Room Rate Structure - Delmar

advertisement

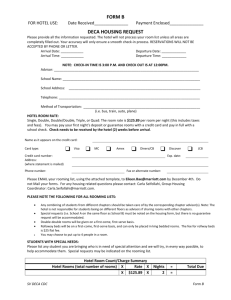

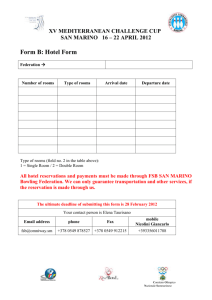

Summary Slide Room Rate Structure Hubbart Formula Hubbart Formula–Schedule I Diagram–Hubbart Formula–Schedule I Hubbart Formula–Schedule II Diagram–Hubbart Formula–Schedule II Hubbart Formula–Schedule III Diagram–Hubbart Formula–Schedule III Other Rate Calculation Methods Room Rate Designations Room Rate Designations Diagram–Weekday vs. Weekend Rate Averages Exercise Figure 7-1 Room Rate Structure The combination of all the rates offered at a hotel is called the rate structure. Hotel room rates are both quantifiable and qualifiable. Average Daily Rate (ADR) is a term used in different ways. In this analysis, it is used to determine a starting point in establishing a hotel’s rate structure. Figure 7-2 The Hubbart Formula Roy Hubbart developed a method to calculate a hotel room rate based on the costs incurred in operating the hotel and a reasonable return on investment for the investors The Hubbart Formula incorporates three schedules. I looks at specific financial calculations, II looks at the rates per occupied room, and III incorporates square footage into the analysis. Figure 7-3 Hubbart Formula– Schedule I Traditional room cost is considered In addition, Return on Investment is factored in to give owners/investors a fair rate of return. What hotel trend precipitated the need to incorporate ROI? That is, what changed in the industry and what other industries became involved? Figure 7-4 Hubbart Formula Example - Schedule I Operating Expenses: Example Rooms Department $450,000 Telephone Department $75,000 Administrative and General $200,000 Payroll Taxes and Employee Benefits $225,000 Advertising and Promotion $75,000 H/L/P (Heat, Light, Power) $150,000 Repairs and Maintenance $125,000 Total Operating Expense Taxes and Insurance Real Estate and Personal Property Taxes Franchise Taxes and Fees Insurance on Building and Contents Lease Costs (Equipment and/or Vehicles) Total Taxes and Insurance $75,000 $25,000 $30,000 $45,000 Depreciation at Book Value Building FF&E (Furniture, Fixtures and Equipment) Total Depreciation $175,000 $125,000 $175,000 $300,000 Fair Market Return on Investment (ROI) of Property Land Building FF&E Total Fair Market ROI TOTAL: Deduct (Income from sources other than rooms) Income from store rentals/leases Profit [Loss] from food and beverage operations Income from other sources (ancillary revenue) Total Income from Other Sources Amount Needed from Room Revenue to Cover Costs and Realize a Fair Market ROI $1,300,000 $500,000 $2,275,000 $25,000 $175,000 $15,000 $215,000 $2,060,000 Figure 7-5 Hubbart Formula– Schedule II The figure reached at the end of Schedule I is used to determine the average daily rate the hotel would need to charge to meet its obligations (operating costs and owner ROI). Schedule II incorporates opportunity cost. Schedule II also assumes an average occupancy percentage. How can using the 70% occupancy figure sometimes cause problems? Figure 7-6 Hubbart Formula Example - Schedule II Example 1. Amount Needed from Guest Room Sales (Schedual I) 2. Number of Guest Rooms Available 3. Number of Rooms Available on an Annual Basis Item 2 multipled by 365 (175x365) 4. Less Allowance for Average Vacancy 5. Number of Rooms to be Occupied Based on Average Occupancy 6. Average Daily Rate Required to Cover Costs and Provide Reasonable ROI (Item 1 divided by Item 5) $2,060,000 175 100% 30% 63,875 19,163 70% 44,712 $ 46.07 Figure 7-7 Hubbart Formula– Schedule III Schedule III makes an assumption that larger rooms are more expensive to maintain. A square footage calculation is made of the area of all the guestrooms in a hotel. What are some of the drawbacks of using a strict square footage calculation? Figure 7-8 Hubbart Formula Example - Schedule III Example 1. 2. 3. 4. 5. 6. Amount Needed from Guest Room Sales (Schedule I) Square Foot Area of Guest Rooms Less Allowance for Average Vacancy (70,000 x 30%) Net Square Footage of Occupied Rooms (70,000 x 70%) Average Annual Rental per Square Foot (Item 1 divided by Item 4) Average Daily Rental per Square Foot (365 divided by Item 5) $2,060,000 70,000 21,000 49,000 42.04 $0.12 Figure 7-9 Other Rate Calculation Methods Cost Rate Formula Market Tolerance Shop Around What ways could a hotel determine its rate structure? Why are anti-trust concerns so important? Figure 7-10 Room Rate Designations Term used to specify the rate threshold within the overall structure. It simply “ranks” all the rates within the rate structure. Rack Rate Corporate Rate Volume Account Rate What is a target rate? Figure 7-11 Room Rate Designations Additional rate designations include: Government Rate Seasonal Rate Weekday/weekend Rate Membership Rate Industry Rate Walk-in Rate Premium Rate Advance Purchase Rate Package Rate Per person and Group rates Figure 7-12 Weekday vs. Weekend Traditional Demand Level Resort Airport Downtown Suburban Monday Tuesday Wednesday Thursday Friday Saturday Sunday Days of the Week Figure 7-13 Rate Averages Used to determine the average revenue figure of specific rates.The most commonly used figure is ADR. Others include: Gross Average Rate Net Average Rate Group Average Rate Transient Average Rate Market Segment Averages Room Specific Averages Figure 7-14 Rate Structure Internet Exercise Using the Web sites and hotels you identified in the Internet exercise of Chapter 3, compare the different rates available for a given day. Why would a hotel identify several rates within its rate structure this way? Do the needs of guests differ greatly? What are the benefits/drawbacks of offering only one rate per day? Figure 7-15