adms4520_-_lecture_3_-_ch

advertisement

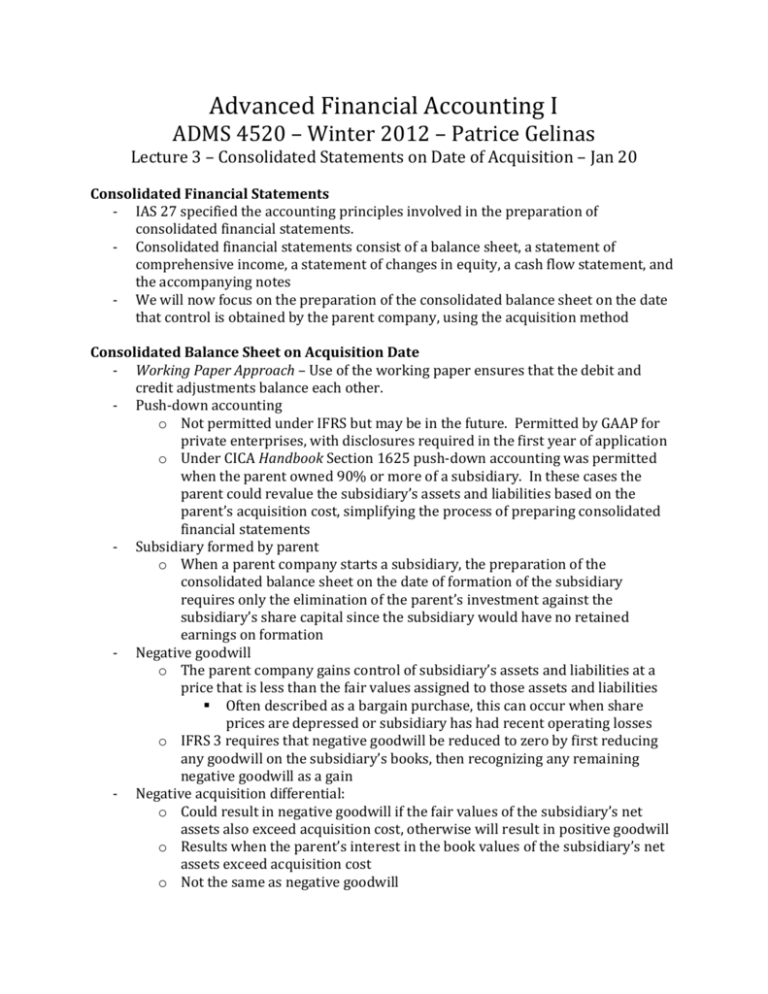

Advanced Financial Accounting I ADMS 4520 – Winter 2012 – Patrice Gelinas Lecture 3 – Consolidated Statements on Date of Acquisition – Jan 20 Consolidated Financial Statements - IAS 27 specified the accounting principles involved in the preparation of consolidated financial statements. - Consolidated financial statements consist of a balance sheet, a statement of comprehensive income, a statement of changes in equity, a cash flow statement, and the accompanying notes - We will now focus on the preparation of the consolidated balance sheet on the date that control is obtained by the parent company, using the acquisition method Consolidated Balance Sheet on Acquisition Date - Working Paper Approach – Use of the working paper ensures that the debit and credit adjustments balance each other. - Push-down accounting o Not permitted under IFRS but may be in the future. Permitted by GAAP for private enterprises, with disclosures required in the first year of application o Under CICA Handbook Section 1625 push-down accounting was permitted when the parent owned 90% or more of a subsidiary. In these cases the parent could revalue the subsidiary’s assets and liabilities based on the parent’s acquisition cost, simplifying the process of preparing consolidated financial statements - Subsidiary formed by parent o When a parent company starts a subsidiary, the preparation of the consolidated balance sheet on the date of formation of the subsidiary requires only the elimination of the parent’s investment against the subsidiary’s share capital since the subsidiary would have no retained earnings on formation - Negative goodwill o The parent company gains control of subsidiary’s assets and liabilities at a price that is less than the fair values assigned to those assets and liabilities Often described as a bargain purchase, this can occur when share prices are depressed or subsidiary has had recent operating losses o IFRS 3 requires that negative goodwill be reduced to zero by first reducing any goodwill on the subsidiary’s books, then recognizing any remaining negative goodwill as a gain - Negative acquisition differential: o Could result in negative goodwill if the fair values of the subsidiary’s net assets also exceed acquisition cost, otherwise will result in positive goodwill o Results when the parent’s interest in the book values of the subsidiary’s net assets exceed acquisition cost o Not the same as negative goodwill - - Subsidiary with goodwill: o Any goodwill on balance sheet of subsidiary on acquisition date is not carried forward to the consolidated balance sheet o That goodwill resulted from a past transaction in which the subsidiary was the acquirer in a business combination, reflecting outdated fair values of the entity it acquired o The parent’s acquisition differential is now calculated as if the goodwill had been written off by the subsidiary and replaced instead by the updated fair values and goodwill of the entity the subsidiary previously acquired Consolidation of non-wholly owned subsidiaries: o The shares not owned by the parent are owned by the other shareholders, referred to as the “non-controlling shareholders”. o The value of shares held by the non-controlling shareholders appears on the balance sheet as “non-controlling interest” (NCI). o Four theories address the following questions: How should the portion of the subsidiary’s net assets not owned by the parent be valued on the consolidated financial statements? How should NCI be valued? How should NCI be presented? Consolidation on Acquisition Date - Income statement in year of acquisition. o Under the acquisition method, only the net income earned by the subsidiary after the date of acquisition is included in consolidated net income. In the above example, P’s financial statements for June 30, Year 1 would include a consolidated balance sheet and net income, changes in equity, and cash flows from P’s separate entity financial statements Conceptual Alternatives - The four theories are: o Proprietary Theory o Entity Theory o Parent Company Theory o Parent Company Extension - Parent Company Theory was GAAP in Canada to January 1, 2011 or sooner upon earlier adoption of IFRS 3 - On January 1, 2011 the Entity Theory replaces Parent Company Theory as the preferred method of consolidating subsidiaries - The Parent Company Extension Theory is also acceptable after January 1, 2011 or sooner - Proprietary Theory is presently used for consolidating joint ventures but may be discontinued soon The Proprietary Theory - Views the consolidated entity from the standpoint of the shareholders of the parent company Therefore the consolidated statements do not reflect the equity of the noncontrolling shareholders Not permitted under GAAP for consolidation of parent and subsidiary, however is used to report joint venture investments where there is no control relationship The consolidated balance sheet consists of the historical values of the parent’s assets and liabilities plus the parent’s share of the fair values of the subsidiary’s assets and liabilities Goodwill is therefore