Protecting Seniors Against Financial Abuse

advertisement

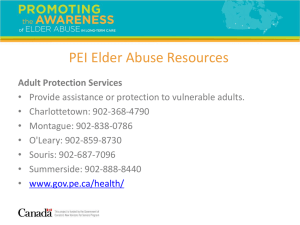

Protecting Seniors Against Financial Abuse Jane Rooney, Financial Literacy Leader Edmonton Financial Elder Abuse Roundtable April 23, 2015 Overview • Prevalence and impact of financial elder abuse • Responding to the needs of seniors • Financial Literacy Leader’s role and mandate • Combatting elder financial abuse Many forms of financial abuse • Bold scams or subtle pressure tactics, including: • Identity theft, forged or altered wills, misuse or abuse of Power of Attorney and joint bank accounts • Seniors must learn how to identify and report fraud and financial abuse Fraud: A common problem • In 2014, the Canadian Anti-Fraud Centre reported: • • 40,986 complaints from 13,690 victims Approximately $69 million in financial loss • Risk factors: Substantial savings or assets, limited contact with friends or family and a greater sense of trust Perception-Reality Gap • Seniors may be at greater risk due to perception-reality gap: • • Seniors rate themselves highest on their financial knowledge Score lower on assessments of their financial knowledge Changing demographics • Canadians aged 65 and over: • • In 2013: 15 percent of population By 2036: 25 percent of population • Canadians with dementia • • In 2011, 747,000 Canadians were living with dementia. By 2031, this is expected to reach 1.4 million Financial Literacy Leader Mandate: • Collaborate and co-ordinate initiatives that strengthen the financial literacy of Canadians • Develop and implement the national strategy for financial literacy National strategy for financial literacy • To be released in 2015 • Steering Committee on Financial Literacy will champion the strategy and engage with stakeholders • Strategy development involved three phases of public consultations What we heard • • • • Recognize seniors as a diverse group Tailor our messages and programs Use Clear communications Collaborate for success Strengthening Seniors’ Financial Literacy Goals for seniors: 1. 2. 3. 4. Preparing financially for the future Plan and manage financial affairs Improve understanding of and access to public benefits for seniors Create tools to combat financial abuse of seniors Current initiatives • Research on elder abuse - NICE • “Your Money Seniors” - CBA • Public Commitment on Powers of Attorney and joint deposit accounts - CBA • “Fraud:Recognize it. Report it. Stop it.” Credit Union Central Canada Our challenges • Maintain balance between privacy and protection • Incident may involve family member or friend • Victims may be reluctant to contact authorities and may resent the advice of a professional Opportunities • • • • Educate and empower seniors Take advantage of “teachable moments” World Elder Abuse Awareness Day June 15 Engage partners and connect to community resources • Develop appropriate intervention measures • Incorporate workplace financial literacy training and prevention programs. Contact us ItPaysToKnow.gc.ca Consumer Services Centre: 1-866-461-FCAC (3222) Follow @FCACan on Twitter Subscribe to FCACan on YouTube Like Financial Consumer Agency of Canada (FCAC) on Facebook Like Financial Literacy Month in Canada on Facebook Follow Financial Consumer Agency of Canada on LinkedIn Join the Financial Literacy in Canada group on LinkedIn