Day 1: Foundations of Energy Trading & Risk Management

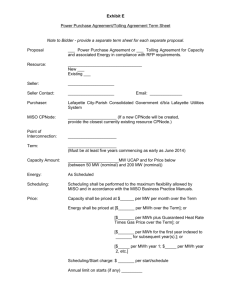

advertisement

APPA GAFA Spring Meeting: A Primer on the Use and Effects of Energy Derivatives Washington, D.C. April 19, 2007 Joanie Teofilo Director, Risk Mgmt - East A Primer on Energy Derivatives: Objectives • Review framework of Risk Management • Develop an understanding of the Energy Markets (Power and Natural Gas) • Discuss Tools (such as Futures and Options) used to manage Risk 2 What is Risk? 3 Risk is… • What? - The probability of experiencing a loss • How large? - The magnitude of a potential loss - how large a loss may be • How Correlated? – How much diversification (a natural risk reducer) do you have? 4 Example of Risk • For a house it is often the risk of a financial loss due to: – – – – Fire Storm (Katrina, Rita!) Burglary Liability • The homeowner’s concern is typically: – The probability that these losses will occur – The potential magnitude of these losses 5 What are “Energy Risks”? • Power generation consumption of fuels? • Forced unit outages (especially during periods of high power prices) • Risk of industrial customer flight • The risk that cash flow is uncertain? (Leading to a requirement to have more capital on hand and/or lower ratings.) • Political pressure to meet budget 6 Energy Risks • Forecast of energy consumption over budget year? • Ability to pass through cost increases? • Type of exposure • fixed • floating • uncertain 7 Why Hedge? • Self Insuring is an alternative • Considerations include: • Requisite cash reserve • Volatility of fuel costs • Potential impact on rates 8 Risk Protection • How do individuals or corporations protect themselves against risk? – Take steps to reduce the probability and/or magnitude of the loss? – Diversity their risk or portfolio – Buy insurance? • How much coverage? • Deductible? – Internalize the risk 9 Why Manage Risk? • The business has changed…today there is significantly more risk in the wholesale market. • Rating Agencies now look more closely for Risk Management • Customers and Boards are expecting it more and more! 10 Hedging and Risk Management • Risk management is the shifting of unacceptable amounts of risk into another form of risk that is more acceptable • outright price risk into credit risk (and possibly basis risk) • basis risk into credit risk • volumetric risk into credit risk • option risk into credit risk • credit risk into less credit risk • All risk is shifted, to an extent, into operational, liquidity, legal, and systemic risks 11 Risk Limits • Risk limits should be established based on the net of physical and financial exposures and positions • Many utilities focus on risk limits for only financial transactions while ignoring the net exposure of physical plus financial • Risk limits should be established based on reducing the net exposure 12 Limit Setting Process Identify Risks Limit Setting Process Quantify Risks Establish Hedge Targets to Reduce Risk to Acceptable Levels 13 Risk Limits (cont.) • A separate measurement of financial exposures only is important for managing potential capital requirements to meet the collateral obligations of financial transactions. • Many utilities are running probabilistic analyses of cash-flow-at-risk and value-at-risk to assist with hedge planning and limit setting/compliance • These models often blend traditional production cost modeling with the affect of physical and financial hedge transactions • More attention is being paid to the establishment and monitoring of credit risk limits 14 Hedge Program Design: Risk Management Objectives • Many municipal utilities, despite their ability to pass-through rising energy costs, are implementing risk management programs to reduce the probability of future rate increases, and to achieve increased rate stability for ratepayers. • Best practice risk management objectives for municipal utilities should focus on price stability or volatility reduction 15 Energy Markets