File

advertisement

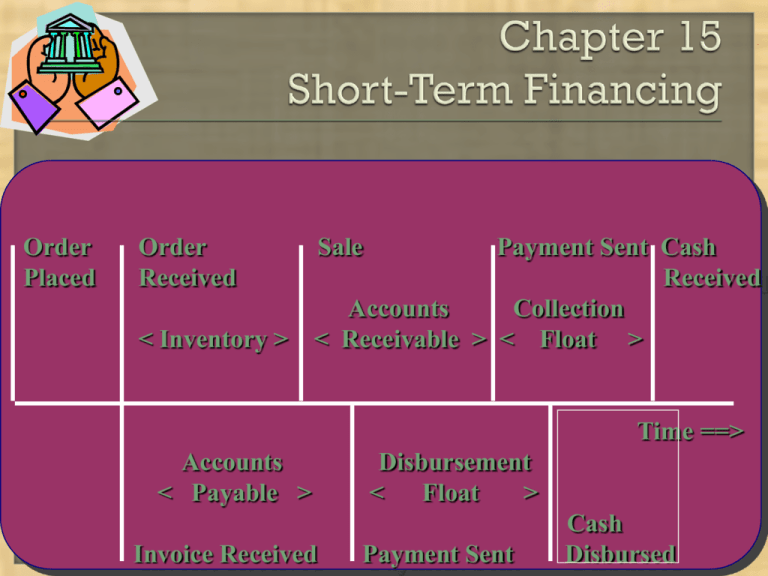

Order Placed Order Received < Inventory > Sale Payment Sent Cash Received Accounts Collection < Receivable > < Float > Time ==> Accounts < Payable > Invoice Received Disbursement < Float > Payment Sent Cash Disbursed Formulate Choose a short-term financing strategy. the appropriate financing instrument. Compute the effective cost of financing. A deficit cash position may result from the interaction of inefficient or inappropriate working capital policies Management should first evaluate its working capital policies to ensure the most efficient stream of cash flow from operations Once this is done, then a short-term financing strategy should be developed Total Assets $ Temporary Current Assets Permanent Current Assets Fixed Assets Time Aggressive Financing Strategy- financing the new current assets with liabilities having comparable maturities Management relies heavily on short-term financing and minimizes long-term financing Net Working Capital position and Current ratios are reduced, impairing solvency Beneficial when short term financing is cheaper than long term sources Exposes to refinancing risk as credit me tighter in future periods and interest rate risk during inflation $ Short-Term Financing Total Assets Long-Term Financing Time Conservative Financing Strategy- use the long term sources of financing to meet working capital requirements Improve solvency as current assets will be higher than current liabilities Expensive because long term sources are more costly than short term sources. Reduced refinancing and interest rate risk. Excess Liquidity $ Long-Term Financing Time Moderate Financing Strategy- combination of both aggressive and conservative strategies. Excess Liquidity Short-Term Financing $ Long-Term Financing Time Lines of Credit: Maximum loan amount a lender is willing to provide to a client upon demand. • Borrower can use line whenever they choose, avoiding the loan application process Committed line of credit: formal, written agreement that binds the lender to provide a maximum funds at the borrower’s bequest • Such agreement requires a commitment fee to pay • Typically have covenants to ensure that the borrower maintains a certain level of financial health Uncommitted Line of Credit: not a binding obligation for the lender • Lenders like the flexibility offered by uncommitted lines, which free the bank from providing funds in the event of financial deterioration by the borrower. Direct Costs • Interest rate: applied on amounts drawn from the line • Commitment fee: only relevant for committed lines and is a stated proportion of the unused portion of the line. Indirect Costs • Compensating Balance: restricts fund availability; reduces net loan proceeds and increasing the effective cost of line. Banker’s Acceptance – Is a time draft drawn against a commercial bank but with payment at maturity guaranteed by the bank. : Letter of credit a promise to a party upon presentation of a draft or bill, provided that the party complies with certain documentary requirements as stated in the agreement between the bank and customer. Standby letter of Credit : Which guarantees that the bank will make funds available if the company cannot or does not wish to meet a major financial obligation. Reverse Repurchase agreement : is the other side of repurchase agreement transaction where the corporate manager may negotiate with its bank to sell the bank a specific dollar amount of marketable securities. Commercial paper is a short term promissory note issued by a corporation for fixed maturity at a fixed discount rate. • Discount basis commercial paper • Interest bearing commercial paper Out of pocket Expenses 365 Effective rate = -------------------- x ------Usable funds M (16.1) Out of pocket costs • Interest expense • Commitment fee • Dealer fee Usable funds • Discounted price (Face value less interest) Out of pocket costs • Interest expense • Commitment fee Usable funds • Net proceed after keeping the compensating balance Short-term financing alternatives in this chapter differ from spontaneous financing sources such as payables and accruals. The chapter began with a discussion of financing three financing strategies. Then discussion focused on the major forms of short-term financing available. The chapter concluded with a discussion of calculating the effective cost of financing with commercial paper and credit lines.