ECO 154/254

Intermediate

Macroeconomics

Prof. Michael B. McElroy

Multimedia by: Mannig J. Simidian

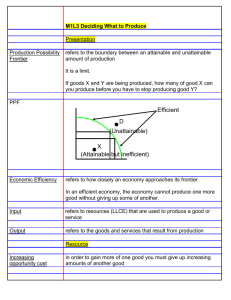

x2

x2a

x2b

x1a x2b x1

•

•

•

•

•

•

•

•

What is Scarcity?

The Production Function

The Production Possibilities Frontier

Opportunity Cost

Dynamics of the PPF: Economic Growth

Choice: Investment or Consumption?

Public vs. Private Spending

Summary & Exercises

What is Scarcity?

Allow me to introduce myself…I am Scarcityman the hero who will never fail to remind you that there’s

no such thing as a free lunch. You can’t get get away from scarcity; it is simply an inherent condition in

nature, that we all must endure. I am sure you have noticed that you can’t just have or produce

everything. Opportunity costs exist and we must constantly make choices. Decisions will always be

about “this or that”, not “this and that” and “now or later” not “now and later.”

No Free

Lunch!

Scarcityman won’t have to remind us to take our bitter pill, scarcity, we will constantly run

into it as we further our study of Macroeconomics. We will come to realize that scarcity exists for

everyone, rich or poor.

For the richer country, scarcity forces people to work instead of play. If

resources were not scarce, the people would pursue more leisure

activities like vacation.

For the poorer country, poverty and appalling

living conditions make scarcity a matter of life

and death.

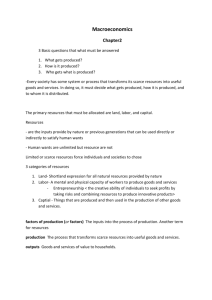

The Production Function

The production function is a process of transforming inputs (labor (n),

capital (k), institutional structure (inst) ) into outputs (final goods

and services for a certain time period).

The algebraic representation is:

y = F ( n, k, inst)

output

is

some function of

our given inputs

The Production Possibilities Frontier

(The PPF)

• Our goal in working with the PPF is to see the most output that can be produced given a certain amount

of inputs.

• So, first assume that as a nation, our inputs (n,k,inst) are fixed and we produce 2 goods, x1 and x2. In

other words, right now, we only have a certain amount of workers, and capital to work with and a certain

level of institutional efficiency within our society.

• Next, we’d like to determine what combinations of our 2 goods we could produce…so here we go.

Let’s say you decide to

produce this amount of goods x2 and x1.

x2

x2a

Remember that points

that lie outside the PPF,

are unattainable.

x2b

Remember

that points

that lie

inside the

PPF are

attainable,

but not

desirable.

x1a x1b x1

Or you could cut back on x2 and

increase your production of x1.

Opportunity Cost

The downward slope of the PPF depicts that the opportunity cost of producing more of one good is the amount

of the other good that must be sacrificed.

x2

10

units

A

Let’s say you are at point A, producing only good x2.

Suddenly you decide to produce some of good x1 without

reducing the production of good x2.

B

Uh oh…this is outside the

PPF, so you must reduce production of x2.

7

units

Notice that in order to gain 8 units of x1, you had

to give up 3 units (10-7) of good x2.

0 units

8 units

x1

Dynamics of the PPF: Economic Growth

Now, let’s suppose we can increase our inputs (n,k,inst). This

will shift out our PPF, making it possible to produce at a

higher PPF.

x2

PPF

This action is called

PPF

Remember that any points

that lie beyond even the higher PPF...

are still unattainable!!!

x1

9

measured in millions of dollars

Investment

Choice:

Consumption

or Investment?

A nation at point A is choosing “zero-growth”, that is, they

would rather consume right now, than invest and consume

more later.

C

B

6

0

A nation choosing point B shows more willingness to invest.

By investing more, the nation can increase its capital stock

and therefore experience an increase in their PPF in the future.

A

5

Consumption

measured in millions of dollars

8

10

A nation choosing point C is

investing even more and will see an even larger increase in their

PPF.

Consumption or investment?

There is no “better” choice, it just depends on whether one places a higher value on current consumption, than on

growth. Keep in mind that investment implies future consumption, so the decision is really about

when to consume.

measured in millions of dollars

Investment

9

C

A nation choosing point C, is said to have a

Low Rate of Time Preference.

B

6

5

Consumption

measured in millions of dollars

8

A nation choosing point B, is said to have

a High Rate of Time Preference.

Public vs. Private Spending

Public Output

The issue of Public and Private spending must also run into the boundaries set by scarcity. There is an

opportunity cost whereby more government output means less private output.

B

gB

gA

+Dg

Starting at point A, if the government decides

to increase public spending...

It must diminish private spending

and land at point B.

A

-D(c+i)

(c+i)B (c+i)A

Private Output

This is known as

Copyright 1997 Dead Economists Society

•

•

•

•

•

Historical Background

A Glimpse of Adam Smith

Market Clearing

A Visit to The Classical Factory: AS* and AD

Conclusions on the Classical Model

Historical Background

The Classical model of economics relates the standard supply-demand

analysis to the macroeconomy. It holds that wages and prices will be

“flexible” as opposed to “sticky.” Adam Smith’s Wealth of Nations

(1776) suggested that the economy was controlled by the “invisible

hand” whereby the market system, instead of government would be

the best mechanism for a healthy economy.

A Glimpse of

Adam Smith

The central thesis of The Wealth of Nations is that capital is best employed for the production and distribution of wealth

under conditions of governmental noninterference, or laissez-faire, and free trade. In Smith's view, the production and

exchange of goods can be stimulated, and a consequent rise in the general standard of living attained, only through the

efficient operations of private industrial and commercial entrepreneurs acting with a minimum of regulation and control by

governments. To explain this concept of government maintaining a laissez-faire attitude toward commercial endeavors,

Smith proclaimed the principle of the “invisible hand”: Every individual in pursuing his or her own good is led, as if by an

invisible hand, to achieve the best good for all. Therefore any interference with free competition by government is almost

certain to be injurious.

"Smith, Adam," Microsoft® Encarta® 96 Encyclopedia. © 1993-1995 Microsoft Corporation. All rights reserved. © Funk & Wagnalls Corporation. All rights reserved.

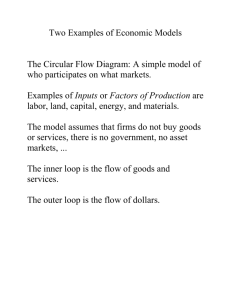

Market Clearing

Market clearing is an alignment process whereby decisions between suppliers and demanders reach an equilibrium.

Here’s how it works...

Let’s say you begin with an initial demand and supply curve for CDs.

Remember that the demand curve slopes downward meaning that as you increase the price (by moving along the demand curve), the quantity

demanded decreases. Conversely, the supply curve slopes upward implying that as the price increases (by moving along the supply curve), the

amount supplied will increase.

P

P´

P*

D

D´

S

The center point A is the place where

market decisions reach an equilibrium.

Now, suppose that there is a sudden

increase in the demand for CDs.

Demand will shift from D to D´.

B

A

Q* Q´

Q

The increase in demand places upward pressure

on the price to point B

since the original price,

P* no longer clears the market.

Welcome to...

The place where

Classical Model

mechanics

are made easy!

P

S

P*

D

Q* Q