Future Trends - Lieber & Associates

advertisement

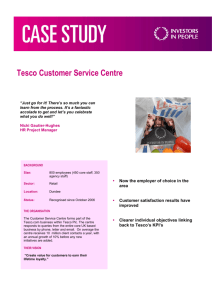

The Shape of Things to Come Martin Block Integrated Marketing Communications Northwestern University CADMEF/Chicago May 14, 2004 Contemporary Marketing World • Data tsunami: POS, loyalty programs, accessible sales data, and customer databases • Management demands for accountability: Six Sigma, Balanced Scorecard and ROI • Measurement issue has shifted to senior management and CFO from marketing department (major change over the past few years) • Debate has shifted from the value of real sales data to the value of customer data • Questions continue about the value of traditional media measures Measuring Financial Returns Fundamental Integrated Marketing Communication Estimating the Baseline Units Store Level Data 18 16 14 12 10 8 6 4 2 0 Promotion A Promotion B Baseline 1 2 3 4 5 6 7 Weeks 8 9 10 11 12 13 Constructing Marketing Strategy Base Volume up Incremental Volume Up Incremental Volume Down Sustain Trade Promotion Building Program Base Volume Down Franchise Building Program Major Overhaul Kinked Demand Curve Total RTE per Pound • Direction of curve changes at the kink • Volume does not continue to increase as price decreases • Lowering price below the kink means lost revenue 350000 300000 250000 Lost Revenue Kink 200000 150000 100000 Below $3.25/lbs 50000 0 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.50 Price Promotion Response Model Store Level Data 550 500 450 Sales Volume 400 350 300 Average Discount TPR 15% Feature 19% Display 10% Both 24% 250 200 150 100 5 10 15 20 25 30 35 Percent Price Discount TPR Feature Display Both 40 45 RTE Household Purchases • Category very skewed to heavy users (15% of customers buy 40% of the volume) • RTE Usage: One time buyers (1 purchase in 6 weeks), light buyers (2 purchases), regular buyers (3 and 4 purchases), heavy buyers (5 or more purchases) 300000 250000 Households 200000 Heavy Users Top 15% 150000 100000 50000 0 1 2 3 4 5 6 7 8 9 10 11 Number of Items in 6 weeks 12 13 14 15 16 Distribution of RTE Usage Percent Volume Percent Customers Ratio One Time 13.1 36.1 36.3 Light Buyers 19.7 27.1 72.7 Regular Buyers 26.7 21.5 124.0 Heavy Buyers 40.4 15.2 266.3 RTE Usage by Household Characteristics • • • RTE usage highest among households with 4 to 10 and 11 to 17 aged members. Heavy buyers have larger households. Regular and heavy buyers spend more on RTE, spend more at the chain, and shop at more different chain stores (8.6% of heavy buyers shop at 2 or more). HH Size Income One Time 3.6 54.8 Light Buyer 3.8 54.7 Regular Buyer 3.9 Heavy Buyer Total Market Shop 2+ Stores RTE $ Total $ 3.54 60.12 2.5 6.97 86.05 55.8 6.6 11.88 144.10 4.3 57.5 8.6 25.31 270.57 3.8 55.4 3.4 9.57 117.19 Basic R-O-C-I Process Loyal Users Switchers Price Buyers 1 Present Income Flow in Category $ $ $ 2 Share of Requirements % % % 3 Customer Income Flow to Brand $ $ $ 4 Contribution Margin % % % % 5 Contribution Margin $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 12 Difference in Contribution Margins With and Without Brand Communication $ $ $ 13 Incremental Gain or Loss $ $ $ 14 Return On Investment % % % 6 Income Flow Without A Brand Communication Program 7 Contribution Margin Without A Brand Communication Program 8 Income Flow With A Brand Communication Program 9 Gross Contribution Margin With A Brand Communication Program 10 Brand Communication Investment 11 Net Contribution Margin Measuring Financial Returns • Basic ROCI Process is fundamental to IMC • Must be based on real data • Must be strategic—Marketing communication activity must be related to short and long term changes in base and incremental sales Rise of the Retailer Tesco Story and Loyalty Programs History of Loyalty Programs • Loyalty Programs started in the 1950’s • Sperry and Hutchinson Co. developed the first program known as the Green Stamp • Attracted customers to the store and inspired purchases and lost effectiveness due to “excessive” use • Point-of-sale data combined with the frequent shopper card the contemporary method. – Use of loyalty programs and frequent shopper cards may becoming excessive. – Retailers and manufacturers must find a unique use of the loyalty program and collected data to be distinguished from their competitors. – Question of how the