Market Failures

advertisement

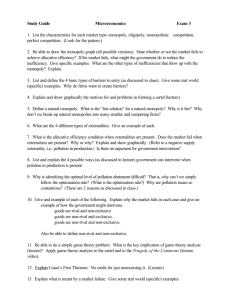

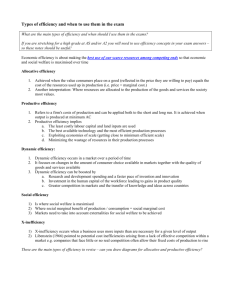

Economics Workshop Better Regulation Executive 2006 Sandeep Kapur s.kapur@bbk.ac.uk WORKSHOP AIMS To provide rigorous but non-mathematical training in economics, enabling BRE staff to • develop a simple but reliable toolkit for economic analysis • practise its application using concrete regulatory problems • explore the application of simple economic theory to their own work Objectives: Day 1 To understand • how markets work, and their efficiency • why markets sometimes fail to be efficient and how various regulatory instruments can improve efficiency • how regulation can improve on other aspects of market outcomes, such as inequity • how, in practice, regulatory interventions carry the risk of government failure Objectives: Day 2 To • review the standard rationale for regulation • the basics of regulatory impact assessment • understand how good regulatory design can cope with risk and uncertainty, informational imperfections, and minimise distortion of incentives • rationale for and implementation of RPI-X regulation • the link between regulation and productivity growth Introduction to Economics Some Concepts and Tools Markets vs. Command The central questions: given existing resources • what goods and service to produce? • how to produce? • for whom? Alternative mechanisms • COMMAND ECONOMY direct control, as in Soviet economy, or firms’ internal decisions • FREE MARKET ECONOMY outcome determined by private transactions in markets, based on prices, incomes, wealth Degree of government intervention differs.. Cuba - China - Denmark - UK - USA - Hong Kong Most countries have mixed economies with both • markets, which are regulated to different extent • public production and provision Scale of government Spending as share of national income (%) 1880 1930 1960 2004 Japan 11 19 18 37 USA 8 10 28 36 UK 10 24 32 43 Germany 10 31 32 47 France 15 19 35 53 Sweden 6 8 31 57 The policy question Markets are generally considered to be efficient If so, why not leave things to the market? Governments care about both equity and efficiency • Free markets rarely deliver equitable outcomes, so some redistributive intervention is unavoidable • Free markets do not always lead to efficient outcomes, so some interventions are motivated by efficiency considerations To understand this, we must look at how markets work How Markets Work Demand, Supply, and Price Adjustment Market • MARKET any arrangement in which prices adjust to reconcile buyers and sellers intentions • DEMAND quantity buyers wish to buy at each price • SUPPLY quantity producers wish to sell at each price • EQUILIBRIUM PRICE the price at which market clears (i.e. quantity demanded = quantity supplied) Price Adjustment Supply curve price Equilibrium Price Demand curve Equilibrium Quantity quantity PRICE ADJUSTMENT Equilibrium price clears market Price Controls Suppose government sets minimum price above market clearing price Price Supply curve Controlled price Equilibrium price Demand curve Examples include • Minimum wages • Rent control • Common Agricultural Policy excess supply Quantity What does price controls do? Price controls interfere with the adjustment process • minimum wages are good for equity: they boost the income of some low-skill workers • But such interventions may not be good for efficiency: if employers are unwilling to hire as many at regulated minimum wage, some potential workers are deprived of the chance to work Economic Efficiency An intervention is said to improve efficiency if it makes someone better off and nobody worse off Economic efficiency: an outcome where no one can be made better off without hurting someone else The key question: do free, unregulated markets always lead to efficient outcomes? Markets and Choice In markets • consumers buy up to the point the marginal benefit equals price • competitive firms sell as long as price covers ‘marginal cost’ of production (this is the opportunity cost of producing another unit of the good) The Efficiency of Markets Thus, in competitive markets • prices align marginal benefit with marginal cost • all possible gainful exchanges are carried out • PUNCH LINE: Free, unregulated markets lead to efficient outcomes This is the so-called Invisible Hand Theorem But free markets are not always efficient.. Market failure: a circumstance in which free markets fails to achieve an efficient outcome Many interventions are designed to correct market failures, and thus to increase efficiency In sum: why intervene? ‘Economic regulation’ • Aims to correct market failures, and make the market outcome more efficient (when the ‘invisible hand’ does not work, the government can provide a helping hand) ‘Social regulation’ • To prevent undesirable social outcomes inherent in market outcomes Group Work: Efficiency and Equity Government intervention in the economy is pervasive. For each intervention listed below identify the possible rationale. Is it primarily a. efficiency considerations? b. equity consideration? c. something else? 1. Income tax 2. Taxation of petrol 3. Regulating gas prices …Group Work 4. 5. 6. 7. 8. 9. 10. 11. 