based only on the cost paid by the parent for the acquisition, and does not include any portion attributable to the non-controlling shareholders. The Entity Theory - Views the consolidated entity as having two distinct groups of shareholders – the controlling and non-controlling shareholders - The basis of GAAP for consolidation beginning January 1, 2011 or upon earlier adoption of IFRS 3 - The consolidated balance sheet reflects full fair values of subsidiary’s net assets and goodwill as if the parent had acquired 100% instead of the lesser amount actually acquired - For the balance sheet to reflect full fair value of the subsidiary, the price per share paid by the parent is effectively extrapolated to the shares not acquired, to establish an implied fair value for the entire company. - As parent’s holding moves further away from 100%, or as parent acquires control through a series of small purchases, straight-line extrapolation loses validity - If the subsidiary was a public company and its shares were actively traded prior to acquisition, an alternative approach to valuing the non-controlling interest would be to multiply the number of non-controlling shares by the acquisition date trading price - Another alternative approach for valuing non-controlling interests would be to perform an independent business valuation using valuation techniques, which could be costly - The entity theory results in the following: o Assets acquired and liabilities assumed are valued at their total fair value at the date of acquisition o Non-controlling interest is valued on the basis of the market value of the company acquired, not the underlying book value as in the parent company theory. o NCI is presented in consolidated equity based on fair values of subsidiary’s net assets and goodwill. The Parent Company Theory - Similar to the proprietary theory the Parent Company theory focuses on the parent’s shareholders - Required by GAAP prior to January 1, 2011 or before earlier adoption of IFRS 3 - - - - The fair values of the assets and liabilities acquired in the consolidation are reflected in the consolidated statements, but only to the extent of the parent’s proportionate interest acquired. The non-controlling shareholders’ portion is reflected at book values Accordingly, the value of subsidiary’s assets and liabilities reflected on the consolidated balance sheet is a hybrid: book value for non-controlling interest portion and fair value for the parent’s share Requires that fair values be recognized only to the extent of the proportion evidenced by the parent’s purchase. That is, with a 90% purchase of a subsidiary, book value is reflected for each asset and liability of the subsidiary, plus the parent’s fair value increment based on 90% of the difference between fair and book values. Consolidated balance sheet is the sum of the: o Book value of Parent Company's Net Assets o Book value of Subsidiary Company Net Assets, and o Difference between fair value and book value of Subsidiary’s assets and liabilities, only for the percentage acquired by the parent. (The noncontrolling portion remains at historical cost) NCI is reflected as a liability Parent Company Extension Theory - Addresses concern about goodwill valuation under the entity theory - Reflects both parent’s and non-controlling interest’s share of identifiable net assets at full fair values. - However only parent’s share of subsidiary’s goodwill is reflected on consolidated balance sheet. Contingent Consideration - What happens when a portion of the total cost of the acquisition is variable depending on future events, so the eventual total cost is not known with certainty at the date of acquisition of the subsidiary? - IFRS 3 requires the contingent consideration to be recorded at fair value at the acquisition date as part of the acquisition cost, using assumptions, probabilities, and other valuation techniques which can be subjective and require significant amounts of judgment - Classify contingent consideration as either liability or equity depending on its nature. o If payable in cash or another asset, record as liability. Revalue liability after acquisition date as circumstances change Record revaluation adjustment in earnings if revaluation arose as a result of events occurring after acquisition; or Adjust the purchase price if revaluation arose as a result of new information about facts and circumstances that existed as at the date of acquisition o If payable in additional shares of the parent, record as equity. Do not revalue contingent consideration classified as equity. Contingent consideration disclosures: o Amount of contingent consideration recognized on acquisition date o Description of the contingency and basis for determining payment o Range of potential payments (undiscounted), or the reasons why a range cannot be estimated o If applicable, the presence of an unlimited maximum payment o Each period until the contingency is settled, changes in the amounts recognized for contingent consideration, changes in the range of outcomes (undiscounted), and the reasons for the changes. o The valuation techniques used to measure contingent consideration. -