Accounting I Study Guide

advertisement

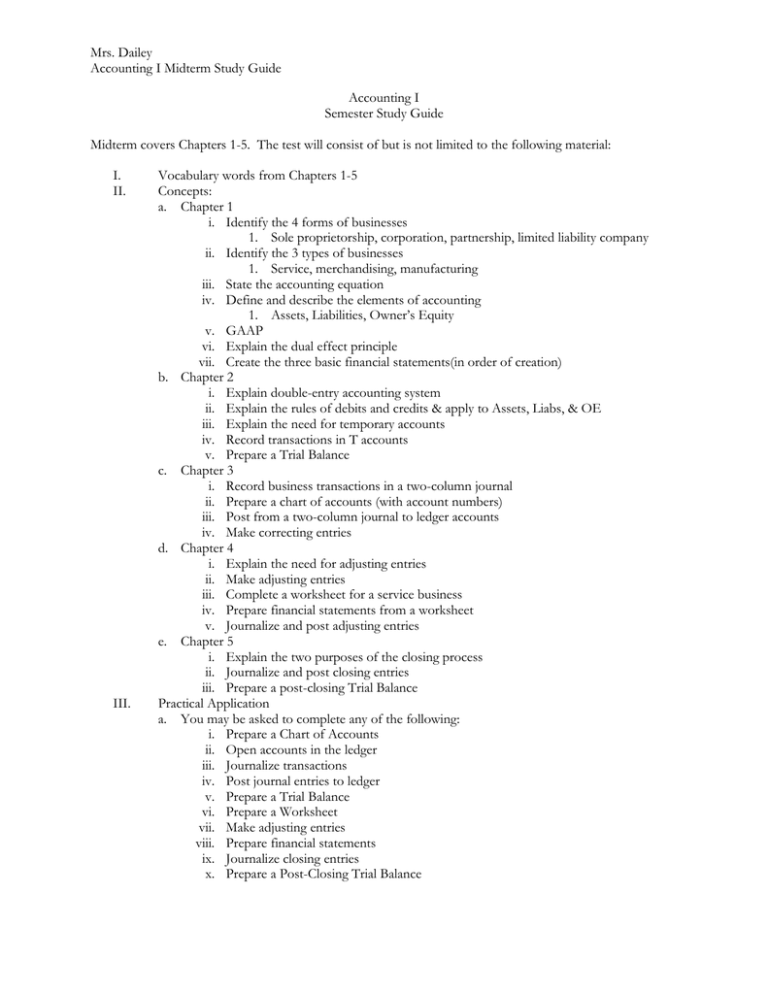

Mrs. Dailey Accounting I Midterm Study Guide Accounting I Semester Study Guide Midterm covers Chapters 1-5. The test will consist of but is not limited to the following material: I. II. III. Vocabulary words from Chapters 1-5 Concepts: a. Chapter 1 i. Identify the 4 forms of businesses 1. Sole proprietorship, corporation, partnership, limited liability company ii. Identify the 3 types of businesses 1. Service, merchandising, manufacturing iii. State the accounting equation iv. Define and describe the elements of accounting 1. Assets, Liabilities, Owner’s Equity v. GAAP vi. Explain the dual effect principle vii. Create the three basic financial statements(in order of creation) b. Chapter 2 i. Explain double-entry accounting system ii. Explain the rules of debits and credits & apply to Assets, Liabs, & OE iii. Explain the need for temporary accounts iv. Record transactions in T accounts v. Prepare a Trial Balance c. Chapter 3 i. Record business transactions in a two-column journal ii. Prepare a chart of accounts (with account numbers) iii. Post from a two-column journal to ledger accounts iv. Make correcting entries d. Chapter 4 i. Explain the need for adjusting entries ii. Make adjusting entries iii. Complete a worksheet for a service business iv. Prepare financial statements from a worksheet v. Journalize and post adjusting entries e. Chapter 5 i. Explain the two purposes of the closing process ii. Journalize and post closing entries iii. Prepare a post-closing Trial Balance Practical Application a. You may be asked to complete any of the following: i. Prepare a Chart of Accounts ii. Open accounts in the ledger iii. Journalize transactions iv. Post journal entries to ledger v. Prepare a Trial Balance vi. Prepare a Worksheet vii. Make adjusting entries viii. Prepare financial statements ix. Journalize closing entries x. Prepare a Post-Closing Trial Balance