Convenience Benefits

advertisement

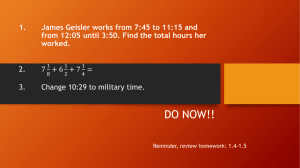

What is the major reason people work? Love of your job? To sharpen your soft skills? To meet new and exciting people? NO – to make money!!! Focus: How to calculate different types of pay? Chapter 8 section 2 Compelling Why! If you are to receive a salary, do you know how to calculate your gross pay for each pay period? What kind of information do you need? Hourly Workers? Are you entitled to overtime? How do you calculate OT? WAGES First 40 hours is at regular pay rate. Anything over 40 hours is at 1.5 Nonexempt employees receive overtime. Hourly wage example Jim worked 45 hours last week He makes $8.90 an hour What is his gross pay? Regular pay 40*8.9 = 356.00 Overtime pay 5*(1.5*8.9) = 66.75 Total gross pay 356.00 + 66.75 = $422.75 Now – you try… Hourly wage example Judy worked 52 hours last week He makes $11.90 an hour What is his gross pay? Regular pay 40*11.90 = 440.00 Overtime pay 11*(1.5*11.90) (1.5*11.90) = 17.85 17.85*12 = 214.20 Total gross pay 440.00 + 214.20 = $654.20 SALARY Exempt employees - No matter how many hours you work, you get paid the same amount each pay period. 52 weeks in a year If paid every two weeks If paid twice a month If paid once a month 26 pay periods 24 pay periods 12 pay periods Salary Sean’s salary is $42,500 a year What is Sean’s gross pay if he gets paid… every two weeks bi- monthly Once a month $42,500/26 $42,500/24 $42,500/12 $1,634.62 $1,770.83 $3,541.67 Commission Incentive to works because pay is directly related to the amount of work a person does Ie. Sales person and Production workers Commission Car Sales Person earns 9% commission for each car sold Sold 2 cars Car 1 - $21,790 Car 2 - $25,650 How much does the Salesperson earn? $21,790 + 25,650 47,440 x _ .09 $4,269.60 Base + incentive Jill works at Best Buy and has a bi-weekly salary of $1,000. She earns 3% of the merchandise she sells. She sold $6,000 in merchandise this pay period. What is Jill’s gross pay? $1,000 + (.03 x 6000) $1,000 + 180 = $1,180.00 Incentive Plans Profit sharing Workers receive a share of the company’s profits. Performance Bonuses Companies pay bonuses to workers who increase the quantity or quality of their work. Bell work Besides pay – what other expectations do you have from your employer when you get a full-time job. Fringe benefits Financial compensation in addition to wages and salary Can cost a company 20% to 40% of a employees salary to provide benefits ie an employee is paid $40,000 This employee’s fringe benefits could cost between $8,000 and $16,000 a year Common fringe benefits Life, health, dental, disability insurance Health insurance most costly and sought after benefit Profit-sharing & Pension plans Builds retirement funds Employers may also contribute Paid Vacations Personal Illness, and bereavement days Absences for the birth of a child Graphic Organizer Employee Compensation INCENTIVE PLANS •Bonuses •Stock options •Profit sharing BENEFITS •Health insurance •Retirement plan •Paid vacations •Convenience benefits PAYMENT •Salary • Overtime •Hourly wages • Commission Chapter 8 • Beginning a New Job Succeeding in the World of Work THOSE REQUIRED BY LAW Unemployment compensation Worker’s compensation Social Security Convenience Benefits Services that make worker’s lives easier flexible work hours fitness center On-site childcare What can you think of? Cafeteria Plan Not a benefit but a policy that lets employees chose the benefits they want. ie an employee may choose disability insurance over vacation time.