Office Hours: By Appointment Only

advertisement

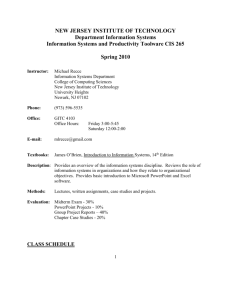

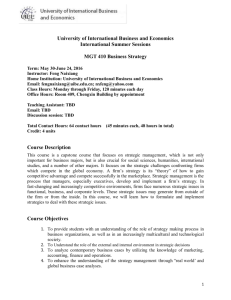

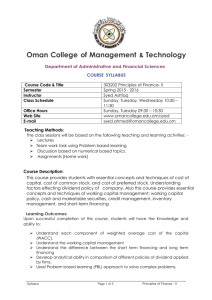

JAMES MADISON UNIVERSITY Dollars and Sense Course Number: IS 275 Spring 2012 Semester Monday 2:30pm – 5:00pm Burruss Room 139 Instructor: Mr. Brad Barnett, MS, AFC, CPFM Office: Warren Hall, Room B504-J Phone: 540-568-2894 Email: barnetbd@jmu.edu Office Hours: By Appointment Only TEXT & MATERIALS: Go to the JMU Bookstore or http://www.daveramsey.com/store. If using the website, type the name of the product in the “SEARCH FOR” box to find it. Materials are not required to be purchased from this site or the JMU Bookstore if they can be found elsewhere. If purchased from this site, please allow a minimum of 5 business days to receive the order. Required materials are needed on the first day of class (January 9th). Required Materials Foundations in Personal Finance College Edition (Item No: 9781936948000CUR) COURSE DESCRIPTION: This practical course will review the affect a personal philosophy on money, influence of societal expectations, and management of personal finances, has on all aspects of life when it comes to securing the “American Dream.” Students will learn real life skills in the areas of eliminating debt, creating a budget, understanding investments and insurance, saving money, planning for retirement, shopping for a house, and other topics dealing with financial issues faced in daily life. COURSE INTENDED LEARNING OUTCOMES: Students completing this course are expected to demonstrate the following competencies: 1. To secure the necessary knowledge and resources that will enable the students to teach this information from this course to others. 2. To understand through demonstration, discussing and experience, the concept of personal finance as it relates to saving. 3. To develop the capacity to communicate with others regarding the effects our values have on our spending and saving habits. 4. To comprehend the basics of developing and maintaining a functional zero-based budget. 5. To refine a personal vision of the “American Dream” and understand the elements needed to make that vision a reality. 6. To gain the knowledge and skills necessary to make wise decisions in how to handle day-to-day finances and plan for the future. 7. To secure the tools to properly evaluate all personal goals, needs, and plan of implementation to financial freedom. COURSE FORMAT: This course is based upon: 1. A study of chapters in the workbook. 2. The reading and completion of supplementary in-class and out-of-class workbook and reference materials. Dollars and Sense Syllabus 1 3. Students will be required to keep a weekly journal, develop a written financial budget, create a financial plan, and perform other written assignments. 4. The viewing of pertinent videos. 5. Lectures, in-class discussions, a mid-term and a final examination. 6. The instructor reserves the right to modify parts of this syllabus throughout the term COURSE EXPECTATIONS: Students fulfilling are expected to meet the following course expectations: 1. Commit time to READ AND PREPARE for class discussions, participate in class discussions, and follow through to completion in each class assignment. 2. ATTENDANCE IS MANDATORY FOR A GRADE OF A! Commit to being in attendance in every class meeting and attending every class meeting on time. Due to the participatory nature of this class, it is impossible to stay current on assignments and responsibilities if one is not present, even if the absences are excused. Therefore, a student will receive a grade of zero for any missed class, even it is excused. 3. All cellular phones and pagers must be turned off prior to entering class. 4. Class participation also includes refraining from talking during all video and other in class presentations. Mutual respect is paramount. COURSE ASSIGNMENTS: Multiple opportunities will be provided for students to demonstrate their intelligence and diligence. These will include several assignments, described below. Additional information will be provided on each of these in class. 1. Class Participation and Attendance: The wisdom of class commentary, including comments on readings, viewings, and presentations will be evaluated in terms of its pertinence, clarity and perceptiveness. Moreover, a series of in-class exercises will be provided in order to elicit reactions to class viewings. Attendance is truly expected every class. Failure to attend class could result in failure of course. Class participation and attendance will count as 40% of the final course grade. Note: Accommodations may be made for religious observances, disabilities, military service, jury duty, illness, family emergencies, or representation of the university. Please see the instructor if one of these situations applies to you. 2. Midterm Exam: An examination will be given. More information will be provided in class as the date for the midterm approaches. The midterm will be a compilation of material covered in every class prior to the date of actual examination. The midterm will count as 15% of the total course grade. 