12. Regulating discharge of sewage in the Thames Legislation against insider trading Banning the use of cocaine Making primary school compulsory Regulating financial advisors Regulating length of the working week Compelling citizens to carry identity cards Minimum wage legislation Regulating taxi fares Market Failures Why intervene? How to intervene? Sources of Market Failure • Externalities • Public goods • Imperfect competition • Imperfect information • Coordination problems We will look at each of these in turn MARKET FAILURE: Externalities EXTERNALITY • A circumstance in which an individual's choices affects others' utility or productivity • the effect is direct (not through market or prices) Examples • Adverse externalities: smoking, pollution Since costs are partly borne by others, self-interested decision-making might lead to excess • Beneficial externalities: bees and orchards, personal hygiene Since benefits partly accrue to others, self-interested choices lead to sub-optimal quantities Adverse Production Externality F MSC G E MPC Demand Q* Q Quantity For social optimum, we want marginal social cost = marginal social benefit At free market equilibrium E, output Q is higher than social optimum Q* Why Externalities Matter THE ESSENTIAL PROBLEM • Market mechanism aligns private costs and benefits • Externalities imply divergence between social and private costs (or social and private benefit) • If divergences exist, should not expect socially efficient allocations Correcting externalities 1. 2. 3. Quantitative regulation or direct government action: e.g. pollution quota [Pigou] Taxes or subsidies to correct prices e.g. pollution tax [Coase] Create markets: assign property rights and enable trade in pseudo-markets e.g. carbon trading Coasean Solution MC (for you) MB (to me) Q* Q Quantity Efficient quantity is Q* • Assign property rights and let people trade these rights in specially-created market • Initial assignment of rights affects distribution but get an efficient outcome regardless • This solution does not work if there are high transactions costs MARKET FAILURE: Public Goods Examples: defence, broadcast TV signal Characteristics • Non-rival consumption: my consumption does not diminish what is available for you • Non-excludability: impossible or too costly to prevent people from consuming it Public goods: the problem and solutions • If you cannot exclude, people will ‘free ride’. But if no one pays, there is nothing to free-ride on (this is the paradox of free riding) • In fact, exclusion is not efficient either In general, markets cannot provide public goods SOLUTIONS • public provision • compulsion Government needs to ensure right quantity, but need not produce itself MARKET FAILURE: Imperfect competition The essential problem of monopoly • Firms with market power can charge prices that exceed marginal cost • which restrains consumption below efficient level • other problems: resources wasted in securing monopoly power (‘rent-seeking’), and in maintaining it Solutions to monopoly problem Solution 1. Nationalize and finance losses through taxes politically not very feasible Solution 2. Break monopoly e.g. anti-trust legislation in US However, no good for ‘natural monopolies’ Industries with severe economies of scale, so having one producer avoids duplication of costs And in some sectors monopoly is good for R&D, or for internal coordination More solutions to the monopoly problem Solution 3. Regulate Prevent abuse of monopoly power through price and nonprice controls Practical issues: when is regulation necessary? What form? How frequently? Solution 4. Nurture competition Encourage new entrants, (but will they enter and will it only lead to cream skimming?) Important to get the right mix of remedies MARKET FAILURE: Imperfect information Information in markets is imperfect. Often there is asymmetry of information between buyer and seller leading to problems of • ‘adverse selection’: people who know themselves to be risk-prone are more likely to buy insurance • ‘moral hazard’: once you have insurance, incentive to be careful is weakened • these distortions may result in ‘incomplete markets’ or even ‘missing markets’: e.g. low-risk people may not find appropriate insurance SOLUTIONS: Imperfect information 1. mitigate informational problems • mandating provision of information (regulate financial advisors) • providing information directly (publish league tables) 2. reduce the possibility of opportunistic behaviour • consumer protection 3. government provision of the good or service Inefficiency due to strategic interaction Individual choices do not always result in the best collective outcomes Country 2 Country 1 No nukes Nukes No nukes 8, 8 1, 12 Nukes 12, 1 2, 2 SOLUTION: coordinate individual choices through agreements or regulation Regulating technological standards Problem: uncertainty about new technological standards may slow down adoption • VHS vs Betamax • Blu-Ray vs HD-DVD Should regulation aim to guide technological choices? • GSM in mobile telephony Lessons for Policy Makers • Market failures makes a potential case for corrective intervention • However, we must beware of the possibility of government failure. If so, the net effect may be to replace market failure with government failure Well-intentioned regulation may • end up being ineffective • have perverse, unintended consequences • persist beyond its purpose • be vulnerable to regulatory creep, with high cumulative burden The scope for successful regulatory intervention is limited by • informational constraints • agency problems • lack of correction Group Work: Pollution control As the National Rivers Regulator, you must tackle the problem of a chemical firm that is polluting the Thames a. If everything could be quantified and valued, show in a diagram how a pollution tax can induce the firm to behave in a socially efficient manner. Group Work: Pollution control b. Instead of the tax you offer the firm a pollution quota (specifying the maximum pollution it can discharge in any year). Show the size of the quota in the diagram. What difference does it make to the efficient quantity of pollution? Group Work: Pollution control c. Now suppose information is harder to come by. As the regulator, you are not entirely certain about the firm's cost curve. Does this affect your choice between tax and quotas? Group Work: Pollution control d. Lastly, suppose there are two chemical firms discharging into the river, one cleaner than the other. Is it better to • set a pollution tax? (same rate per unit polluted for both?) • auction pollution quotas?