Development of the Financial Markets - Originated from the economic need to manage commodity price risk - Original “futures” markets were for agricultural products - Markets soon developed for other industrial “raw materials” 17 Development of the Financial Markets - In 1848, the Chicago Board of Trade opened as the first organized commodity market in the United States. - Today’s organized futures exchanges provide an efficient way to manage commodity price and credit risk. 18 Who are the Participants in the Energy Markets? • Those with a Physical Interest • Those without a Physical Interest 19 Those with a Physical Interest • Electric Utilities • Oil and Gas Producers • Industrial Oil/Gas Consumers • Coal Mines 20 Those without any Physical Interest • Financial Entities - Hedge Funds, Banks • Private Investors - via Commodity Indexes • Local Traders on the Exchanges 21 WHY? • For utilities (and other entities with a physical interest), the intent is to manage risk. • For those without a physical interest, the intent is to take on risk in hopes of a reward or arbitrage opportunity. 22 Types of Market Participants Three types of participants in forward markets: • Hedgers • Speculators • Arbitrageurs 23 Types of Market Participants Hedgers • Intent is protection, to avoid exposure to adverse price movements Speculators • Intent is profit, willing to take a position in the market, betting that the price will go up or down. 24 Types of Market Participants Arbitrageurs • Intent is profit • Lock in profit by concurrently taking positions in two different markets • Important group for liquid markets and keeping markets in balance • Existence ensures minimal arbitrage opportunities for liquid markets 25 Relationship between the Physical & Financial For those with a physical interest in the market, they are naturally short (in need of a commodity) or naturally long (with an excess of a commodity). Their participation in the market is in direct relationship to their naturally short or naturally long position. 26 Relationship between the Physical & Financial Those with a physical interest will use the market to balance their naturally short or long position. This takes much of the risk out of the commodity prices and allows the utility to focus on its core business. 27 Physical & Financial PHYSICAL FINANCIAL Naturally Short Natural Gas Long Natural Gas Contract • This utility needs (is short) natural gas; it hedges the price risk by purchasing (going long) a financial natural gas contract. • May also hedge physical delivery risk by entering into a physical purchase with index based pricing. 28 How is Energy Traded? Buys Sells Different Markets • Exchange Traded • Over the Counter 29 Exchange • An organization formed to provide an orderly market for trading futures and options. • Provides the requisite infrastructure and support to facilitate trading. • Facilitates the shifting of risk between counter-parties and price discovery. 30 Different Exchanges • New York Mercantile Exchange (NYMEX) • Chicago Mercantile Exchange (CMEX) • Chicago Board of Trade (CBOT) 31 Exchange Traded Contracts • Pit Traded (in person) • Via Electronic Trading - e.g., NYMEX’s Globex 32 Exchange Traded Contracts The Exchange specifies the following: • Product Quality • Delivery Location • Amount of the Asset to be delivered per the contract • Delivery Period • Margin Provisions 33 Exchange Traded Contracts • Product Terms are standardized and non-negotiable (set by the Exchange) • Counter-party risk is assumed by the clearing members of the exchange • Most contracts are Financially Settled (though a small number may be Physically Delivered) • Characterized by generally greater liquidity than Over-the-Counter 34 Exchange Traded Contracts • The trade is between the Exchange and the buyer or seller. • The parties buying and selling with the Exchange are required to post a Margin (to mitigate counterparty credit risk) 35 Exchange Traded Energy Contracts • New York Mercantile Exchange (NYMEX) - Henry Hub Natural Gas - Central Appalachian Coal Light, Sweet Crude Oil (WTI) Brent Crude Oil Heating Oil - Unleaded Gasoline Propane 36 Margin Margin Requirements • Before buying or selling an exchange traded contract, each party is required to post a percentage of the value of the contract with the exchange. • This goes into each party’s “margin account.” • The margin provides insurance against a loss. • The terms of the contract specify both initial and maintenance margin levels for each commodity. 