Operation Analysis 2 Engineering Economy •

advertisement

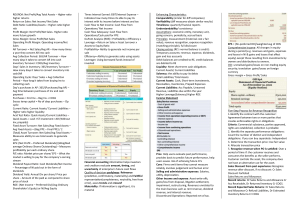

Operation Analysis 2 • Engineering Economy Engineering Economy Lecture Notes (Some of the materials are taken from Prof. Vate’s lecture notes) Outline Accounting Terminologies Engineering Economy 3 Accounting Basis of decision making “The language of business” Balance Sheet: Asset versus Liability Net Worth = Assets – Liabilities “How well am I doing?” Income Statement: Profit/Loss = Revenues - Expenses 4 Accounting: Balance Sheet Assets Current assets Cash, account receivable, inventories Fixed assets Takes time to convert them to cash Depreciation: convert fixed assets into expenses Liabilities and stockholders’ equity Current liabilities Other liabilities Stockholders’ equity = net worth Common stock , Preferred stock, Treasury stock (buyback), and Outstanding stock (# shares in public) Retained earnings Paid-in capital (capital surplus): sale of stock more than the par value of the stock 5 Accounting: Income Statement Making or losing money? Revenue Net sales COGS Gross margin Operating income Net income EPS (Earning per Share) 6 Business’ Performance Debt Management Analysis Ability to pay long-term liabilities? – Debt Ratio – Times-Interest-Earned Ratio (EBIT/interest expense) • Liquidity Analysis Focus on working capitals – Current Ratio – Quick (Acid Test) Ratio (subtract inventory) • Asset Management Analysis Ability to manage the assets Inventory Turnover (Sales/Average Inventory) Total Assets Turnover (Sales/Total Asset) 7 Business’ Performance (Cont’d) Profitability Analysis Market Value Analysis P/E Ratio Book value per share (equity – preferred stock)/outstanding shares 8 Cost Concepts Determine COGS and COGM Direct Material Direct Labor Overhead (Indirect Material/Labor) Charge OH to production by: • % of direct labor cost • % direct material cost • Rate per direct labor hour COGM = DM + DL + OH COGS = COGM + BegInv – EndInv 9 Cost Behaviors Fixed Cost Variable Cost Mixed Cost (semi-variable cost, i.e. depreciation) Average Unit Cost, for… Fixed Cost? Variable Cost? Mixed Cost? Opportunity Cost Sunk Cost Marginal Cost, Marginal Revenue 10 Engineering Economy F = P(1 + i) n 1 i 1 P A n 1 1 i (1 i ) (1 i ) Notation: i = annual interest rate n = annual interest periods P = present principal sum A = single payment in a series of n equal payments made at the end of each annual interest period F = future sum P|F, i, n = Find P given F, i, n 11 A Piece of Cake Exercises How much will $150 be worth 20 years from now at annual interest rate of 12%? If $100 is set aside at the end of each year for 10 years at an annual interest rate of 12%, what would it be worth at the end of the 8th year? How much would be required at the end of each year for 10 years to accumulate $5,000 at the end of the 10th year if the annual interest rate is 12%? How much can be borrowed now if it can be repaid by 10 equal endof-year payments of $100 each? Annual interest rate is 12%. 12 Present Worth Calculation PV =? $ 3,000 $ 3,000 $ 4,000 $ 2,000 $ 4,000 $ 10,000 13 Financial Education Game With interest rate i = 12%, what will you choose? • Start investing $12/year now (your age) • Start investing $12/year at age 30 14