Contents 1) INTRODUCTION 2) THE SITUATION IN GREECE

advertisement

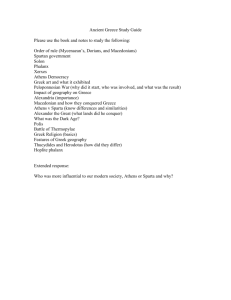

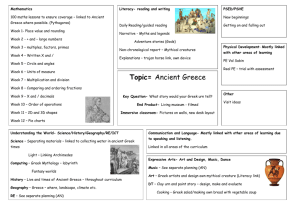

ΤΜΗΜΑ ΟΙΚΟΝΟΜΙΚΩΝ ΕΠΙΣΤΗΜΩΝ ΜΑΘΗΜΑ: ΑΓΓΛΙΚΑ ΓΙΑ ΟΙΚΟΝΟΜΟΛΟΓΟΥΣ IV ΕΞΑΜΗΝΟ: Δ ΔΙΔΑΣΚΩΝ: ΤΣΕΛΙΓΚΑ ΘΕΟΔΩΡΑ GREEK/WORLD ECONOMIC CRISIS AND PUBLIC SECTOR 1) ILIANA DIAMANTI A.M. 2375 2) CHRISTINA KAKOULAKI A.M. 2400 3) XRISANTHI VASILIADHI A.M. 2565 4) STAVROS PRASSOS A.M. 2566 Contents 1) INTRODUCTION 2) THE SITUATION IN GREECE 3) SECTORS THAT HAVE BEEN AFFECTED BY GREEK CRISIS 4) PRODUCTIVITY IN THE PUBLIC SECTOR 5) CORRUPTION 6) TAX EVASION 7) CONCLUSION 1) INTRODUCTION Economists try to collect, analyze and estimate different economic conditions. Study the economy itself and how it behaves under certain political or economic actions. Also economists study the whole and each parameter of economy and try to see and estimate how those parameters combine each other or affect each other and the economy itself. A very big issue since 2006 is the worldwide financial crisis and especially the Greek crisis that affects the whole economy and many sectors of it. 2) THE SITUATION IN GREECE Many analysts have analyzed the Greek economic crisis. Many analyzes have identified as the main factors of the crisis the huge debt, high budget deficits, the irresponsible management of public expenditure, the long lag exports against imports, low competitiveness and the dysfuctioning of the labor market. According to Gregory T. Papanikos (2012) economic crisis started in United States of America in 2007 and in year 2009 hit Greece very hard so Greece was put under troika’s supervision. The crisis has created enormous problems in the country and the word bankruptcy sounds daily. Some people do not even want to think of it, some other believe that this is the solution. However, bankruptcy can be prevented and Greece can return to growth only with significant economic reforms. Social consensus plays an important role for the success of these reforms. Nevertheless the consensus is absent. Let’s see the progress of the economic crisis in Greece more specifically: The debt was increased rapidly during the 1980s and continued to increase slower during the decades of 1990 and 2009 (Costas Meghir, Dimitri Vayanos,Nikos Vettas). Table 1: Government debt (Source: OECD) Year 1980 1990 2000 2009 Gov. debt as % 26 71 101,5 115,1 of GDP Debt caused a reduction in productive investment and in consumption growth. Greek citizens were consuming beyond their capabilities. To get out of this economic crisis Greece decided in cooperation with the European Union to take the first bailout loan package. On 1st May of 2010 the Greek government with prime minister George Papandreou decided to sign on a large EU/IMF loan package accompanied by its austerity measures. The European Union in cooperation with International Monetary Foundation concluded in a 3-year package which volume was 110 billion euro but also accompanied by a high interest rate of 5,5%. This package was known as the 1st memorandum. This austerity package was met with a great anger by the Greek public. Also the effects of memorandum were not those that were expected to be. The revisions of 2009 have shown that deficits and debt levels were increased, by making 2010 target more difficult to get reached than it was expected. While in 2011 the severe economic crisis decreased again the tax revenues by making impossible now, for Greece to meet its fiscal goals. These led EU/IMF to recreate a 2nd bailout loan package, in July of 2011. This package was known as the 2nd memorandum and has a volume of 100billion euro with an extended repayment period from 7 to 15 years and a decreased interest rate at 3,5%. This package was also accompanied again by austerity measures which were focused again in the size of public sector. These made the great crisis more severe (wikipedia). 3) SECTORS THAT HAVE BEEN AFFECTED BY GREEK CRISIS The crisis in the public sector affects indirectly many sectors of community, many financial sectors and even human behavior. The unemployment, inflation, private sector, GDP and tourism are the most affected financial data in the country. When crisis made its appearance there were plenty of problems that come up, on the surface and affected immediately the public sector. Electoral interests made public sector’s labor too large and the sector couldn’t work properly. So public sector needs to be transformed to an engine of growth and an efficient provider of services to Greek economy and society. The public sector transformation is one of the most important reforms that Greek government should be focused on. The public sector should be transformed from an institution of hiring party supporters to a new one, that will work only productive and efficient employees, where their productivity will be rewarded. Only those employees, will create a new public sector that will provide a good level of services. 