collected data should be used Loyalty Program Customer Statistics • 80 percent of the retail profit comes from 20 percent of the retailer’s customers • Top customers generally buy higher-priced items • Bottom 20 percent tend to purchase items on discount only and contributed little to the stores profit • Average number of Loyalty Cards held by one customer is 3.2 • Only 20 percent of the U.S. population shop exclusively at one store and over 50 percent shop at two stores The Tesco Success • Tesco share exceeded Sainsbury share after Clubcard launch • Turnover up 52% since the launch of Clubcard in 1995. • Floor space up only 15% Clubcard launched Food retailers’ market share in Britain Tesco Sainsbury’s Asda Tesco Safeway Source: IGD © Copyright,dunnhumby 2002 Feb 1995 2000 Each customer has a unique “dna profile” derived from the products they buy – “you are what you eat” © Copyright,dunnhumby 2003 Product DNA Typing: Each product is assigned “important to customer” attributes Value Oven Chips, 2.7 kg • • • • • • • • • • • • • • • • • • Big Box (+) / Small Box (-) Healthy Prepacked (+) / Loose (-) Fresh (+) / Longlife (-) Convenience Cooking from Scratch Branded (+)/Tesco Own Label (-) Kids Value Finest Foreign Green High (+)/ Low (-) Price Vegetarian Meat Adventurous Traditional Low Calorie (+) / High Calorie (-) © Copyright,dunnhumby 2002 1 0 0 -1 0 0 -1 0 1 0 0 0 -1 0 0 0 0 -1 We work with Tesco in many areas Database management Personal Relationships Media Effectiveness Pricing Strategy Format Development Customer Insight Shopping Analysis Better Ranging © Copyright,dunnhumby 2002 ... making data make sense ... Local Store Research Customer Acquisition Targeted Communication The Magnificent Seven •Our image of customers is built from seven pieces Lifestage Application form, what they buy Basket Typology Vegetarian, organic,You are what you eat! Profitability Primary Channel Brand choice, packaging preference, weight ofPreferred format (Supermarket, Express, On-line, purchase Petrol) Promotional Promiscuity Cherry picking deals, bulk buying to larder fill Brand Advocacy Participation in extensions (Tesco.com, Baby Club, Wine club) Shopping Habits Share of shopping, Recency & frequency •This is how our customers behave. •How do they see the products we want them to buy? © Copyright,dunnhumby 2002 Tesco communicates very smartly •Local store information •Clubcard Statement •Clubcard Magazine •Recipe Magazine •Bespoke mailings •Baby Club •Tesco.com •Clubcard deals – targeted and mailed frequently – targeted and mailed quarterly – targeted and mailed quarterly – targeted and retailed monthly – targeted and mailed ad hoc – targeted and mailed quarterly – targeted via the web - targeted via the magazine © Copyright,dunnhumby 2002 The Looming Retailer Battle • Retailer power will continue to expand • Some retailers will become their own media message delivery vehicles • The retail war will be between the “WalMart” logistical model and the “Tesco” customer data model Marketing Mix Models Managing Marketing Communication TRENDS IN CPG MARKETING MIX (As Percent of Sales) 23% Total Marketing Spend 11% Trade Promotion • • • 15% 5% 6% Consumer Promotion 6% 6% Advertising/ Media 1978 2000 4% Source: Donnelly Marketing; Accenture; Zipatoni, via Promo, March 01; IBM Strategy & Change analysis • • • • • Pressure for sales growth Explosion of scanner-based knowledge regarding price/promo lift Advertising impacts generally are not visible in syndicated scanner data Money follows knowledge/information Trade’s role in the mix has increased dramatically over time The “power of brands” has eroded To increase its share of budget, and revitalize brand equity, marketing communication decision making processes must leverage the data The Marketing Mix Modeling is born The CPG Industry Solution Shift marketing dollars toward mix elements and tactics that generate the strongest ROI The Problem "The pressure is on in most organizations because the chief financial officer is asking 'What are we getting for what we're spending’? How do I improve the return on investment?” Don Schultz Professor of Integrated Marketing - Northwestern University Generate Volume Growth Yield: VolumeDriven Profit Growth Hold Marketing Spending Flat The CPG Industry Solution Shift marketing dollars toward mix elements