doctor's, Dentist’s, CPA's, Lawyers, Engineers) • Manufacturers • Wholesalers • Retailers SBA CAPLines SBA CAPlines Program Working Capital CAPlines Revolving lines of credit based on eligible accounts receivable to finance short-term working capital needs Contract CAPlines Contract financing that will finance all costs associated with specific eligible contracts (excluding profit). May be revolving. SBA CAPlines Program Seasonal CAPlines Finance seasonal working capital needs. May be revolving. A 30-day zero balance is required annually. Builders Line Provides financing for small contractors or developers to construct or rehabilitate residential or commercial property that will be sold to a third party that is not known at the time construction/rehabilitation begins. Contract CAPLines • Eligibility – An SBA “small business” is one that: • • • • Operates “for profit” Has a net worth of less than $15 million and Has annual average 2 year net profit of less than $5 million Meets other criteria per SBA regulations • Maximum SBA loan amount is $5 million at one time (can have multiple loans) • Maximum interest rate – P+2.25% to 12 months; P+2.75% over 12 months (5.5% and 6% respectively) • SBA Guaranty fee is .25% of guaranteed loan amount for loans up to 12 months; per SBA schedule for loans longer than 12 months • Interest only due during contract period unless progress payments outlined Contract CAPLines – Use of Proceeds Proceeds can be used to finance all costs related to the specific contract, excluding profit). Contract CAPLine proceeds may NOT be used for: permanent working capital to acquire fixed assets to pay delinquent taxes to refinance existing debt to finance a contract in which significant performance has already begun for change of ownership floor plan financing to cover any mark-up or profit to finance the performance of another contract or sub-contract PURCHASE ORDER FINANCING Purchase Orders may be substituted for a formal contract, provided the following conditions exist: The purchase order is issued to the borrower under a Master Agreement; AND The combination of the PO and the Master Agreement constitute a binding agreement SBA CAPlines Program SBA International Trade Loan Program The International Trade Loan offers loans up to $5 million for fixed assets and working capital for businesses that plan to start or continue exporting. Eligibility • International Trade Loans are available if your small business is in a position to expand existing export markets or develop new export markets. These loans are also available if your small business has been adversely affected by import competition and can demonstrate that the loan proceeds will improve your competitive position. Use of Proceeds • The borrower may use loan proceeds to acquire, construct, renovate, modernize, improve, or expand facilities and equipment to be used in the United States to produce goods or service involved in international trade and to develop and penetrate foreign markets. Funds also may be used to refinance an existing loan. General Small Business Loans: 7(a) In FY 2014, the SBA’s flagship loan program, the 7(a) loan program achieved another lending record. By the end of the fiscal year (Sept. 30), SBA had approved 52,044 7(a) loans for nearly $20 billion, an increase of 12 percent in the number of loans and 7.4 percent in dollar amount over the previous year. SBA 7(a) Loan Program Eligible Use of 7(a) Loan Proceeds Include (Non-Exclusive): • The purchase of land or buildings, to cover new construction as well as expansion or conversion of existing facilities • The purchase of equipment, machinery, furniture, fixtures, supplies, or materials • Long-term working capital, including the payment of accounts payable and/or the purchase of inventory • Short-term working capital needs, including seasonal financing, contract performance, construction financing and export production • Financing against existing inventory and receivables. • The refinancing of existing business indebtedness that is not already structured with reasonable terms and conditions • To purchase an existing business Typical SBA Loan Program Criteria Conditions of the Applicant: • Nominal profitability past 3 years • • May have had a loss 1 of the 3 years but the most recent 12 months plus interim shows an upturn • Future repayment via projections • • Business needs to diversify operations to grow or to improve conditions caused by recessionary times • • • Personal credit may have received a few dings in the past due to unavoidable circumstances (medical, divorce, etc) but is now on the mend and explanation makes sense • Nominal collateral - secondary source of repayment modest Typical SBA Loan Program Criteria SBA Loans Cannot Be Used for These Purposes: • To refinance existing debt where the lender is in a position to sustain a loss and SBA would take over that loss through refinancing • To effect a partial change of business ownership or a change that will not benefit the business • To permit the reimbursement of funds owed to any owner, including any equity injection or injection of capital for the business's continuance until the loan supported by SBA is disbursed • To repay delinquent state or federal withholding taxes or other funds that should be held in trust or escrow • For a non-sound business purpose SBA 7(a) Term Loan Program The SBA 504 Loan Program – Fixed Assets Loan limits have been increased to $5 million In addition to traditional real estate lending, including purchase, construction, improving or expanding owner-occupied commercial real estate, the program also provides for the financing of the purchase of major business assets 90% loan availability (as low as 10% down for multi-purpose commercial property) Repayment terms on real estate up to 25 years amortization with a 10 - 25 year maturity on a first trust deed, up to 20 years fully amortized on the SBA portion Repayment terms on equipment fully amortized up to 10 years What is the SBA 504 Program? • Partnership between a private lender and CDC/SBA • Provides up to 90% financing for owner occupied commercial real estate and eligible equipment • Fully amortizing 20/20 or 10/10 year term loans • Below market fixed interest rate • Bank interest rate on the first have a tendency to be issued at a lower than conventional offering SBA 504 Loan: Use of Proceeds A 504 loan can be used for: • The purchase of land, including existing buildings • The purchase of improvements, including grading, street improvements, utilities, parking lots and landscaping • The construction of new facilities or modernizing, renovating or converting existing facilities • The purchase of long-term machinery and equipment A 504 loan cannot be used for: • Working capital or inventory • Consolidating, repaying or refinancing debt • Speculation or investment in rental real estate 504 Loan Structure 50% Bank 1st Trust Deed 40% CDC/SBA 2nd Trust Deed 10% Borrower down SBA 504 Owner Occupied Projects Purchase of existing building • Business must occupy 51% Purchase of existing building and improvements • Business must occupy 51% Construction of new building • Business must occupy 60% initially and 80% in 10 years Purchase of machinery & equipment • Useful life greater than 10 years Maximum Loan Amounts-SBA 504 • $5.0 million for standard projects • $5.5 million for Manufacturers or Production/Conservation Energy usage (must have all production facilities in the US) • The private sector participant (bank) in most cases does not have a loan ceiling in a 504 project. Their requirement typically ties to a maximum Loan to Value requirement not to exceed 70% for their portion of the debt package in a 504. • Projects can typically range from $250,000 to $15,000,000 to keep borrower injection at 10% of purchase Contact information Mark Morales Vice President – SBA Division Pacific Mercantile Bank 9720 Wilshire Boulevard Beverly Hills, CA 90212 310-766-0399 mobile mark.morales@pmbank.com viimmm@ca.rr.com