4) PRODUCTIVITY IN THE PUBLIC SECTOR The Greek government should transform the old unproductive public sector, to a new efficient provider of services. This transformation is not easy to become true because of the need for spending cuts. The repeated wage cuts and the massive dismissals discouraged more the civil servants. The feeling of desperation led them to strikes something that makes the public sector more dysfuctional than it was. The best solution in this case is the financial rewarding. The rewarding should be in relation with the quantity and quality of their output using as benchmarks relevant international indices. In the following table we see the productivity of public educational system in Greece and the average in the European Union,measured by an international organization (PISA). Table 2. PISA score PISA score PISA score mathematics reading Number of Graduation universities rates science Greece 460 459 473 2 29,8 492 498 500 4 48.1 EU27 or OECD avg. But how can we reach this evaluation of the Greek public sector? The answer relay on the following principles: The 1st is that Greece should be adjusted to foreign practices promoting meritocracy and trust. The 2nd one promotes the alignment of the evaluators and of those who will be evaluated, interests. Analysts believe that the public sector in Greece is large enough and consumes a huge amount of recourses. The total wage bill in the Greek public sector is actually higher than the European average. For example in 2007 Greece spent the 11,2% of GDP (Gross Domestic Product) for the payments of civil servants while the european average was 10,4% of GDP. However this difference is not significant when it is placed in a wider context. For example, Sweden spent the 15% of GDP for the payments of civil servants. So as we mentioned above the solution to the problems that Greek crisis has created is to make reforms ( Michael Haliassos Dimitri Vayanos). 5) CORRUPTION An important problem which nowadays is a widespread phenomenon in Greece is corruption and this is a widespread problem because there are no incentives to discourage it. To give a final solution, government should be focused on reforms such as: creating tougher penalties against corruption, modernize the old one accounting practices and also the relationship between government and citizens should be simplified and be more anonymous. However, some believe that in case of corruption any effort for reforms will eventually have poor result and this happens because corruption in Greece works from bottom (public servants) and up (political personnel) and vice versa. The only way for changing the situation is by changing social behavior which means that public should be educated and especially young generation. This will also help to save other unsocial behaviors such as tax evasion. 6) TAX EVASION Fighting tax evasion should be a top priority for the government. Indeed if the government had been able to collect taxes from all citizens according to their actual incomes, deficits would have been much smaller and Greece would not have a debt problem today. Also in this case, again we come across with the unproductiveness of public sector and the incapability of tax offices to distribute fairly the volume of the taxes. Many governments practice different taxation systems. Usually the citizens ask for a progressive taxation system where the total amount of payments is analog with their annual revenue. But an economic theory against them, supports the proportional taxation system that keeps a stable level of payments (ex 10%) and says that this is an amount that all are willing to pay for. In this way we have no tax evasion. Greece practices the progressive taxation system and in table 5 we see how direct and indirect taxes are distributed. Table 3: Government revenue (Source: Eurostat) Total revenue Indirect Direct taxes Social as % of GDP taxes as % of GDP contributions as % of GDP (VAT) as % of GDP Greece 39,7 12.5 7,9 13,4 EU27 AVG 44.9 13,5 13,4 13.5 7 ) CONCLUSION Finally, it worths mentioning that the economic crisis over the negative effects on the economy and society, it is also an opportunity for social change. It is a challenge for the degradation of a rotten attitude and behavior and the emergence of a healthy collective consciousness that will help us to go forward. Learning from past mistakes, we can proceed in the formation of other cultures which will help us in creating a better society. REFERENCES: Gregory T. Papanikos Athens, 17 March 2012 http://www.atiner.gr/gtp/P2012-01Crisis.pdf Michael Haliassos and Dimitri Vayanos(Goethe University Frankfurt and CFS; London School of Economics) http://greekeconomistsforreform.com/wpcontent/uploads/Getting-Greece-back-on-Track-HowEnglish.pdf Costas Meghir (Yale University,University College London and IFS) Dimitri Vayanos (London School of Economics CEPR and NBER ) NikosVettas (Athens University of Economics and Business) 5 August 2010 http://greekeconomistsforreform.com/wpcontent/uploads/Reform.pdf http://en.wikipedia.org/wiki/Greek_government_debt_crisis