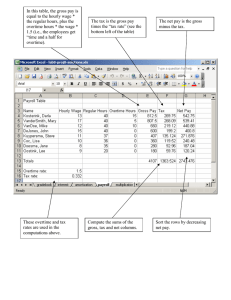

Gross Pay

advertisement

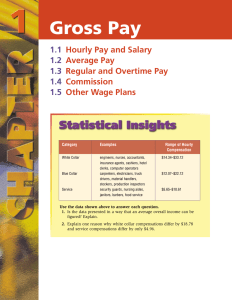

Chapter 1 Employee: those who work for others Employer: the person or company an employee works for. Hourly rate: a certain amount of money paid for each hour worked. Gross pay: total amount of money that an employee is paid. Also called gross wages, total earnings or total pay. ◦ Gross pay= Number of hours worked x hourly rate A: ◦ G= 46 x $7.50 ◦ G= $345 B: ◦ G= 25 x $16.25 ◦ G= $406.25 C: ◦ 5x8=40 hours ◦ G= 40 x $18.75 ◦ G= $750 D: ◦ 8+6+7+6+5=32 ◦ G=32 x $9 ◦ G=$288 Overtime: time worked beyond the regular working day or week. ◦ Regular working day: based on an 8 hour day ◦ Regular work week: based on 40 hours Time-and-a-half: overtime pay that is calculated by multiplying regular rate by time-and-a-half (1.5). ◦ 1.5 x regular pay rate (do NOT round) Double-time pay: earning twice your regulartime pay rate for working OT or weekends/holidays. ◦ 2 x regular pay rate (do NOT round) E: ◦ $7.51 1.5 x $7.51=$11.265 2 x $7.51=$15.02 ◦ $8.76 1.5 x $8.76=$13.14 2 x $8.76=$17.52 ◦ $13.67 1.5 x $13.67=$20.505 2 x $13.67=$27.34 F: ◦ 1.5 x $11.25= $16.875 ◦ 2 x $11.25= $22.50 G: ◦ ◦ ◦ ◦ ◦ M-9.75, T-8, W-6, TR-8.5, F-8 Regular hours: 8+8+6+8+8=38 OT hours: 1.75+.5=2.25 hours Regular pay: 38 x $13.69 =$520.22 OT pay rate: 1.5 x $13.69=$20.535 ◦ OT pay: 2.25 x $20.535=$46.20 ◦ Gross pay: $520.22+$46.20=$566.42 H: ◦ ◦ ◦ ◦ ◦ ◦ ◦ 45.3+8.1=53.4 hours worked Regular hours: 40 OT hours: 13.4 Regular pay: 40 x $17.50=$700 OT pay rate: 1.5 x $17.50=$26.25 OT pay: 13.4 x $26.25= $351.75 Gross pay: $700+$351.75= $1051.75 Salary: a fixed amount of money for each pay period worked. ◦ Get paid the same regardless of how many hours they worked. ◦ They don’t get paid OT even if they work more than 40 hours a week. ◦ They get paid the same even if they are absent from work if approved by employer. ◦ Typically earn more money than hourly employees, have more education and skills required. Commission ◦ Some salespeople earn a commission instead of a fixed salary or hourly pay. ◦ May be an amount for each item sold, or it may ne a percent of the dollar value of sales. ◦ Sometimes a salary + commission may be earned. Straight commission ◦ Salespeople who earn money only when they sell stuff. Commission = quantity sold x rate of commission When the rate of commission is a percent, multiply the amount of sales by the rate to find the commission. Commission=sales x rate of commission Quota: a fixed amount of sales that a person may be required to meet before receiving a commission. Graduated commission: a salesperson’s rate of commission increases as their sales increase. Rate of Commission: ◦ Rate of commission=amount of commission/sales Piece-rate: when employees are paid for each item or “piece” they produce. ◦ Gross pay=# of pieces produced X piece rate Per diem: when employees are paid a fixed daily amount. ◦ These are usually temporary employees provided by temporary help agencies Gross pay= # of days worked X per diem rate Tip: an amount of money given to someone for services they provide. ◦ They are typically paid less than minimum wage. ◦ Tip amount= total bill X tip percent ◦ Tip amount = # of units x tip per unit