38 Determination of Margin Amounts • Each Futures Exchange determines the amount of initial and maintenance margin levels for each commodity. • Margin levels will generally reflect the historical volatility of that commodity. • The margin levels for each commodity are set to protect the Clearinghouse from a large one day move in price. 39 Margin Requirements • Before buying or selling an exchange traded contract, each party is required to post a percentage of the value of the contract with the exchange. • This is the Initial Margin and goes into each party’s “margin account.” • The initial margin provides insurance against a loss. 40 Margin Requirements • As the market moves up or down, each party will either need to put additional dollars into their margin account or will receive additional dollars in their account. • The Maintenance Margin is the minimum level of funds that must be maintained in the account at all times. • This again provides insurance against a loss for the broker and/or clearinghouse. 41 Margin Call • If the market moves sufficiently against a current position, then a margin call will be issued. • This is a request to deposit additional funds in the margin account, in order to bring the amount of money in the margin account up to the minimum level. 42 Over-the-Counter (OTC) • All transactions completed outside of a regulated exchange (e.g., NYMEX) are considered over-the-counter (OTC). • An OTC deal is negotiated between two counter-parties or with a broker. • The counter-parties take on credit risk. • The terms of an OTC deal are negotiable and can be customized. 43 Over the Counter (OTC) • Electronic Exchange - e.g., Intercontinental Exchange (ICE) • Through a Broker • Directly with Counterparty via bilateral contracts 44 Bilateral Contracts • A contract between two parties. • The contract can be customized as agreed to by the two parties. • Both parties will be subject to credit risk. • Some “standardized” bilateral contracts have been developed. 45 “Standardized” Bilateral Contracts • International Swaps and Derivatives Association (ISDA) – Standard agreement for financial trading • Edison Electric Institute (EEI) – Standard agreement for trading physical power • North American Energy Standards Board (NAESB) – Formerly GISB (Gas Industry Standards Board) – A standard agreement for trading physical gas 46 Defining Derivatives 47 Derivatives A derivative is a financial instrument whose value is based upon the underlying physical product/commodity (e.g., electricity, natural gas, oil, coal). 48 Derivatives Options Forwards Futures Physical Commodity: Electricity or Natural Gas 49 Derivatives Thus a Forward, Futures or Option Contract is a derivative of the underlying physical commodity. 50 Forward Contract • An agreement between two counter-parties to buy/sell the commodity in the future at an agreed upon price. • The terms of the contract are negotiable and may be customized. • Since forward contracts are not traded on an exchange, each counter-party takes on credit risk. • Forwards can not always be easily liquidated with an off-setting trade. 51 Forward Contract • A forward contract is considered “must take” energy. • Many forward contracts for electricity are “fixed price” (though they can also be based upon an index) and are traded in monthly blocks. • Financially Firm is the standard, although System/Unit-Contingent are also traded. • May be physically delivered or booked out. 52 Futures Contract • A futures contract is a standardized contract to buy or sell the underlying commodity at a given price, at a specified time. • It is traded on a futures exchange and thus is a contract with the exchange. • The terms of the contract are non-negotiable and are set by the exchange. 