Banking Industry

advertisement

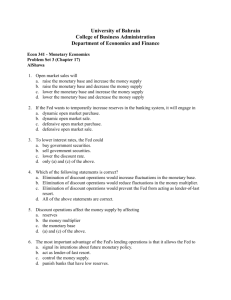

Banking Industry Features of U.S. Banking Industry • many banks / many sizes • Dual banking system • Three major crises – Great Depression – S&L crisis in the 80s – Housing crisis 2008-9 • Trends: – continual financial innovation – consolidation – more fee generating services – integration of financial services Some History • City vs. Country battle – Gold vs. Silver – Wizard of OZ / Cross of Gold • Fed was not established until 1913 – rural states concerned about econtrol by big city bankers. – JP Morgan bailed out the U.S. • McFadden Act (20s) – outlawed cross state banking – limited control of a single bank More History • Great Depression – bank failures – stock market crash, lost savings • FDIC created • Glass-Steagall Act separated commercial banking from – investment banking – securities brokers – insurance Glass-Steagall was punishment of big banks. Bank Consolidation • Traditional banking in decline – Regulation Q (1970s) – Mutual Funds – Junk bonds • Consolidation despite McFadden – Holding companies – ATMs • Riegle-Neale, 1994 finished the job, interstate banking OK • Pros: – less transactions cost – lower risk • Cons: – small, local banks may not survive – new huge bank might engage in risky behavior Repeal of GS • Gramm-Leach Bliley Act (1999) repeals Glass-Steagall – State Farm takes deposits – Banks can make investments – Holding companies can have different financial firms. • Investment banks (What?) Financial Innovation • Always happening - banks try to increase profits • Old type: foreign bond funds • New type: derivatives / junk bonds / CDO / SIV • All these fill a market void. – derivatives allow farmers to hedge against low prices – junk bonds allow financing for troubled companies • Potential problems – investors don’t fully understand the risks – regulators are a step behind (CDS) Banking Regulation • FDIC – deposit insurance up to $250,000 • Prevents runs – deals with failed (insolvent) banks • insurance payoff (dissolution) • finds a new partner, purchase and assumption method • Creates incentives for banks to take on more risk – moral hazard – Less depositor vigilance • More regulation is needed (!?) Asymmetric information • Insured banks tend to be riskier - MH • AS - crooks become bankers Sometimes FDIC does more: “Too big to fail” creates similar incentives MH and AS between regulators and bankers. Regulations • Capital requirements – min leverage ratio/max EM • Disclosure regulations – Show balance sheets – standard accounting practices • Consumer protection (CRA) – anti-discrimination – standardized contracts Chartering Banks chartered by the • Comptroller of the Currency (Treasury) for national banks • State agency • helps w/ AS problem • Banks also file periodic call reports Examination • National Banks – Comptroller • State banks – Fed – state agency • CAMELS ratings • Basel accords – Uniform banking regulation – Asset quality Dodd – Frank (2009) • • • • • OTS eliminated Consumer Protection Agency Research & Macro oversight Insurance regulation Standardized – CDS – MBS etc. • Many other provisions Nothing about TBTF S&L crisis of the 80s Causes: • lower profits • higher risk • little oversight Profit squeeze • Regulation Q – hard to attract funds • Mutual funds • Interest rates rise More causes Risky assets • Junk Bonds • Derivatives (innovations) • Real Estate Oversight • Depositors didn’t pay attention to risks – Higher deposit insurance – Brokered deposits • Regulation – S&Ls deregulated (1980) – Regulators had little expertise assessing risk of new assets Bank and S&L failures • Recession of early 80s • High interest rates – affected liabilities more than assets – Regulation Q phased out • Overinvestment in real estate – commercial buildings – High risk typical of large ventures • Large number of insolvent banks and S&Ls Role of Regulators • Regulators (FSLIC) let S&Ls continue to operate – Effect on S&Ls? • Huge Moral Hazard Problem – S&L engaged in extremely risky behavior (why not, they’re already dead) “Zombie S&Ls” Politics • S&Ls contribute to politicians who pressure regulators (Keating 5) • Politicians didn’t give regulators enough money • Regulators didn’t want to admit mistake Deal with it 1987 – Congress lends money to FSLIC, not nearly enough – more defaults 1989 – FIRREA, • eliminates FSLIC • creates OTS • restricted S&L asset holdings • created RTC to take over insolvent S&Ls and sell off assets – cost of $150 billion Dealing with it 1989 – FDICIA • FDIC’s insurance fund was running out of money • Congress lends them money • Mandate - FDIC must close insolvent