The “bankable feasibility study”

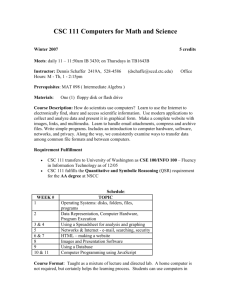

advertisement

Bankable feasibility studies for mining projects The “bankable feasibility study” is not a guarantee that a mining project will produce a planned outcome. Further independent review is advisable, if not necessary, to test and validate strategic targets, directions and goals. Quantitative risk analysis can not only play a key role in the making of quality decisions for project approval, but will also provide grounded measures for project execution risk management. D. S. Evans, PhD, PGeol. Sr. Partner CSC Project Management Services Calgary 403-233-7994, dave@cscproject.com CSC Excellence In Risk Management There are more risks to mining than just commodity price fluctuations…. Limitation Statements define some uncertainties, but not all of them….. Statements, other than statements of historical fact, may constitute forwardlooking information and include, without limitation, timing and content of upcoming feasibility studies and other economic or financial analyses; anticipated availability and terms of future financing; future production, operating and capital costs; and operating or financial performance. -ORForward-looking information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Important factors that could cause actual results to differ materially include: fluctuations in commodity prices and currency exchange rates; the need for co-operation of government agencies in the issuance of required permits and approvals; the possibility of delay in development work or in construction and uncertainty of meeting anticipated milestones; and other risks and uncertainties. CSC Excellence In Risk Management Mining is a risky business and each stage is impacted by uncertainties Political Uncertainty Investor Uncertainty Political Uncertainty Financial & Economic Uncertainty Science & Technology Uncertainty Investor Uncertainty Mining Complexity Geological Uncertainty Construction Uncertainty Mining Uncertainty Metallurgical Uncertainty Market & Commodity Pricing Uncertainty Exploration Performance Development Performance Mining Performance Processing Performance Marketing Performance Social & Environmental Uncertainty Social & Environmental Uncertainty Social & Environmental Uncertainty Social & Environmental Uncertainty Social & Environmental Uncertainty Location Uncertainty CSC Excellence In Risk Management Pervasive, Largely Uncontrollable Risks Poorly Defined and somewhat Controllable Risks Direct Controllable Risks Global Financial & Economic Risks Corporate Performance Social & Environmental Uncertainty “Risk Categories” Definitions & Basis • Typically, a bankable feasibility study is a comprehensive forward analysis of a project’s economics (+/-15% precision) to be used by financial institutions to assess the creditworthiness for project financing. • The feasibility part is guided by a set of assumptions, a strategy, development conditions and a planned outcome. The outcome is uncertain and targets and objectives may not be achievable. • The bankable part relates to the basis and conditions for a future financial agreement to collateralize mining assets for a project loan, to set a premium and a repayment schedule, with appropriate risk/reward factors. What do others say about mining feasibility studies… • “The mining industry has had a spotty record in the area of estimating initial capital cost and operational performances, even though the standard of feasibility studies has improved in the last decade. Third party reviews rarely have time and funds for due diligence”…taken from Shillabeer and Gypton, Mining Risk Management, 2003, Australian IMM Proceedings • Project Evaluation 2007 contains an article entitled “The Use and Abuse of (Mining) Feasibility Studies” by Mackenzie and Cusworth who state that most feasibility examples are unbalanced, or provide inaccurate views of one or both technical and business aspects. The authors subscribe to a project management framework (to include risk analysis) to overcome strategic and execution failures that often occur following feasibility studies CSC Excellence In Risk Management So what does +/- 15% really mean? • A +/-15% estimate is somewhere between the definition of a Class 5 and Class 2 estimate. Class has to do with both the content and quality of the estimate and the estimating confidence (precision). • Well, doesn’t contingency cover estimate shortfalls (+15%)? Contingency is a separate decision in support of the estimate to resolve cost uncertainty precision. Current thinking is that contingency will be “used up” for some, but not all cost categories. Contingency does NOT make the estimate “more accurate”. • Quantitative Risk Analysis is a process to assess and quantify the potential variances around project drivers. When key project drivers (i.e. risks) become quantified, corrective measures and actions can be taken, with confidence, in the making of quality decisions about precision and accuracy. CSC Excellence In Risk Management The bankable feasibility study as a comprehensive engineering study, cost estimate and mining development plan • Normally, a feasibility study is prepared by a qualified engineer or estimator. It is a forward-looking document that captures a precision level but not necessarily an acceptable* level of accuracy. • So, what does “bankable feasibility” really mean in terms of accuracy for owner and investor confidence in the development and construction of a mining project? • And how does risk analysis capture precision and accuracy for better decision-making and executing a transparent, accountable and defensible execution plan? * As known or required by the project owner CSC Excellence In Risk Management The hierarchy of Capital Cost estimates • • • • Conceptual (Class 10 Estimate) Class 5 (also called DBM Estimate) Pre-Feasibility (Class 3 or 5, depending) Class 2 or 3 (+/-15% has now gained acceptance as a bankable feasibility study) • AFE Estimate, may be a Class 1 or Class 2 and is designed to go for project sanction & EPC bids. It should be the most accurate and the most precise estimate obtainable given circumstances and conditions; and, is normally accompanied by a PEP. CSC Excellence In Risk Management Precision and accuracy are separate variables in the Cost Estimate “Precision” “Accuracy” •Precision is the ability to reproduce a result; •Accuracy is a confidence in the absolute result or outcome. The Definition of Estimate Classes • The Study or Class 5 estimate is prepared in conjunction with the Design Basis Memorandum phase of the project. At this point all critical design alternatives have been examined and the preliminary project execution plan has been established. This type of estimate is defined as “an estimate, including contingency, that has a probability of overrun by more than 10%, 1 time in 3”. • The AFE or Class 2 estimate is prepared in conjunction with the Basic Engineering phase of a project. At this point, all key design documents such as P&ID’s, layouts and electrical single lines have been established. The project execution plan, construction plan, and schedule have also been established. This type of estimate is defined as where “the final cost of the project will be within plus or minus 10% of the estimated value, 80% of the time”. CSC Excellence In Risk Management The definition of estimate classes describes the expected range of uncertainty around an estimate (in assessment and simulation this is the slope of the probability distribution) Class II Accuracy Class V Accuracy Final cost will be within +/- 10% of the estimate, 80% of the time Estimate including contingency, has a probability of 10% overrun, 1 time in 3. Base estimate plus contingency 200 $MM Base estimate plus contingency 200 $MM 100% 100% 90% 90% 80% 80% P90 =220 $MM +10% 60% 50% P50 = 200 $MM P90-P10 = 80% 40% 30% P10 =180 $MM -10% 10% 0% P50 = 200 $MM 50% P67.7 crosses at 10% over estimate 40% 20% P10 =168 $MM -19% 10% 0% 180 200 $MM Excellence In Risk Management 60% 30% 20% CSC P90 =237 $MM +19% 70% Probability Probability 70% 240 160 180 200 $MM 220 240 Quantitative risk analysis calculates the probability distribution of a cost outcome This distribution can be used to : 1. Determine the contingency required for any confidence level (probability). 2. Compare the estimate uncertainty (slope) with other estimate class definitions. Base = 160 $MM 100% 90% P90 =222 $MM +11% Probability 80% Slope of Class V Estimate 70% 40 $MM Contingency Required for P50 Confidence 60% 50% Slope of Class 2 Estimate 40% P50 = 200 $MM 30% 20% P10 =178 $MM -9% 10% 0% 120 160 200 $MM CSC Excellence In Risk Management 240 280 A example of risk analysis applied to a mining capital cost estimate CSC Excellence In Risk Management The CAPEX Influence Diagram for a UG Mining Construction Project $ 3,799k Bid Rate Competing Projects Shaft Excavation Materials/ Estimate Variance $ 53,635k Mine $ 38,215k Level Excavation $ 11,621k Labour Rate Subsurface Equipment Scope Variance Used Equipment Labour Productivity Roads Mill Total Project CAPEX $ 17,570k Infrastructure Cost Variance Engineering Cost Variance Local Benefits $ 17,409k EPCM Excellence In Risk Management $ 171,682k $ 1,270k Organization Performance CSC $58,387k Water Miscellaneous $5,179k $ 11,121k ($ 1,602k/yr) $ 2,592k Sustaining Capital Administration Exchange Rate $22,088k $ 20,001k Indirects Contingency @ 15% From the probabilistic simulation conducted during the quantitative risk analysis, the Expected Value output of Total CAPEX is $ 181 MM, which is $ 9 MM above the Base with contingency. Base Mine CAPEX Mill CAPEX Infrastructure Indirects Contingency Total CAPEX 53.6 58.4 17.6 