53 Forward Price Curve A strip of forward prices starting with the prompt month and ending with some point out in the future. Represents the term structure of forward prices. This is NOT a price forecast! It is the current view of the market on forward prices. 54 Natural Gas Forward Curve As of Close April 17, 2007 Monthly Gas Forward Curve Nov-11 May-11 Nov-10 May-10 Nov-09 May-09 Nov-08 May-08 Nov-07 May-07 $10.00 $9.75 $9.50 $9.25 $9.00 $8.75 $8.50 $8.25 $8.00 $7.75 $7.50 $7.25 $7.00 $6.75 $6.50 $6.25 $6.00 55 Option “ABCs” 56 What is a Call Option? • A Call is an option to buy the underlying at a given price. • Calls set CEILINGS! 57 Buying and Selling a Call • The buyer of a Call option has the right, but not the obligation, to buy the underlying at a given price. - Protects against a higher market price. • The seller of a Call option has an obligation to sell the underlying at a given price, at the buyer’s sole discretion. 58 What is a Put Option? • A Put is an option to sell the underlying at a given price. • Puts set FLOORS! 59 Buying and Selling a Put • The buyer of a Put option has the right, but not the obligation, to sell the underlying at a given price. - Protects against a lower market price. • The seller of a Put option has an obligation to buy the underlying at a given price at the buyer’s sole discretion. 60 Option Terminology • Exercise and Assignment describe the conversion of the option into the underlying forward contract. • The Option buyer exercises the option. • The Option seller is assigned the option. 61 Buying vs. Selling Options Buying (“Long” the Option) • Option Buyer exercises the Option • Involves Choice • Pays Premium • Profitable Underlying Position Selling (“Short” the Option) • Option Seller is assigned the Option • • • No Choice Receives Premium Unprofitable Underlying Position 62 Strike Price A strike price is the price at which the underlying is bought or sold in an options contract. E.g., $50.00/MWh Call Option $6.50/MMBtu Put Option 63 Option Example: Long Call Option Power 64 Specifics • Utility ABC is “economically short” generation for the summer, with a cost of generation of $65.00/MWh • Utility ABC is considering the purchase of a call option. 65 Purchase of a $50.00/MWh Call Option • Provides price protection (a cap) for Utility ABC • The strike price is below Utility ABC’s cost of generation (of $65.00/MWh) • Utility ABC will pay an option premium ($5.00/MWh) for the purchase of this option 66 Purchase a Call Option What: Buy a $50.00/MWh Call Option for $5.00/MWh Why: To provide price protection 67 Long a Call Option Purchase Price $60.00 $55.00 $45.00 $40.00 $35.00 $30.00 $25.00 $20.00 $15.00 Underlying Market Price ($/MWh) $1 00 .0 0 $9 0. 00 $8 0. 00 $7 0. 00 $6 0. 00 $5 0. 00 $4 0. 00 $3 0. 00 $10.00 $2 0. 00 Purchase Price ($/MWh) $50.00 68 Purchase of a Call Option Profit and Loss at Expiration $50.00 $45.00 $40.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $$(5.00) Underlying Market Price ($/MWh) $1 00 .0 0 $9 0. 00 $8 0. 00 $7 0. 00 $6 0. 00 $5 0. 00 $4 0. 00 $3 0. 00 $(10.00) $2 0. 00 Profit / Loss ($/MWh) $35.00 69 Option Example: Long Call Option Natural Gas 70 Purchase of a $7.00/MMBtu Call Option • Provides price protection (a cap) for Utility ABC’s gas cost • The strike price is $7.00/MMBtu • Utility ABC will pay an option premium ($0.73/MMBtu) for the purchase of this option 71 Purchase a Call Option What: Buy a $7.00/MMBtu Call Option for $0.73/MMBtu Why: To provide fuel price protection 72 Purchase of a $7.00 Call Option Purchase Price of Gas $9.00 $8.50 Gas Cost (MMBtu $8.00 $7.50 $7.00 $6.50 $6.00 $5.50 $5.00 $4.50 0 .0 5 $ 5 0 5 .2 .5 .7 5 5 5 $ $ $ 0 5 .0 .2 6 6 $ $ 0 5 .5 .7 6 6 $ $ 0 5 0 .0 .2 .5 7 7 7 $ $ $ 5 0 .7 .0 7 8 $ $ 5 0 5 .2 .5 .7 8 8 8 $ $ $ 0 .0 9 $ Underlying Market Price (MMBtu) 73 Purchase of a $7.00 Call Option Profit and Loss at Expiration Profit / Loss ($MMBtu) $2.00 $1.00 $- $(1.00) $(2.00) 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 Market Price (MMBtu) 74 9.00 Option Example: Short Put Option Natural Gas 75 Sale of a $6.00/MMBtu Put Option • This involves the sale of a put option, which obligates Utility ABC to buy natural gas at the strike price. • The strike price is at Utility ABC’s budgeted natural gas cost of $6.00/MMBtu). • Utility ABC will receive an option premium of $0.20/MMBtu for the sale of this option. • The premium received will offset gas costs. 76 Sale of a $6.00/MMBtu Put Option • This is a “Short Put” since Utility ABC is short natural gas • The strike price is at Utility ABC’s budgeted natural gas cost of $6.00/MMBtu) • Utility ABC will receive an option premium of $0.20/MMBtu for the sale of this option • The premium received will offset gas costs 77 Sale of a $6.00 Put Option Purchase Price $8.00 Gas Cost (MMBtu $7.50 $7.00 $6.50 $6.00 $5.50 $5.00 $4.50 $4.00 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 Underlying Market Price (MMBtu) 78 Sale of a $6.00 Put Option Profit and Loss at Expiration Profit / Loss ($MMBtu) $3.00 $2.00 $1.00 $$(1.00) $(2.00) $(3.00) $(4.00) 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 Market Price (MMBtu) 79 Option Example: Long Collar 80 Long Collar Long a Call and Short a Put • Combining the Sale of a Put Option with the Purchase of a Call Option • The long Call provides a Cap for the purchase price • The short Put premium offsets the cost of the Call option • Premiums: Buy $7.00 July Call = $0.15/MMBtu Sell $6.30 July Put = $0.10/MMBtu Net Premium Cost of $0.05/MMBtu 81 Long $7.00 Call and Short $6.30 Put Purchase Price of Natural Gas Purchase Price (MMBtu) $7.20 $7.00 $6.80 Gas cost will range from a minimum of $6.35/MMBtu (floor), to a maximum (cap) of $7.05/MMBtu $6.60 $6.40 $6.20 $6.00 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 Market Price (MMBtu) 82 Long $7.00 Call and Short $6.30 Put Profit & Loss at Expiration $2.00 Profit / Loss ($MMBtu) $1.00 $- $(1.00) $(2.00) $(3.00) 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 Market Price ($/MMBtu) 6.75 7.00 7.25 7.50 7.75 8.00 83 Option Example: Long Call and Short Put Spread (3-Way) 84 Long Call and Short a Put Spread • Combining the purchase of a Call option with the sale of a higher strike Put option and the purchase of a lower strike Put option • The Call option provides upside price protection • The short put option premium offsets the cost of the call. • The long put option allows for some participation in a downward market. 85 Long Call and Short a Put Spread • Upside price protection is fixed • Price floats down with the market down to the short put strike price • If the market drops below the long put strike, this position will be above the market (by the difference in the put strike prices), but will float down, providing some benefit from lower market prices. • Premiums: – Buy $7.00 Call = $0.38/MMBtu – Sell $6.00 Put = $0.18/MMBtu – Buy $5.00 Put = $0.11/MMBtu – Net Premium Cost of $0.31/MMBtu 86 Long $7.00 Call, Short $6.00 Put & Long $5.00 Put Purchase Price of Natural Gas $8.00 Gas Purchase Cost (MMBtu) $7.50 $7.00 $6.50 $6.00 $5.50 $5.00 $4.50 $4.00 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 Market Price (MMBtu) 9.50 10.00 10.50 11.00 11.50 12.00 87 Long $7.00 Call, Short $6.00 Put and Long $5.00 Put Profit and Loss at Expiration $2.00 P/L ($MMBtu) $1.00 $- $(1.00) $(2.00) 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 10.00 10.50 11.00 11.50 12.00 Market Price (MMBtu) 88 Option Example: Long Futures and Long Put (Synthetic Call) 89 Long Futures and Long Put • Upside price protection is fixed • Purchasing a put option provides a floor for the value of the futures contract. • This position