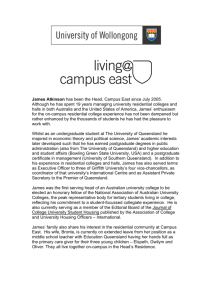

Department of Science, Information Technology, Innovation and the

advertisement