Social and private insurance

advertisement

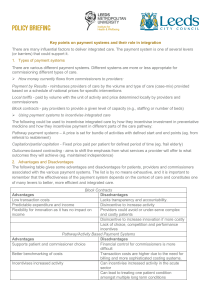

Financing Systems Part 2 Social and Private Insurance Unit 7 Outline • • • • 1) Multiple purposes of insurance 2) Private systems and “experience rating” 3) Methods to control over utilization 4) Varieties of public insurance – Providers on payroll – Contracting in – Contracting out Part 1: Multiple purposes of insurance Multiple Purposes of Insurance? • For Society – Move money from the healthy to the sick – Move money from the rich to the poor • For Individual – To be able to afford health care at all-thanks to the cross subsidies engineered into the system – Make smooth predictable payments with certainty instead of chaotic unpredictable and possibly large payments • Called “consumption smoothing” Why insurance is good • Consider 2 income streams: A and B A Time • People prefer B over A 49 45 41 37 33 29 25 21 17 13 9 B 5 100 80 60 40 20 0 -20 -40 -60 1 Income Two Income Streams with Same Mean Different Variances Old forms of insurance persist • All of the following insurance forms continue to co-exist because they fill important niches in our lives – – – – – – Family Kin Village Church State Formal • Formal and state insurance systems can crowd out family and kin in taking care of us during shocks – Alienation of modern life What Should be the Relative Coverage of Different Services? • • • • Prevention Plastic surgery Emergency care Cancer treatment • Depends on how you answer “What is the purpose of insurance?” Part 2: Experience or Community Rating Advantages of Community Rating • Controls adverse selection • Enforces subsidies from the healthy to the sick • Lower loading costs because no need to spend money cherry picking Disadvantages of community rating • The healthy people could get cheaper insurance – People who try to stay healthy pay the same rates as people who don’t take care of themselves • Some insurance companies prefer the high profits they can make if they cherry pick Experience Rating • Advantages – Savings for the healthy – Incentives for people to stay healthy to get cheaper premiums – Profits for some companies • Disadvantages – Higher spending for the sick – Premiums can become unaffordable for the sick – Adverse selection can destroy the insurance market Part 3: Methods to Control Moral Hazard Co-Payments • If patients have to pay a portion of their fees that can lower the amount of moral hazard • Co-payments can help control utilization Disadvantages of Co-Pays • Depends on which type of care people give up as they have to pay more – Patients may not know what type of care is worthwhile and what type is not – The co-payments may discourage them from seeking important and vital services • RAND Health Insurance Experiment suggests that people forego both less and more valuable care Capitation to control moral hazard • Definition of capitation: Under capitation the provider is paid a flat amount for every patient in their practice regardless of how sick they become • Capitated providers will try to restrain a patient’s utilization to save money Disadvantages of capitation • With capitation the provider and the patient are in conflict – The patient wants “insured” services and requests them – The provider withholds services • Anticipating these clashes can make patients prefer non-capitated providers Part 4: Varieties of Public Insurance Options for Public Systems • Staff Model – Most common approach around the world – Public sector hires doctors and pays them a flat salary out of Ministry of Health funds • Contracting in – Performance incentives (bonuses) to salaried government health workers • Contracting out – Public sector makes an offer to private providers for services (with performance incentives) Staff Models • Administratively simplest – Don’t need to measure performance – Don’t need to administer bonuses • Centralized collection of revenue and payroll at center • Easy to inject donor funds at center Disadvantages of Staff Models • Provider incentives similar to the capitated systems • Providers don’t get more pay for working harder or providing quality Contracting In • Improves incentive structure for salaried providers • Requires financing for honest supervisors to check performance • Improved quality does not come free Contracting Out • Public sector collects tax revenue and uses it to insure special groups for the care they receive from private providers – The insurance executives can be public employees or private insurers too Government Tax Authority Plan A) Private companies Administer the insurance payments Plan B) Public Sector administers the insurance payments Private Providers Contracting Out • Appropriate when private sector is too big to ignore – Need to have the ability to monitor the providers – Tasks that are monitored need to be simple enough to monitor • Preserves heterogeneity of the providers in the system Disadvantages of Contracting Out • Concerns about sustainability – Contracts could alter how much they compete – Contracts may be based on non-sustainable outside funding • Concerns about adequate monitoring Summary • Purposes of insurance – Conflict between social goals and private goals • Experience rating vs. community rating – Advantages and disadvantages • Solutions for moral hazard • Interface between public finance and private medical care