is a synthetic call option • Future price and put option premium: – Long Jan Futures = $7.20/MMBtu – Buy $5.50 Jan Put = $.23/MMBtu 90 Long Futures and Long $5.50 Put Purchase Price of Natural Gas Gas Purchase Cost (MMBtu) $7.00 $6.50 $6.00 $5.50 $5.00 $4.50 $4.00 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 10.00 10.50 11.00 11.50 Market Price (MMBtu) 91 Long Futures and Long $5.50 Put Profit & Loss at Expiration $3.00 P/L ($MMBtu) $2.00 $1.00 $- $(1.00) $(2.00) 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 10.00 10.50 11.00 11.50 Market Price (MMBtu) 92 Hedging Strategies 93 Hedging Strategies – Part I Agenda I. Hedging Strategies for a Naturally Long Utility 1. Sell Forward 2. Sell Call Option 3. Buy Put Option 4. Sell Collar (Sell Call, Buy Put) II. Hedging Strategies for a Naturally Short Utility 1. Buy Forward 2. Buy Call Option 3. Sell Put Option 4. Buy Collar (Buy Call, Sell Put) 94 Long Hedging Example • • • Assume Utility ABC is long energy for a given month at a cost of $18.00/MWh Assume underlying market price for this month = $30.00/MWh Possible Hedges for Utility ABC include: 1. 2. 3. 4. Selling Forward at $30.00/MWh Selling an Out-of-the-Money Call Option with a $35.00/MWh strike price * Buying an Out-of-the-Money Put Option with a $25.00/MWh Strike Price * Selling Call and Buying Put to create a Short “Collar” * Selling Calls and Selling Puts generates premium revenue and reduces total net delta exposure, but does not provide price protection. 95 1. Forward Sale Forward Sale at $30.00/MWh Sales Price Cost of Gen Transmission Net Margin $30.00/MWh $18.00/MWh $ 5.00/MWh $ 7.00/MWh 96 Impacts of a Forward Sale • Secures revenue • Avoids uncertainty of spot market • Provides diversity (assuming some sales in the spot market) • Locks in a fixed price – If the market price increases, this will result in a loss of opportunity (to sell at a higher price) 97 2. Sale of a $35.00/MWh Call Option • This is a “covered Call” since Utility ABC is long the energy • The strike price is above Utility ABC’s cost of generation (of $18.00/MWh) • Utility ABC will receive an option premium ($5.00/MWh) for the sale of this option 98 Short Call and Long Underlying What: Own Generation at $18.00/MWh (long underlying) Sell a $35.00 Call Option for $5.00/MWh (short Call) (“Covered Call”) Why: To obtain Premium from the Sale of the Call Option (Premium can be used to offset overall energy costs) Note: Assuming gas is the marginal unit, consider purchasing a daily call option on gas (in order to hedge the potential fuel cost if and when the option is assigned). 99 Risks Associated with Sale of a Covered Call Option • Price Risk/Opportunity Loss – The Call will only be exercised when the market price is higher than $35.00/MWh (ie: Utility ABC could otherwise be selling in the daily market at a price > $35.00/MWh on these days) • Operations Risk – If a unit fails (or system load is significantly greater than anticipated), Utility ABC may be unable to deliver the energy. A standard Call option is an “FLD” product. If Utility ABC does not deliver the energy, then they must pay the cost of replacing it in the market. 100 Sale of a Covered Call Option Sales Price $50.00 $45.00 Sell at strike price of $35.00/MWh w hen market is > $35.00/MWh $35.00 $30.00 $25.00 $20.00 Sell in the market w hen market price is < $35.00/MWh $15.00 $10.00 $5.00 Underlying Market Price ($/MWh) $5 0. 00 $4 5. 00 $4 0. 00 $3 5. 00 $3 0. 00 $2 5. 00 $2 0. 00 $1 5. 00 $- $1 0. 00 Sales Price ($/MWh) $40.00 101 Sale of a Covered Call Option Profit and Loss at Expiration $30.00 Capping Profit at $22.00/MWh (Market Price of $35.00/MWh) $20.00 $15.00 $10.00 $5.00 $$(5.00) Breakeven at $13.00/MWh Market Price $5 0. 00 $4 5. 00 $4 0. 00 $3 5. 00 $3 0. 00 $2 5. 00 $2 0. 00 $1 5. 00 $(10.00) $1 0. 