banks using the least costly method available – counters moral hazard problem • Required regulators to assess capital/risk conditions of banks • Provided for Treasury dept. lending to regulators in times of crisis. S&L Debacle Summary • Initial crisis due to – squeeze on profits – increase in real interest rates ’79-’80 • Crisis extended because of weakness of regulators – under-funded – tended to use assumption method, in effect all deposits were guaranteed – politically influenced • FDICIA helps prevent future crises – mandates dealing w/ insolvency – mandates using the cheapest method – give financial backup to regulators Banking Crises The rule not the exception • Financial innovation is always occurring. • Regulators struggle to keep up. • Consequently – banks are regulated – regulators are regulated – enough regulation? Monetary Policy Institutions Federal Reserve • check clearing • Economic research / data • Regulates Banks – charters national banks and state banks that choose to join (about 1/3 of all banks) – approves bank mergers • Controls the Money Supply • Discount loans (original purpose) Structure of the Fed System • Board of Governors (Washington D.C.) – Chairman – appointed by president / confirmed by Senate – Board Members have 14 year terms – Chairman has a 4 year term • 12 Branch Banks • FOMC – Makes decisions on monetary policy every 6 weeks – 7 members of the board (including the chairman) and 5 branch presidents (always including NY) Tools of Monetary Policy • Reserve Requirement • Discount Rate/lending • OMO – decision of the FOMC – most important in practice – Chairman rules Fed Independence How? • Congress/President can’t fire Board members or dictate policy • Governors have 14 year terms and can be reappointed. • Fed has its own source of funds and budget. Fed Independence Why? • Avoid continual print & spend policy – excessive seignorage • Gov’t revenue from inflation – Fed can think long term – independence lowers inflation • avoid the temptation to print money before an election Fed Independence Arguments against: • too much power in too few hands • undemocratic • fiscal and monetary policy uncoordinated Fed Balance Sheet Assets: • Bonds • Discount Loans • Gold etc. • Foreign currencies Liabilities: • Reserves deposits from banks • Legal tender (green stuff) Very profitable business model. Money Supply Process Monetary Base or “High Powered Money” is MB = C + R (liabilities of the Fed) C – Currency in circulation R – Reserves Changes in MB lead to large changes M=C+D The Fed affects the MB through OMO and discount loans. OMO example Fed buys $100 in bonds from the banking system with its notes (cash). Change in Monetary Base? OMO purchase FED Assets Liabilities Bonds +$100 Notes +$100 Banks Assets Reserves +$100 Bonds -$100 Liabilities OMO example Fed buys $100 in bonds from the public w/ cash. The public holds $50 as cash and deposits $50 in the bank. Change in Monetary Base? What if public deposits $75? OMO purchase FED Assets Liabilities Bonds +$100 Notes +$50 Reserves +$50 Banks Assets Reserves +$50 Liabilities deposits +$50 OMO The effect of an OM purchase (or sale) • on reserves R – depends on how much is held as currency • on the MB – is the same as the amount of the purchase (sale) The Fed and the MB • To increase the MB the Fed buys bonds (or issues more discount loans). • To decrease the MB the Fed ….. Changes in M Why would a change in MB have a bigger change on M? • Part of an increase in MB will be an increase in Excess Reserves. • Some ER will be lent out and deposited again. Example of Deposit Creation • Fed buys $100 of bonds from Corp Z • Corp Z deposits the $100 at Bank A • Bank A lends you $50 cash How much has M changed? $100 in deposits and $50 in cash Deposit Creation Bank A Assets Liabilities Reserves +$50 Loans +$50 deposits +$100 MB rises $100 M rises $150 Money Multiplier Bank lending creates money. DM = m x DMB “change in” D- M = C + D the money supply MB = C + R the monetary base m – money multiplier Money Multiplier Bank lending creates money. DM = m x DMB “change in” D- m measures how much changes in MB affect changes in the total money supply similar to the multiplier from macro Multiple Deposit Creation •The Fed makes an OM purchase of $400 worth of bonds from Joe’s bank. •MB increases by $400 •Joe’s Bank lends it out •rD = 50%, •MB increases by $400 •Joe’s Bank lends it out •rD = 50% DM? Joe’s Bank Assets Bonds -$400 Loans +$400 Liabilities Multiple Deposit Creation •The money lent from Joe’s is eventually deposited in Bank A •Bank A lends its ER. If the rD = 50%, how much can Bank A lend? Bank A Assets Liabilities Reserves +$200 Loans +$200 Deposits $400 Multiple Deposit Creation •The money lent from Bank A is eventually deposited in Bank B •Bank B lends its ER Bank B Assets Liabilities Reserves +$100 Loans +$100 Deposits $200 Multiple Deposit Creation •The money lent from Bank B is eventually deposited in Bank C •Bank C lends its ER Bank C Assets Reserves +$50 Loans +$50 Liabilities Deposits $100 How much has the total money supply changed? Add the deposits Bank A Bank B Bank C $400 $200 $100 If this continues indefinitely, what’s the total change? Total change (D and M) = 400 + 200 + 100 + 50 +…. =400 + 400(0.5) + 400(0.5)2 + … =400(1 + ½ + ¼ + ….) 