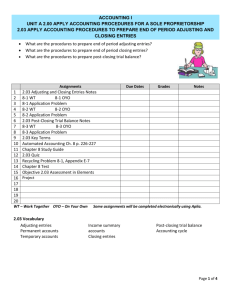

Content Map of Unit

advertisement

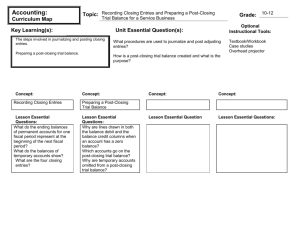

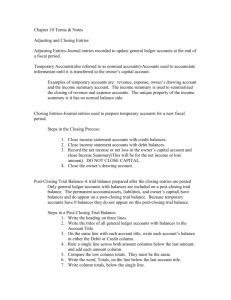

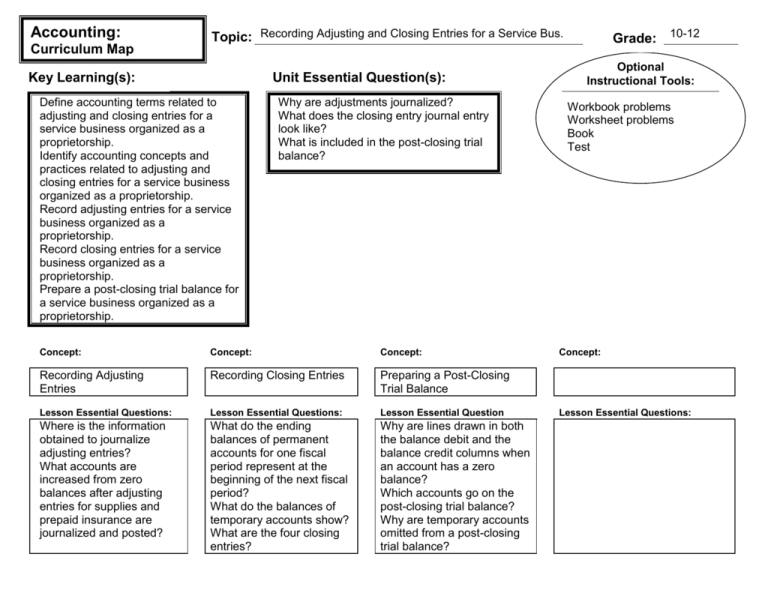

Accounting: Curriculum Map Topic: Recording Adjusting and Closing Entries for a Service Bus. Key Learning(s): Unit Essential Question(s): Define accounting terms related to adjusting and closing entries for a service business organized as a proprietorship. Identify accounting concepts and practices related to adjusting and closing entries for a service business organized as a proprietorship. Record adjusting entries for a service business organized as a proprietorship. Record closing entries for a service business organized as a proprietorship. Prepare a post-closing trial balance for a service business organized as a proprietorship. Why are adjustments journalized? What does the closing entry journal entry look like? What is included in the post-closing trial balance? Concept: Concept: Concept: Recording Adjusting Entries Recording Closing Entries Preparing a Post-Closing Trial Balance Lesson Essential Questions: Lesson Essential Questions: Lesson Essential Question Where is the information obtained to journalize adjusting entries? What accounts are increased from zero balances after adjusting entries for supplies and prepaid insurance are journalized and posted? What do the ending balances of permanent accounts for one fiscal period represent at the beginning of the next fiscal period? What do the balances of temporary accounts show? What are the four closing entries? Why are lines drawn in both the balance debit and the balance credit columns when an account has a zero balance? Which accounts go on the post-closing trial balance? Why are temporary accounts omitted from a post-closing trial balance? Grade: 10-12 Optional Instructional Tools: Workbook problems Worksheet problems Book Test Concept: Lesson Essential Questions: Vocabulary: Adjusting entries Other Information: Vocabulary: Permanent accounts Temporary accounts Closing entries Vocabulary: Post-closing trial balance Accounting cycle Vocabulary: