Salary vs. Hourly

advertisement

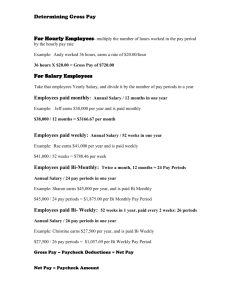

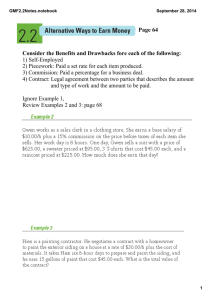

Salary vs. Hourly Is one better than the other? Employees • Workers are categorized not only by what they do, but also how they get paid. • One may be paid a salary, or one may be paid hourly. • Is one better than another? Salary • A salaried employee is paid based on an annual or yearly amount, called a salary. • The salary is divided among pay periods (weekly, bi-monthly, or monthly). Usually this is based on a 2,080 hour year. • 2,080 hours is 40 hours per week for 52 weeks per year. Salary • Salaried employees are not required to sign a time sheet or otherwise to account for their time. They get paid not on hours worked but on that overall salary, so if a salaried employee works more or less than a "normal" 40-hour work week, that is not documented by the employer. Hourly • An hourly employee is paid based on an hourly amount. • They are paid for the hours that they work. • The employer determines the hours for an hourly employee each week. • Hourly employees must document their work by using a time card system or completing a time sheet, which the employer verifies. Hourly • Employees who work less than fulltime are considered parttime, and they may have different pay rates, benefits, and paid time off than full-time hourly employees. Examples • A salaried employee is paid $20,000 a year. This salary is divided by the number of pay periods in the year to determine the salary for each pay period. If salaried employees are paid monthly, this employee would receive $1666.67 a month. Examples • An hourly employee is paid $9.62 an hour. To find this employee's pay amount, the hourly rate is multiplied by the number of hours worked in a pay period. ($9.62 X 2080 = $20,009.60) • For calculation purposes, a salaried employee is determined to work 2080 hours a year (52 weeks times 40 hours a week). So, in the examples, the $9.62 an hour paid to the hourly worker is roughly the same as the $20,000 annual salary paid to the salaried worker. Overtime Pay • If an hourly employee works more than 40 hours a week, they may be eligible for overtime pay (federal law). • State laws also regulate when overtime may be paid and the rate of pay. • An employer is always allowed to pay overtime more generously to hourly employees. Example Time Card with Overtime Example • Q: If an hourly employee works 50 hours one week (which is 10 hours over-time), and gets paid $10 per hour and time and a half for over-time pay; what is his gross pay for the week? • A: 40 hours X $10 per hour = $400 • 10 over time hours X ($10 X 1.5) = $150 • $400 + $150 = $550 gross pay for the week Gross Pay vs. Net Pay • Gross pay is the amount of pay before withholdings (taxes withheld by the federal and state government). • Net pay is your take-home pay. The amount that your paycheck is written to you for (this is after taxes have been taken out). Your Turn • 1. Jen worked 48 hours last week. She makes $22/hour and earns time and a half over 40 hours. What is her gross pay for last week? • 2. Carl earns $14/hour. His work schedule last week is as follows: Mon. 8am-4pm, Tue. 8am6pm, Wed. 7am-4pm, Thurs. 8am-7pm, Fri. 8am-6pm. Carl does not get paid for his 1 hour lunch break each day and earns time and a half for any hours worked over 40. What was his gross pay last week? Your Turn • 3. Kim is a salaried employee and earns $42,000 per year. Based on a 2,080 hour schedule and a bi-weekly pay period, what is the gross pay of each of her paychecks? • 4. Aaron wants to figure out how much he earns hourly if he makes $80,000 per year, and works 50 weeks per year and 50 hours per week. What is his gross hourly wage? Answers • 1. $22 X 40 hours = $880 (1.5 X $22) = $33 per hour (time and a half) $33 X 8 hours = $264 $880 + $264 = $1,144.00 gross pay • 2. Remember he doesn’t get paid for lunch. •$14 X 40 hours = $560 Mon= 7 hours Tue = 9 hours Wed = 8 hours Thurs= 10 hours Fri = 9 hours Total Hours = 43 Hours •$21 x 3 hours = $63 •(1.5 * $14 ) = $21 •$560 + $63 = $623 gross pay • 3. $42,000 / 26 paychecks per year = $1615.38 • 4. $80,000 / 50 weeks per year = $1600 per week $1600 / 50 hours per week = $32 per hour