400(2) = 800 MB increases by 400, M increased by 800. The money multiplier m = 1/rD = 1/0.5 = 2 Money Multiplier M = m x MB m = 1/rD Lower reserve requirement implies - higher money multiplier - more powerful deposit creation process This formula for m assumes: • All ER are lent out • All loans are deposited (not held as currency) rD = 10% implies m = 10 Great Depression • Stock Market Crash – Depression – bank failures – no FDIC – bank runs • people held more cash • lower m and M. • Less credit available depression worsens • 1937 Fed raises rD – more reserves – Effect on M? The Fed and the MB • The Fed can closely control the Monetary Base. • In practice, they also have control over Reserves. • Changes in the MB have big effects on the money supply. Conduct of Monetary Policy Tools • OMO • Discount Loans • Reserve Requirement All affect Reserves (part of MB) which affects the money supply (dramatically). Analyze w/ S&D of R S&D of Reserves What’s the price of Reserves? iff Who demands reserves? banks Who supplies? banks and the FED Slopes of S&D for R same as for money. Determines equilibrium R and iff Discount Lending & Reserves • Banks can borrow reserves – from each other (at iff) – or take discount loans at iD. • If iff > iD where would banks go? • The supply curve for reserves becomes horizontal at iD • Is this a restriction on monetary policy? No, the Fed controls iD directly. Fed Policy and Reserves Q: If the Fed want to lower interest rates, show how they would use OMO to do it. (Assuming iff < iD) OMO affects the supply of reserves. Tools / S&D for Reserves • OMO shift Supply for Reserves left or right • Changes in the Discount Rate shift Supply up or down • Changes in the reserve requirement shift Demand Problem The federal funds rate is currently 2.75%. If the discount rate was 3.5%, draw the graph for the supply and demand for reserves. If the Fed decided to raise the fed funds rate to 3%, show how they could accomplish this with • reserve requirement • open market operations • discount policy If the Fed wanted to raise the fed funds rate to 5%, what would they have to do? Monetary policy in practice • Reserve requirement is fixed – rD=10% • The discount rate is adjusted to be above the fed funds rate. • Discount lending not actively used to change M. • Open Market Operations – primary tool – Fed sets iff – influences MB, M & interest rates and the economy Advantages of OMO • Easy to fine tune • Implement quickly • Predictable Discount Lending -still important • standing lending facility • Fed is the lender of last resort. • Loans to banks in danger of default (Continental IL) – Recently AIG • Helps FDIC with crises – prevent panics – Deal with large banks Black Monday • Stock market crash in 1987 • many brokerages were in danger of insolvency • Banks stopped lending to brokerages. • Fed guaranteed loans to brokerages. • Few failures. The Fed did not actually make any loans. Discount Policy • Used to avert panics and provide liquidity (graph?) • Allows Fed to indicate policy • Can have unpredictable effects on MB and M. Reserve Requirement • too powerful - possibly destabilizing • Have been eliminated in some countries (Switzerland) – higher bank profits • SWEEP accounts make them less relevant. Interest on Reserves • Fed now has the ability to pay interest on Reserves. – More control over R • Affect on S&D for Reserves? – min iff – Another kink in Supply • Similar to “corridor” approach used in New Zealand Problem • Draw a graph of the S&D for reserves when the interest rate on reserves is zero, and there is some discount lending. • Use the graph to show how the Fed could use OMO to lower the equilibrium fed funds rate. • What would the Fed have to do to raise the equilibrium fed funds rate? Goals of Monetary Policy • • • • low unemployment high (stable) growth low and stable inflation stable interest rates (smoothing) • stable financial and international markets • avoid deflation (recently important) Unemployment Should unemployment be 0%? No, 