00 Net Profit/Loss ($/MWh) $25.00 102 3. Purchase a $25.00/MWh Put Option • The purchase of a Put option provides Utility ABC with a floor for the sales price of this energy. • In return for the option premium ($3.00/MWh), Utility ABC locks in a minimum sales price (a floor) of $25.00/MWh for this block of energy. • This results in an effective price of no less than $22.00/MWh ($25.00 - $3.00 premium) for this block of energy. 103 Purchase of a Put Option and Long Underlying WHAT: Long Underlying Generation at $18.00/MWh Buy a $25.00 Put for $3.00/MWh Premium WHY : To lock in a floor for the Sales Price of $25.00/MWh 104 Long Put Option and Long Underlying Sales Price $60.00 $55.00 $50.00 Sales Price ($/MWh) $45.00 $40.00 Minimum Sales Price of $25.00/MWh $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $16.00 $22.00 $28.00 $34.00 Underlying Market Price ($/MWh) $40.00 $46.00 $52.00105 Long Put Option and Long Underlying Profit and Loss at Expiration Net Profit/Loss ($/MWh) $15.00 $10.00 $5.00 $- 0 8.0 $1 0 0.0 $2 0 2.0 $2 0 4.0 $2 0 6.0 $2 0 8.0 $2 0 0.0 $3 0 2.0 $3 0 4.0 $3 0 6.0 $3 0 8.0 $3 0 0.0 $4 Underlying Market Price ($/MWh) 106 4. Short Collar Sell a Call and Buy a Put • Combining the Sale of a Call Option with the Purchase of a Put Option (and the long underlying) creates a “collar” • The long Put provides a floor for the sales price • The short Call limits or caps the sales price, but offsets the cost of the Put option. • Premiums: Buy Put = $3.00 Sell Call = $5.00 107 Collar Sales Price Long $25 Put, Short $35 Call & Long Underlying $45.00 Sell at cap of $35.00/MWh (when call is exercised) $40.00 $30.00 $25.00 $20.00 Sell at floor of $25.00/MWh (exercising put) when market is < $25.00/MWh $15.00 Underlying Market Price ($/MWh) 108 $54.00 $52.00 $50.00 $48.00 $46.00 $44.00 $42.00 $40.00 $38.00 $36.00 $34.00 $32.00 $30.00 $28.00 $26.00 $24.00 $22.00 $20.00 $10.00 $18.00 Sales Price ($/MWh) $35.00 Collar Profit & Loss at Expiration Long $25 Put, Short $35 Call & Long Underlying $25.00 $15.00 $10.00 $5.00 Underlying Market Price ($/MWh) $54.00 $52.00 $50.00 $48.00 $46.00 $44.00 $42.00 $40.00 $38.00 $36.00 $34.00 $32.00 $30.00 $28.00 $26.00 $24.00 $22.00 $20.00 $$18.00 Net Profit/Loss ($/MWh) $20.00 Margin ranges from a minimum of $9.00/MWh (floor), to a maximum (cap) of $19.00/MWh (with a generating cost of $18.00/MWh) 109 Hedging Strategies – Part I Agenda I. Hedging Strategies for a Naturally Long Utility 1. Sell Forward 2. Sell Call Option 3. Buy Put Option 4. Sell Collar (Sell Call, Buy Put) II. Hedging Strategies for a Naturally Short Utility 1. Buy Forward 2. Buy Call Option 3. Sell Put Option 4. Buy Collar (Buy Call, Sell Put) 110 Short Hedging Example • • • Assume Utility ABC is “economically short” energy for a given month, with a cost of generation for the next block of $60.00/MWh Assume underlying market price for this month = $30.00/MWh Possible Hedges for Utility ABC include: 1. 2. 3. 4. Purchasing Forward at $30.00/MWh Buying an Out-of-the-Money Call Option with a $35.00/MWh strike price Selling an Out-of-the-Money Put Option with a $25.00/MWh Strike Price Buying Call and Selling Put to create a long “Collar” 111 1. Forward Purchase Forward Purchase at $30.00/MWh Cost of Gen Purchase Price Transmission Net Margin $60.00/MWh $30.00/MWh $ 5.00/MWh $ 25.00/MWh 112 Impacts of a Forward Purchase • Secures physical supply and transmission • Avoids uncertainty of spot market • Provides diversity (assuming some purchases in the spot market) • Locks in a fixed price – If the market price decreases, this will result in a loss of opportunity (to buy at a lower price) 113 2. Purchase of a $35.00/MWh Call Option • Provides price protection (a cap) for Utility ABC • The strike price is below Utility ABC’s cost of generation (of $60.00/MWh) • Utility ABC will pay an option premium ($5.00/MWh) for the purchase of this option 114 Purchase of a Call Option What: Buy a $35.00/MWh Call Option for $5.00/MWh Why: To provide price protection 115 Purchase of a Call Option Purchase Price $50.00 $45.00 $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 Underlying Market Price ($/MWh) $5 0. 