a temporary account.

advertisement

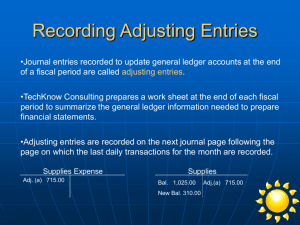

Chapter 8 RECORDING ADJUSTING AND CLOSING ENTRIES FOR A SERVICE BUSINESS Key terms • accounting cycle: the series of accounting activities included in recording financial information for a fiscal period • adjusting entries: journal entries recorded to update general ledger accounts at the end of a fiscal period • closing entries: journal entries used to prepare temporary accounts for a new fiscal period Key terms • permanent accounts: accounts used to accumulate information from one fiscal period to the next • post-closing trial balance: a trial balance prepared after the closing entries are posted • temporary accounts: accounts used to accumulate information until it is transferred to the owner’s capital account Identifying Financial Statement Procedures: • Income summary is a temporary account. • Temporary accounts begin each new fiscal period with a zero balance. • The journal entry to close Income Summary when there is a net income is debit Income Summary; credit owner’s capital. • Accounts used to accumulate information from one fiscal period to the next are permanent accounts. Identifying Financial Statement Procedures: • The journal entry to adjust Supplies is debit Supplies Expense; credit Supplies. • When the total expenses are greater then the total revenue, the income summary account has a debit balance. • Accounting Period Cycle concept applies when a work sheet is prepared at the end of each fiscal cycle to summarize the general ledger information needed to prepare financial statements. • After the closing entries are posted, the owner’s capital account balance should be the same as shown on the balance sheet for the fiscal period. Identifying Accounting Concepts and Procedures: • A source document is prepared for adjusting entries FALSE • The income summary account has a normal debit balance FALSE • The drawing account is a permanent account FALSE (temp) • Temporary accounts must start each fiscal period with a zero balance TRUE Identifying Accounting Concepts and Procedures: • A post-closing trial balance verifies the equality of debits and credits in a general ledger after the closing entries are posted TRUE • Journal entries used to prepare temporary accounts for a new fiscal period are closing entries TRUE • The balances of the expense accounts must be reduced to zero to prepare the accounts for the next fiscal period TRUE • To close a temporary account, an amount equal to its balance is recorded in the amount on the side opposite to its balance TRUE