0% cyclical is the goal. “natural rate of unemployment” NAIRU Unemployment below the natural rate could cause wage and price inflation. What is it? Good Q. Inflation • High / variable inflation makes planning difficult. – Bad for consumer and businesses • Penalizes savers. • Hurts people on a fixed income. • Some inflation is OK, avoids deflation, allows real wage flexibility. Growth (GDP) • Strongly tied to unemployment. • Excessive growth can lead to inflation Goals can conflict. Example: Achieving low unemployment can lead to inflation. BUT long run – low inflation should help GDP/U Targets • Fed does not have precise control over its goals. • Ex: can’t specify a GDP growth rate • It has tight control over its Targets: MB, R, fed funds rate, discount rate Intermediate targets • It has indirect control over the Intermediate targets: – M1, M2, M3, longer term interest rates – Affected by targets – Provide info (Fed & public) Current approach • Primary tool: OMO • Primary target: fed funds rate • Intermediate targets: reserves, monetary aggregates and interest rates • Goals: – low stable inflation – high stable growth – smooth interest rates Fed does not have stated goals. Examples • If high inflation is the biggest problem, what does the Fed do with iff ? • What if a recession is the biggest problem? – lower rates – cheaper to borrow – helps business invest – housing Issues • Should Fed state growth / inflation targets • Should Fed concentrate solely on an inflation target (like ECB and others)? • How to avoid deflation? Q: Should the Fed respond to stock market/housing bubbles? Taylor Rule Rule on how to adjust iff iff responds to inflation and output gaps inflation gap – deviation from target output gap – deviation from the natural rate Taylor Rule y - output p - inflation y* - output target (potential GDP) p* - inflation target iff* - equilibrium real fed funds rate iff = p +iff* + 1/2(p - p* ) + 1/2(y - y* ) What does this mean the Fed should do if inflation and output are below their targets? 20 16 12 8 4 0 -4 60 65 70 75 80 85 TAYLORRATE 90 95 FFR 00 05 10 10 8 6 4 2 0 -2 90 92 94 96 98 00 TAYLORRATE 02 04 FFR 06 08 10 Review questions • Draw a graph for S&D for Reserves when there is no discount lending. The Fed makes a $100 open market bond purchase. – Show the change in the balance sheet for the Fed and the bank they purchased the bonds from. – Show the change in the graph. Review Questions • Show a graph of the S&D for Reserves when there is discount lending. Show and explain how the Fed could lower the Fed funds rate by changing the – Discount rate – Reserve requirement Review Question The recent crisis has increases banks desire to hold excess reserves. In response the Fed lowers the discount rate, which increases discount lending by $2000. Explain/show the changes in the following. – Balance sheets for the Fed and a representative bank – Supply and Demand for Reserves – The Monetary Base – Supply and Demand for Money – If the reserve requirement is 10%, what is the maximum change in the money supply? Macro View of Monetary Policy Aggregate Supply & Aggregate Demand CPI AS AD GDP Aggregate Demand Downward Sloping: As prices rise AD falls Monetarist Explanation: MV = PY • For fixed M and V • P rises then Y must fall More money used per transaction Changes in M shift AD Aggregate Supply Quantity firms produce at a given price level. As prices rise • Potential profits increase • firms produce more BUT: • Wages and input prices increase too. • What really changes for the firms? Aggregate Supply • Wages and input prices tend to remain fixed (sticky) – so AS slopes up – Short run • Long run – wages and input prices adjust along with output prices – AS is vertical – Output determined by “real factors.” • Quantity of labor • Quantity of capital • productivity • Recessionary gap – equilibrium GDP is below potential • Inflationary gap – equilibrium GDP is above potential What is wrong with each? How could the Fed act to cure each? Problem Use graphs for AS-AD and S&D of Reserves to show how the Fed would act to cure a recessionary gap. What does the Fed do in terms of OMO? What would happen to the money supply? Review Problem The equilibrium real fed funds rate is 2% and both inflation and output growth are at their targets of 2% and 3%, respectively. According to the Taylor rule, where should the Fed set the fed funds rate. Starting from the situation above, both output and inflation rise 1% above their target levels. What should the new fed funds rate be (according to the Taylor rule)? Show the change using graphs for • Reserves S&D (no discount lending) • Money S&D • AD & AS (show LRAS)