3º Forum Capital Market Brazil

advertisement

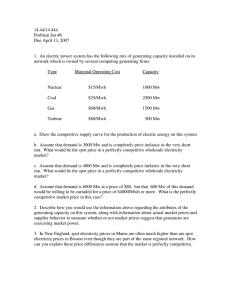

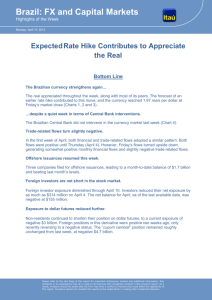

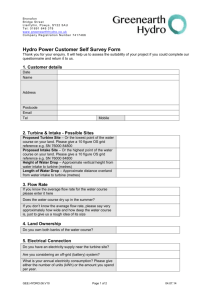

R 3º Forum Capital Market Brazil - China CONFIDENTIAL | Rio de Janeiro, August 2012 Environmental Policy: WHY? To identify, evaluate, control, transfer and monitor environmental risks (Credit / Valuation Enhancement Analysis): SHAREHOLDERS ● Lower Credit Risks; ● Lower Devalued Portfolio; ● Stronger Portfolio. CAPITAL MARKETS ● Greater Confidence/ Reputation / Boycott; ● Access to Multilateral Agencies Credit Line (MLAs). COMPLIANCE ● Compliance with regulatory requirement and voluntary commitments; ● THERE IS NOT JUST ONE STAKEHOLDER. 2 Hypothetical Example Assumptions: 1. Let’s assume a 3000MW Hydro Plant to be constructed to generate 12,000,000 Mwh per year or 1,000Mwh per month; 2. Let’s also assume this Hydro Plant managed to sell its entire energy output to the grid (auction) at US$40/Mwh – Monthly Revenue of US$40 Million (commitment to deliver to the grid on August/2009); 3. Eventually this project, according to its Environmental Action Plan (PS), was evaluated to provide 2,000 families Resettlement (including indigenous people!!!); 4. Finally let’s suppose the entrepreneur of this Project decided that the environmental risk mitigation was not necessary or was incomplete. 3 Hypothetical Example 4 Uncomfortable Questions!!! 1. What it would happen if your analyzed company was sponsoring this project? 2. How this delay would affect the NPLs of your company and eventually its creditworthiness and bankability? 3. How these protests would spill over on your company’s reputation and image? 4. How this event would impact the share performance of your analyzed company? 5 Itaú Unibanco: A Global Power Banco Itaú Unibanco is the largest financial conglomerate in Latin America, is recognized for its excellence in sustainability … Recent Awards FT Sustainable Banking Awards 2012, 2011, 2010, 2009 SUSTAINABLE BANK OF THE YEAR (2011) SUSTAINABLE BANK OF THE YEAR (AMERICAS) 2012