Chapter 1 and Chapter 5

advertisement

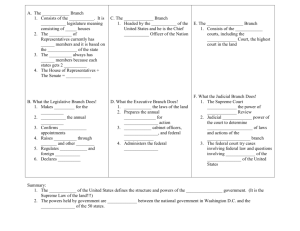

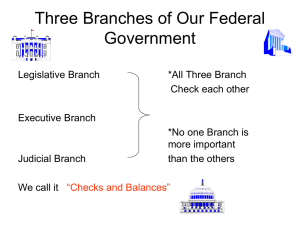

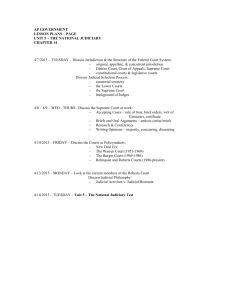

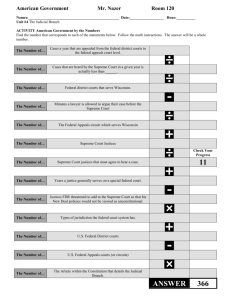

Chapter 1 Types of Taxes and the Jurisdictions that Use Them Definitions Tax = payment to support government contrast with fine/penalty or user fee Taxpayer = person or organization that pays tax (includes individuals and corporations) Incidence refers to ultimate economic burden of a tax. may not be person who pays tax Jurisdiction is the right of a government to tax. Tax formula Tax revenue = rate x base Rate can be flat or graduated (usually progressive) Base may change in response to changes in rate (see chapter 2) Describe by frequency of levy or purpose of tax Transaction (event) based taxes Sales or excise tax Estate or gift tax Activity based tax Income tax Earmarked taxes: social security, superfund State and local taxes Property (ad valorem taxes) Real property tax Abatements often granted to entice new business Personal property tax Household tangibles (vehicles), business tangibles, intangibles (securities) State and local taxes Sales/use Broad-based but, typically excludes necessities (food, drugs) Personal responsibility for use tax Effects of catalogs and internet purchases Excise tax – special rates Income tax (personal or corporation) Federal taxes Employment and unemployment taxes Excise taxes (luxury, sin, transportation, communication) Transfer taxes (gift, estate, generation skipping) Income taxes (individual and corporation) Foreign taxes Income taxes similar to U.S. Value added tax VAT like a sales tax on incremental value added by manufacturing. VAT is self-enforcing because taxpayer can claim a credit for VAT paid to supplier with proof of payment. Sources of tax law Sixteenth Amendment ratified in 1913 created income tax. Internal Revenue Code was created in 1939 and subsequently revised in 1954 and 1986. Statutory authority = Internal Revenue Code (Legislative) Administrative authority (Executive) Treasury regulations IRS Revenue Rulings, Revenue Procedures Judicial authority (Judicial) Supreme Court Appeal courts Trial courts (Tax Court, District Court) Research / Know your authorities Tax Legislation – Chart – How tax legislation generally occurs Sources broken down into two types: Primary and Secondary. Where do primary and secondary sources of tax material come from? Primary Sources Pie Chart Primary Sources of Tax Law - Legislative Internal Revenue Code Primary and most powerful source of Federal tax law unless a U.S. treaty conflicts (most recent item takes precedence) Congress can override a U.S. Supreme Court decision by amending the Code. Congressional committee reports found in cumulative bulletin are important in interpreting the code Citation of Code: Sec. #, subsection, paragraph, subparagraph, clause: Sec 162(g) (1)(A)(i) Administrative Sources of the Tax Law - Department of Treasury - Executive Regulations (Legislative, Interpretive, Procedural, Temporary - Interpretive in nature) Force and effect of law Numbered in same sequence as the Code with an preceding numeral indicating type of tax covered by the regs Revenue Rulings (pronouncement of IRS Nat’l Office) provide guidance to both IRS and T/P more restrictive Revenue Procedures:deal with IRS internal mgmt practices Other sources: letter rulings (proposed trans),determination letters (completed trans), Technical Advice Memoranda Judicial Sources - Primary Sources Findings have precedential value (except for small tax cases) Trial courts - Tax Court (do not pay the deficiency), District Court, U.S. Court of Federal Claims (pay first, sue for refund), Small Cases Division Appeals court - Regional Circuit, Federal circuit and Supreme Court (hear very few tax cases) All courts must follow SC decisions, not the case for circuits Tax Research – Chapter 5 Research is a process of finding a professional conclusion to a tax problem (may involve completed or proposed transactions). Procedures; Establish the facts Identify the issues Locate the authority (primary preferred) Evaluate the authority Develop conclusions/recommendations Communicate the recommendations to the client Technological Advances in taxes Personal computers - facilitate use of tax research software, tax research services, tax prep software On-line services facilitate up to date research information. World wide web - provides access to a multitude of tax planning and compliance resources