3. Homework Assignments: Each student will be required to complete and submit a series of homework assignments. These may include weekly journal entries, assigned readings, topical papers, a zero-based budget, a personal biography (including history, present and future goals for life and personal finance), and a plan for achieving the “American Dream.” These assignments will be used to create a financial plan that will be submitted at the conclusion of the semester. Homework turned in late will be docked one letter grade for each week (or any portion of a week) it is late, regardless of the reason. 4. Final Exam: The final will cover material from the entire course semester. The final exam will count as 15% of the total course grade. COURSE CONTENT: The course will focus on the following topics as they relate to the students securing their “American Dream”: Savings Reviews the societal influences on spending and saving habits, the affect our emotional development has in this area, discusses savings from a historical perspective, and teaches discipline, patience, and goal setting. Budgeting Focuses on the importance of budgeting and challenges students to determine what can be classified as essential and non-essential expenses for them. The incorporation of planning for short term and long goals Dollars and Sense Syllabus 2 as they relate to needs and wants is also part of this lesson, as well as an overview of some basic tax information. Debt Debt is often acquired due to a lack of emotional maturity when it comes to spending (e.g., impulse shopping, etc.), poor planning skills, and/or succumbing to societal expectations of what the “American Dream” should be for everyone. Students will learn about these influences as well as discuss methods for eliminating current debt and avoiding future debt, as well as discuss some key differences between debit cards and credit cards. College Student Essentials The importance of being in touch with your personality and desires as it relates to selecting your career, finding money to pay for college, and some issues related to the transition of life after college will be reviewed. Family, Friends, and Philanthropy Students will learn how individuals and families relate with money, how emotions affect our purchasing decisions, and the role our personal and family values play on how we spend and save our money and the overall quality of our relationships. Consumer Awareness The psychology of spending, marketing, and succumbing to personal desires when it comes to purchasing to “make yourself happy” will be discussed. Bargain Shopping Students will discover the benefits of negotiating and ways to save money when shopping. Credit Bureaus Students will learn about debt collection practices, gain knowledge about credit bureaus, and learn how to read a credit report Insurance The various aspects of acquiring physical and emotional security by having the right type of insurance for your situation will be reviewed in this lesson. Investing The basic terminology of investing, compounding interest, and a variety of investment methods appropriate for specific goals will be discussed. Students will be given tools to calculate compounding interest. Retirement and Savings Plans The importance of goal setting and long range planning to ensure you are adequately prepared for retirement and future college expenses will be reviewed, as well as the multitude of options available to save for these situations. Real Estate Reviews the buying, selling, and purchasing aspects of securing a home, including the influence others may have on the choices we make. BLACKBOARD USAGE: DVD lessons for viewing after class Syllabus Various worksheets and assignments Communication to class (this may be done via e-mail as well) Dollars and Sense Syllabus 3 WEEKLY JOURNAL ARTICLE FORMAT: No more than one typed page. Discuss something financial you learned or were more conscious of during the week outside of class. Talk to the knowledge you gained and the feelings you experienced at that time. For example, did you think twice about making a certain purchase based on something we discussed in class? If so, describe the situation and talk about your feelings about the decision