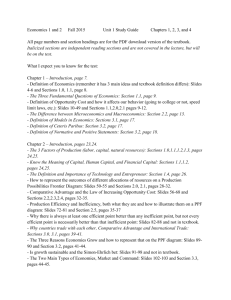

Economics CP Final Exam Review

advertisement

Economics CP: Final Exam Review Basics 1. Economics 2. Microeconomics versus Macroeconomics 3. Scarcity 4. Opportunity Cost 5. Incentives 6. Goods versus Services 7. Four Factors of Production (list and define) 8. Circular Flow Model (draw and label) 9. Market 10. Three Economic Questions 11. Market versus Command Economies 12. Mixed Economy 13. Standard of Living PPF + 1. PPF (what does it stand for?) 2. Graph and label PPF (think links and smiles) Label- An efficient point (A) An inefficient point (B) An unattainable point (C) A Trade-off A Free Lunch 3. Absolute Advantage 4. Comparative Advantage Supply and Demand 1. Law of Demand versus Law of Supply 2. List things that change demand 3. List things that change supply 4. Compliment versus Substitute 5. Change in Demand versus Change in Quantity Demanded 6. Equilibrium Price versus Equilibrium Quantity (may show it graphically) 7. Elastic versus Inelastic Demand 8. Price Floor (graph, define, and effect of) 9. Price Floor (graph, define, and effect of) 10. Black Markets Economic Indicators + 1. GDP (what stand for?, define, formula) 2. Business Cycle (graph and label) 3. Recession 4. Unemployment (frictional, structural, cyclical, seasonal) 5. Labor Force 6. CPI (stand for?, define) 7. Externalities (positive versus negative) Business and Labor 1. Sole Proprietorship 2. Partnership 3. Corporation 4. Dividends 5. Stockholders 6. Double Taxation 7. Unlimited Liability 8. Labor Union 9. Strike versus Lockout 10. Collective Bargaining 11. Right to Work Laws Market Structures 1. List the Four Market Structures and Major Characteristics of Each (or just attach your chart from class) 2. Fixed versus Variable Costs/Resources 3. Law of Diminishing Marginal Returns/Benefits 4. Marginal Analysis Fiscal Policy 1. Fiscal Policy 2. Supply-Side Economics 3. Demand-side Economics 4. Laissez-Faire Economics 5. Adam Smith 6. Deficit Versus Debt 7. Surplus 8. Balanced Budget 9. Revenue versus Expenditure 10. Progressive versus Flat (proportional ) Tax 11. Greatest Federal Discretionary Spending 12. Greatest Federal Mandatory Spending 13. Greatest Source of Federal Revenue 14. Greatest State Expenditure Monetary Policy 1. Monetary Policy 2. Money 3. Inflation 4. Federal Reserve System (basic structure) 5. Fed Chairman 6. List the 3 Fed Tools to Reduce the Money Supply