00 $4 5. 00 $4 0. 00 $3 5. 00 $3 0. 00 $2 5. 00 $2 0. 00 $1 5. 00 $$1 0. 00 Purchase Price ($/MWh) $40.00 116 Purchase of a Call Option Profit and Loss at Expiration $30.00 $25.00 $15.00 $10.00 $5.00 $$(5.00) $5 0. 00 $4 5. 00 $4 0. 00 $3 5. 00 $3 0. 00 $2 5. 00 $2 0. 00 $1 5. 00 $(10.00) $1 0. 00 Net Profit/Loss ($/MWh) $20.00 117 Underlying Market Price ($/MWh) 3. Sale of $25.00/MWh Put Option • The sale of a Put option obligates Utility ABC to purchase energy at the strike price of $25.00/MWh in return for the option premium of $3.00/MWh • When the market is < $25.00/MWh, the Put will be exercised and Utility ABC will be obligated to purchase energy at $25.00/MWh 118 Comparison of a Forward Purchase and the Sale of a Put Option • Both a forward purchase and the sale of a Put option involve potential opportunity loss (energy could be purchased for a lower price on the days the market is lower than the strike or forward price) • The difference is that a forward purchase is “must take” energy; energy will only be supplied by the Put option on the days when the market is lower • In return for this optionality, a premium is collected with the sale of the Put option 119 Risks of Selling a Put Option • A Put option will only be exercised when the market is lower than the strike price, resulting in opportunity loss on the days it is exercised (e.g., Utility ABC could have purchased in the daily market for a lower price than the strike price on these days) • The strike price is still significantly less than Utility ABC’s cost of generation for the next block (e.g., $25.00MWh vs. $60.00/MWh) • Selling a Put option has downside risk which is significantly less in the electricity market than upside risk (e.g., floor of about $14.00/MWh) 120 Sale of a Put Option WHAT: Next block cost of generation at $40.00/MWh Sell a $25.00/MWh Put for $3.00/MWh Premium WHY : To collect premium to offset purchase price of physical energy. Obligation to buy at $25.00/MWh is “economically attractive” for Utility ABC given their cost of generation. Net purchase price is $22.00/MWh. 121 Short Put Option Purchase Price $60.00 $55.00 $50.00 Pruchase Price ($/MWh) $45.00 $40.00 Minimum Purchase Price of $25.00/MWh $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 122 $16.00 $22.00 $28.00 $34.00 Underlying Market Price ($/MWh) $40.00 $46.00 $52.00 Short Put Option Profit and Loss at Expiration $15.00 $5.00 $- $(5.00) $(10.00) Underlying Market Price ($/MWh) $3 4. 00 $3 2. 00 $3 0. 00 $2 8. 00 $2 6. 00 $2 4. 00 $2 2. 00 $2 0. 00 $1 8. 00 $1 6. 00 $1 4. 00 $1 2. 00 $(15.00) $1 0. 00 Net Profit/Loss ($/MWh) $10.00 123 4. Long Collar Long Call and Short Put (at a lower strike) while being short the Underlying (e.g., native load can be equated to being short a forward contract) • This position establishes a ceiling for the purchase price (cap of $35.00/MWh) • Selling the Put option offsets the cost of the Call, but also establishes a minimum floor for the purchase price (Utility ABC will pay at least $25.00/MWh for this block of energy) 124 Collar Purchase Price Short $25 Put, Long $35 Call & Short Underlying $45.00 Purchase at cap of $35.00/MWh (when exercising the call) $35.00 $30.00 $25.00 $20.00 Purchase at floor of $25.00/MWh (when put is exercised - i.e.: when market is < $25.00/MWh $15.00 Underlying Market Price ($/MWh) 125 $50.00 $48.00 $46.00 $44.00 $42.00 $40.00 $38.00 $36.00 $34.00 $32.00 $30.00 $28.00 $26.00 $24.00 $22.00 $20.00 $18.00 $16.00 $14.00 $12.00 $10.00 $10.00 Purchase Price ($/MWh) $40.00 Collar Profit & Loss at Expiration Short $25 Put, Long $35 Call & Short Underlying $60.00 $55.00 Cost of $2.00/MWh (net option premiums) on days when neither the call nor put is exercised. $45.00 $40.00 $35.00 $30.00 $25.00 $20.00 Underlying Market Price ($/MWh) $50.00 $48.00 $46.00 $44.00 $42.00 $40.00 $38.00 $36.00 $34.00 $32.00 $30.00 $28.00 $26.00 $24.00 $22.00 $20.00 $18.00 $16.00 $14.00 $10.00 $12.00 $15.00 $10.00 Net Profit/Loss ($/MWh) $50.00 126