Note on Acquisition and Elimination Entries

advertisement

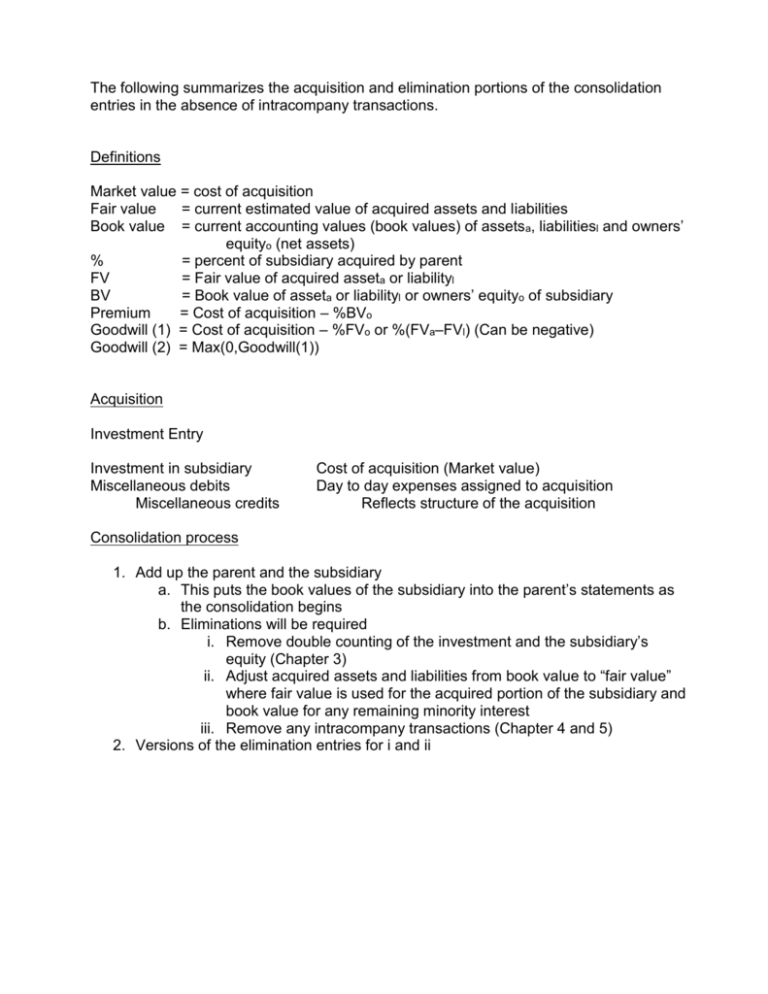

The following summarizes the acquisition and elimination portions of the consolidation entries in the absence of intracompany transactions. Definitions Market value = cost of acquisition Fair value = current estimated value of acquired assets and liabilities Book value = current accounting values (book values) of assetsa, liabilitiesl and owners’ equityo (net assets) % = percent of subsidiary acquired by parent FV = Fair value of acquired asseta or liabilityl BV = Book value of asseta or liabilityl or owners’ equityo of subsidiary Premium = Cost of acquisition – %BVo Goodwill (1) = Cost of acquisition – %FVo or %(FVa–FVl) (Can be negative) Goodwill (2) = Max(0,Goodwill(1)) Acquisition Investment Entry Investment in subsidiary Miscellaneous debits Miscellaneous credits Cost of acquisition (Market value) Day to day expenses assigned to acquisition Reflects structure of the acquisition Consolidation process 1. Add up the parent and the subsidiary a. This puts the book values of the subsidiary into the parent’s statements as the consolidation begins b. Eliminations will be required i. Remove double counting of the investment and the subsidiary’s equity (Chapter 3) ii. Adjust acquired assets and liabilities from book value to “fair value” where fair value is used for the acquired portion of the subsidiary and book value for any remaining minority interest iii. Remove any intracompany transactions (Chapter 4 and 5) 2. Versions of the elimination entries for i and ii Elimination entry Comprehensive entry Owners’ equity of subsidiary BVo (net book value of subsidiary) Fair value adjustment for assets %(FVa – BVa) Fair value adj for nonmarketable Long-term assets Max (0,%( FVa – BVa) – Min(0,Goodwill(1))) Goodwill (2) Maximum (0, Goodwill(1)) Investment in subsidiary Cost of acquisition Minority interest BVo(1–%) Fair value adjustment for liabilities %(FVl – BVl) Extraordinary gain Max (0, Goodwill(1) –%FVa (nonmarketable)) Series of entries 1) Owners’ equity of subsidiary Investment in subsidiary Minority interest BVo (net book value of subsidiary) %BVo BVo(1–%) 2) Premium Investment in subsidiary Cost of acquisition – %BVo Cost of acquisition – %BVo 3) Fair value adjustment for assets %(FVa – BVa) Fair value adj for nonmarketable Long-term assets Max (0,%( FVa – BVa) – Min(0,Goodwill(1))) Goodwill (2) Maximum (0, Goodwill(1)) Premium Cost of acquisition – %BVo Fair value adjustment for liabilities %(FVl – BVl) Extraordinary gain Max (0, Goodwill(1) –%FVa (nonmarketable))