Document - Oman College of Management & Technology

advertisement

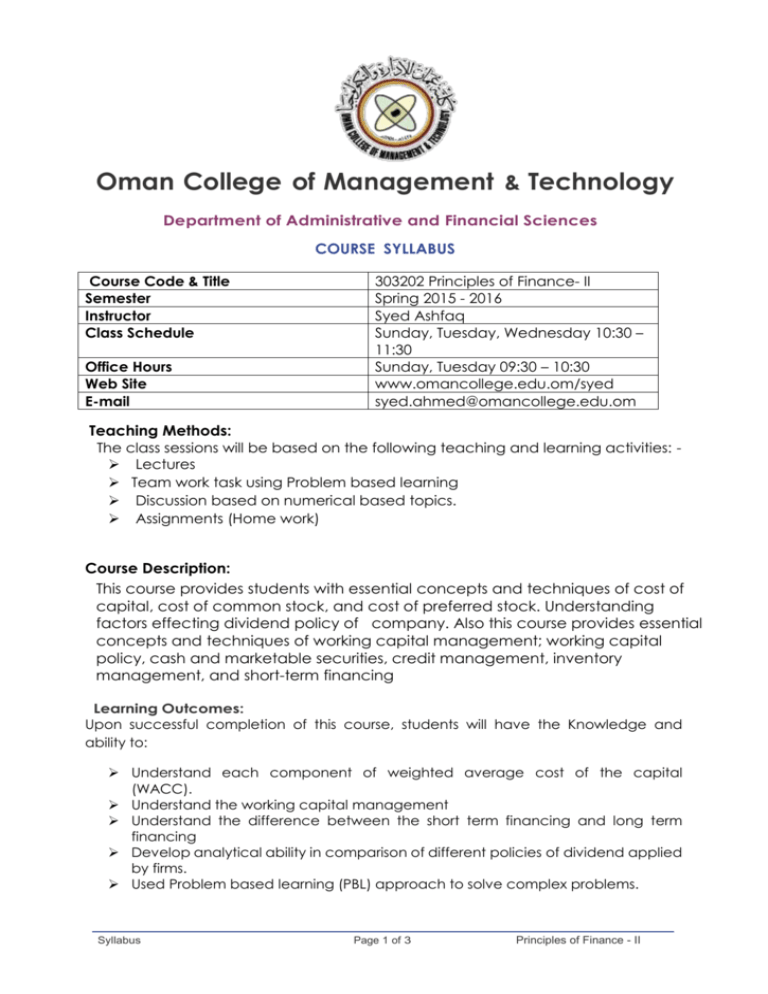

Oman College of Management & Technology Department of Administrative and Financial Sciences COURSE SYLLABUS Course Code & Title Semester Instructor Class Schedule Office Hours Web Site E-mail 303202 Principles of Finance- II Spring 2015 - 2016 Syed Ashfaq Sunday, Tuesday, Wednesday 10:30 – 11:30 Sunday, Tuesday 09:30 – 10:30 www.omancollege.edu.om/syed syed.ahmed@omancollege.edu.om Teaching Methods: The class sessions will be based on the following teaching and learning activities: Lectures Team work task using Problem based learning Discussion based on numerical based topics. Assignments (Home work) Course Description: This course provides students with essential concepts and techniques of cost of capital, cost of common stock, and cost of preferred stock. Understanding factors effecting dividend policy of company. Also this course provides essential concepts and techniques of working capital management; working capital policy, cash and marketable securities, credit management, inventory management, and short-term financing Learning Outcomes: Upon successful completion of this course, students will have the Knowledge and ability to: Understand each component of weighted average cost of the capital (WACC). Understand the working capital management Understand the difference between the short term financing and long term financing Develop analytical ability in comparison of different policies of dividend applied by firms. Used Problem based learning (PBL) approach to solve complex problems. Syllabus Page 1 of 3 Principles of Finance - II Course Time Table: Weeks 1 2 3 CHAPTER 01 Capital Budgeting Cash flows The Capital Budgeting Decision Process , Relevant Cash Flows Finding the Initial Investment, Finding the Operating Cash Inflows Finding the Terminal Cash Flow, Summarizing the Relevant Cash Flows CHAPTER 02 Capital Budgeting Techniques Overview of Capital Budgeting Techniques 4 5 6 Payback Period, Net Present Value, Internal Rate of Rate Comparing NPV and IRR Techniques and IRR Techniques First Exam (Covering Weeks 1- 6 ) CHAPTER 03 Working Capital Management Net Working Capital Fundamentals, Cash Conversion Cycle 7 8 9 Inventory Management, Accounts Receivables Management Management of Receipts and Disbursements CHAPTER 04 Current Liabilities Management Spontaneous Liabilities 10 11 12 Unsecured Sources of short-term loans, Secured Sources of short-term loans. Second Exam (Covering Weeks 7- 12 ) CHAPTER 05 The Cost of Capital An Overview of the Cost of Capital The Cost of Long-Term Debt , Cost of Preferred Stock and Common Stock The Weighted Average Cost of Capital, Marginal Cost and Investment 13 14 15 16 Decision Revision Second Exam (Covering Whole Syllabus) Text Book: Title: Principles of Managerial Finance. Authors: Lawrence J. Gitman Edition: 11th edition. Performance Evaluation: The grade will be based upon the following: First Exam Second Exam Class Participation & Activity Final Project (Exam) Syllabus 20% 20% 10% 50% Page 2 of 3 Principles of Finance - II Student Responsibility: Mobile phones must be turned off during class time. Students are expected to participate in class discussion and critiques. Failure to do so will result in grade reduction. Students are expected to follow OCMT’s standardized attendance policy. Lecture attendance is mandatory. Students are allowed maximally of 15% absentia of the total module hours. Students are required to work on projects in and outside of class, and must complete all assignments. Meeting all deadlines and complete all assignments, (Late papers will not be accepted). Coming on time and staying till class is over. Syllabus Page 3 of 3 Principles of Finance - II