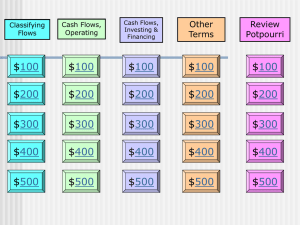

Cash Flow Statement

advertisement

Statement of Cash Flows CENTRAL FACT Over long enough periods: NI = Cash from Ops. + Cash from Inv. = Free Cash Flows • The difference is timing • The goal of SCF is to explain the difference Why do we care about cash? • Information on: – Liquidity – “Quality” of earnings – “Free cash flows” for valuation • Problem: – interpretation is difficult and context specific – depends on the life-cycle of the company – it is hard to know what is a good cash flow Fundamental Relations Assets = Liabilities + Owners’ Equity Cash = Liabilities + OE - Noncash Assets Cash = Liab. + OE - Noncash Assets Cash = NI + Liab. + CC - Div. - NCA Formats • Two formats for the operation section • Financing and investing are always the same Miscellaneous Cash Flow Stuff • Why don’t lines on SCF tie to changes on B/S? • Foreign currency translation – subsidiaries are generally accounted for in local currency – in consolidation local currency is converted to dollars – changes in accounting balances that result from changes in currency are handled as a separate line item on SCF – changes in shareholders’ equity go to “other equity” on the balance sheet Example • Foreign sub with the following ‘96 and ‘97 ¥ B/S and the ¥ weakening from ¥100/$ to ¥111/$. ‘96 & ‘97 ‘96 ‘97 Cash ¥100 $1.0 $0.9 Inventory ¥200 $2.0 $1.8 Equity (100% owned) ¥300 $3.0 $2.7 • B/S--change in equity ($0.3) is “foreign currency translation adjustment” in shareholders’ equity • SCF--the change in cash ($0.1) is separate line item (not spread across change in inventory, etc) Acquisition Accounting • You buy a company with identifiable assets with a book value of $100 (fair value of $200) for $250. Identifiable Assets Goodwill Cash $200 $50 $250 Goodwill will appear as an intangible asset On the SCF, the only effect will be $250 as an investing use of cash, even though lots of other accounts change Major Noncash Transactions • Transactions not involving cash are not reported on the face of the statement – e.g., purchase PP&E for debt, acquire other companies for stock, swap assets • Disclosure is required – typically at the bottom of the SCF Other Items • Firms must disclose interest and taxes paid – – – – income statement gives “accrual” amounts cash interest & taxes are used in some analysis generally disclosed at the bottom of SCF sometimes disclosed in notes (e.g., Coke)