you made. Was it hard? Was it easy? Did you feel proud that you fought off the impulse, or ashamed that you gave into it? Grading will be based on the content of the journal. COURSE GRADING: The overall course grade will be determined by the following constraints: Attendance and Class Participation 40% Homework Assignments 10% Midterm Exam 15% Weekly Journal 10% Financial plan 10% Final Exam 15% 100% The distribution of grades will be determined by the percentage value that each student acquires throughout the course of the semester. The final course grade will be given on the following points scale: A= 94 - 100% B= 86 - 93% C= 78 - 85% D= 70 - 77% F= 0 - 69% MID-TERM AND FINAL EXAMS: You will be given a “test” for each topic discussed in class. Your mid-term and final exams will predominantly come from these questions, but Mr. Barnett reserves the right modify this format. FINANCIAL PLAN FORMAT: The plan can be as long as you need it to be, but it must be typed using the template provided by Mr. Barnett. Your plan should demonstrate how you personally plan to address these areas of your life. Grades will be determined based on the quality of the content, not necessarily the length of the plan. Include SMART Goals in your plan. 1. Introduction Personal history including future life goals and financial goals. Discuss how your values play a role in this and what values those are. Has your American Dream changed since the paper you submitted after the first class? If so, how? If not, how has it been validated? 2. Saving, Investing, and Retirement How you plan to save for large expenses (e.g., car, house, etc), develop an emergency fund, invest, build wealth, and prepare for retirement. 3. Debt and Banking Credit cards, debit cards, banking, student loans, repayment plans, philosophy on having it, pros and cons of it, etc. 4. Consumer Awareness The influence it has had on your purchases in the past and how being cognizant of this will impact your future purchases 5. Credit Bureaus Dollars and Sense Syllabus 4 6. 7. 8. 9. 10. 11. 12. Building credit and/or if that is important, credit report/scores, and dealing with collections agencies (if applicable) Budgeting and Taxes Developing budgets and mechanisms for how you will ensure you stay within budget and ensure your budget reflects your personal values, how you will try to manage your taxes Bargain Shopping Incorporating bargain shopping and/or negotiating techniques Family, Friends, and Philanthropy The impact your personal values play on your use of money and how that affects your relationships, now and in the future. Careers Thoughts about your career choice Insurance Types of insurance you have, and/or plan on purchasing and why Real Estate Plans for purchasing a home and/or investing in real estate (if applicable) Conclusion Summary of how this class has affected you and how you think these principles will change your life. Dollars and Sense Syllabus 5 Date January 9th January 16th January 23rd January 30th February 6th February 13th February 20th February 27th March 5th March 12th March 19th March 26 th COURSE SCHEDULE, TOPICS, READING SCHEDULE & HOMEWORK: Class Session Readings Prior to Class Homework Due Next Class Intro & Savings Foundations in Personal 1. American Dream Paper Finance Introduction and 2. Watch Savings video Blackboard Chapter 1 3. Watch Budgeting video Blackboard 4. Savings Test MLK Holiday Budgeting Part 1 Foundations in Personal 1. Journal Finance Chapter 2 2. Budgeting Test 3. TBD Budgeting Part 2 & Foundations in Personal 1. Journal Debt Finance Chapter 3 2. Debt Test 3. February Budget 4. TBD College Student Foundations in Personal 1. Journal Essentials Finance Chapter 4 2. College Essentials Test 3. TBD Family, Friends, and Foundations in Personal 1. Journal Philanthropy Finance Chapter 5 2. Family and Friends Test 3. TBD Consumer Awareness Foundations in Personal 1. Journal Finance Chapter 6 2. Consumer Test due 2/22 3. Pull Credit Report for 3/26 class 4. TBD Mid-Term Exam Spring Break Bargains Foundations in Personal 1. Journal Finance Chapter 7 2. Shopping Test 3. TBD Credit Bureaus Foundations in Personal 1. Journal Finance Chapter 8 2. Credit Test Insurance Foundations in Personal Finance Chapter 9 April 2nd April 9th Hold Investments Foundations in Personal Finance Chapter 10 April 16th Retirement and Savings Plans Foundations in Personal Finance Chapter 11 April 23rd Real Estate Foundations in Personal Finance Chapter 12 April 30th Final Exam (TBA) 3. 1. 2. 3. TBD Journal 1. 2. 3. 1. 2. 3. 1. 2. Journal Investments Test TBD Journal Retirement Test TBD Real Estate Test due 4/25 Financial plan Insurance Test TBD Dollars and Sense Syllabus 6