20.0 22.1 172 $MM Expected 66.6 60.6 23.6 30.5 0.0 181 $MM P10 49.1 58.3 16.0 21.6 0.0 151 $MM • Expected Value is P55 or about a 55% chance of happening • P10 & P90 are each about a 10% chance of happening and define the range of this outcome which is a measure of the accuracy of the estimate CSC Excellence In Risk Management P90 85.7 63.5 35.3 42.1 0.0 212 $MM The Base Capital Cost estimate is $ 172 MM. The expected Total Capital Cost is $ 181 MM. In this case there is only a 39% chance that the project will achieve the CAPEX Base Case estimate with contingency Total CAPEX Base with contingency ( 172 $MM) 100 90 Mine Base 54 $MM 80 Mill Base 58 $MM Probability 70 EV = 181 $MM 60 50 40 30 20 Mill CAPEX EV = 61 $MM Mine CAPEX EV = 67 $MM Total CAPEX EV = 181 $MM 10 0 0 50 100 150 $MM CSC Excellence In Risk Management 200 250 The Range in CAPEX is largely due to uncertainty in Mine Unit Cost Variance, Mine Quantities Variance and Level Development Scope Variance. Total Capital Expenditure -15 Mine Unit Cost Variance - Multiplier Mine Quantities Variance - Multiplier -10 -5 $MM 0 5 0.86 1.26 Cool Execution Organization Performance Heated 0.84 Infrastructure Costs 1.18 0.7 2 Excellent Infrastructure Construction Duration - Months Regulatory Process Duration - Months Poor 7 12 10 34 Tailings Cost Variance - Multiplier 0.8 6 Road Cost Variance -Base - 1.27 MM 2.5 7 Subsurface Equipment Costs Mine Construction Duration - Months EPCM Cost Variance -Base - 9.6 + 6.7MM 15.5% Community Negotiations & Agreements Duration - Months 1.01 1.3 18 28 0.12 0.14 11 25 4.2 7 181 $MM Excellence In Risk Management 20 1.5 Level Excavation Scope Variance- Multiplier CSC 15 1 Competing Projects Environment Water Cost Variance -Base - 5.2 MM 10 Expected increases to Construction Costs add $ 23 MM to the Base CAPEX Estimate. Schedule Impacts add $ 7 MM. Total CAPEX 190 EV = 181 $MM +9 180 0 -1 $MM +2 +12 170 160 150 +7 Base = 150 $MM Excellence In Risk Management Indirect Costs Labour Costs Mill Costs Infrastructure Costs CSC Mine Costs Schedule 140 A planned outcome requires a sound strategy and a sound execution plan Strategy Flawed Flawed Doomed from the Beginning Sound Flirting with Disaster Sound A Botched Job A Pretty Good Chance In absolute terms, there is about a one in four chance of getting the “right” strategy paired with the “right” execution plan for the “planned outcome”… ...the idea is to get it approximately right rather than perfectly wrong... CSC Excellence In Risk Management Bankable Feasibility Studies for Mining Projects….things to remember. • • • • • • • • Accuracy and precision are different. Accurate estimates are precise, but precise estimates are not necessarily accurate. Beware of the Halo Effect: the tendency to believe and place faith that your strategy and execution plan are sound, grounded, etc.; The Delusion of Absolute Performance: any given formula cannot ensure high organizational performance, etc.; The Delusion of Lasting Success: enduring success is not sustainable; Recognize the Role of Uncertainty: adjust your thinking to accommodate uncertainty (risk & opportunity!) and make better decisions; See your Project through Probabilities: approach problems as interlocking internal and external probabilities; Separate Inputs from Outcomes: actions and outcomes are imperfectly linked. It is easy to infer that bad outcomes must mean somebody made mistakes, or a good outcome must mean somebody made good decisions (or got lucky!); There are more things that can go wrong rather than right in execution: determine the project drivers, assess & quantify risk and develop a risk management plan to build better valued projects; CSC Excellence In Risk Management A Final Note…. • We often hear the phrase “We have to get cost certainty or else……) We are rarely told what the “or else” is, but it sounds pretty awful. In these circumstances, CSC takes the position that owners, their consultants and contractors to look for the value proposition in their development and construction projects. Should your project go over budget, or goes long, make sure that the project achieves value in the completed cost. When the project delivers value that respects or justifies the cost, then it is a good project. CSC Excellence In Risk Management Specifics: • Supports Owner Organizations in major project development. • Group formed in 1982, over 350 project assignments in 7 countries. • Extensive and varied background in Project Planning and Management. Specialties: • Risk & Decision Analysis for a wide range of capital Projects. • Strategic & Mitigation Planning for projects using risk models. • Facilitation of Project Management, Business Planning, Environmental & Safety Planning & Management and Team Building. • Project Management Education Workshops. • Development of Contract Claims and disputes and litigation support.