and tactics that generate the strongest ROI Marketing Mix Model Historical Sales Data Statistical Modeling Deseasonalizing Baselining Bump Analyses Marcom Spending Assumptions and Theories ROI Ten Year Financial Model Annual Sales Revenue by Year Short Term versus Long Term Predictive Year Short-term 1 2 3 Brand Equity 4 5 6 7 8 9 10 Growing Importance of Marketing Mix Models • Assembling sufficient disaggregate historical data still a challenge for most organizations • Determining synergistic effects and the value of IMC programs the analytical challenge • Importance of measuring long-term brand value as part of the model Time Budgets Tracking Media and Entertainment Average U.S. Time Budget in 1972 Minutes per Day Minutes 1. Main Job 225 Minutes 17. Study--Clubs 28 18. Television 92 2. Second Job 5 3. Work--Other 12 19. Radio 4. Travel to Job 25 20. Newspapers 5. Marketing 14 21. Magazines 6 6. Shopping Errands 18 22. Books 5 7. Cooking 44 23. Movies 3 8. Home Chores 58 24. Social Activity 63 9. Laundry 26 25. Conversation 18 3 26. Active Sports 6 10. Pets and Garden 4 24 11. Other House 24 27. Outdoors 2 12. Child Care 33 28. Entertainment 5 13. Personal Travel 31 29. Cultural Events 1 14. Leisure Travel 19 30. Resting--Naps 19 15. Eating 81 31. Other Leisure 20 16. Personal Care 69 Sleep 459 Time Spent with Media Hours per Week 25 Radio Broadcast TV 20 Cable and Satellite TV Recorded Music 15 Daily Newspaper Projection Magazines Books 10 Home Video Video Games 5 Internet 0 1997 Source: Veronis Suhler Stevenson 1998 1999 2000 2001 2002 2003 2004 2005 Shifting Media Consumption Patterns Hours/Week Annual Growth Projected Growth 2002 1997-2002 2002-2007 Radio 19.1 1.1 2.0 Cable and Satellite TV 17.6 8.0 2.3 Broadcast TV 15.1 -2.2 -0.7 Recorded Music 3.9 -5.3 -5.5 Daily Newspaper 3.4 -1.1 -0.9 Internet 3.0 43.1 7.1 Magazines 2.4 -1.6 -1.0 Books 2.1 -1.3 -0.2 Video Games 1.3 14.2 10.4 Home Video 1.1 3.7 11.1 Source: Veronis Suhler Stevenson The Changing Media Entertainment Environment • Media is question of time allocation for the consumer who can increasingly negotiate with the provider • Entertainment is the key to attracting and holding audience attention • Coming media technologies will accelerate the change • Media is increasingly consumed simultaneously and should be used with this in mind Demographic Shifts 18 to 34 Myth Demographic Targeting 18 to 34 Growth by age of population • For the projectable future, the share of population under the age of five and between five and seventeen will never be higher than it is today. • Growth in population over sixty-five will remain slow for the next decade and then increase, from 13% of the population to around 20% in 2030. • Eighty-five plus is most rapidly growing segment, doubling by 2025 and increasing by fivefold by 2050. • The median population age is older now than it ever has been (35.7 in 2000) and will continue to advance through 2050. 18 to 34 Target ? • CPM on Network TV – $23.50 for 18 to 34 – $9.50 for 35+ • People aged 50+ – – – – – • • • • • account for half of all discretionary spending watch more television (than young people) go to more movies buy more CDs YET are the focus of less than 10% of advertising In 1940, 6.8% were 65+, in 2000 12.4% were 65+ Real income with head under 30 fell 16% between 1973 and 1990 3 out of 4 men between 18 and 24 were still living at home in 1990 (largest proportion since the depression) Only 1 in 5 of “youth-oriented” Honda Civics are sold to those under 26 Brand loyalty of female household heads (Nielsen study) – 67% 18 to 34 are willing to change brands – 70% aged 35 to 64 Deciles 10 Customer groups defined by incorporating frequency of purchase with spending—REAL BEHAVIOR! Frequency 10 9 8 7 6 5 Gold 9 S p e n d i n g 8 Silver 7 Bronze 6 5 4 3 2 1 Tin 4 3 2 T a r n i s h e d 1 In one retailer, 19% of shoppers are classified as Gold, 20% as Silver, and 21% as Bronze Shoppers 25% 20% 15% 10% 5% 0% Gold Silver Bronze Tarnish Tin These 19% of Gold customers account for nearly 70% of total sales Total Sales Dollars 80% 70% 60% 50% 40% 30% 20% 10% 0% Gold Silver Bronze Tarnish Tin New Marketing Thinking • Markets must be defined in terms of real behavior to show financial return • The youth myth and mass demographic marketing need to be left in the past Thank you!