Lecture 13 Chapter 18

advertisement

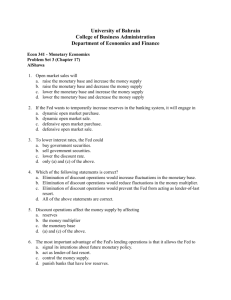

Chapter 18 Tools of Monetary Policy Using Interest Rates to Stabilize the Domestic Economy Monetary Policy & Interest Rates: The Big Questions 1. What are the tools used by central banks to meet their stabilization objectives? 2. How are the tools linked to the central bank’s balance sheet? 3. How is the interest rate target chosen? From Chapter 17 : The Fed can control the MB but cannot precisely control the Money Supply M1 = m x MB M1 = 1+(C/D) rD + (ER/D) + (C/D) MB Households can change C/D, causing the money mutiplier (m) and M1 to change Banks can change ER/D, causing m and M1 to change The Fed’s “Traditional” Policy Tools • Open Market Operations - OMO. • Discount Rate - the interest rate the Fed charges on the loans it makes to banks • Reserve Requirement - the level of balances a bank is required to hold either as vault cash on deposit or at a Federal Reserve Bank • NOTE: The primary instrument of monetary policy is the Federal funds rate: the interest rate on overnight loans of reserves from one bank to another A New (fourth) Tool • Interest on Reserves - required and excess • Currently set at 0.25% • Often referred to as IOER – Interest on Excess Reserves. • The Financial Services Regulatory Relief Act of 2006 authorized the Federal Reserve to begin paying interest on reserve balances of depository institutions beginning October 1, 2011. • The Emergency Economic Stabilization Act of 2008 accelerated date to October 1, 2008. More New Tools in the Works • http://www.federalreserve.gov/monetarypo licy/policytools.htm 18-7 Open Market Operations • The Fed buys and sells U.S. (Gov’t) securities in the secondary market in order to adjust the supply of reserves in the banking system. • Traditionally short-term T-bills. • This changed with “quantitative easing”. Fed has purchased long-term T-bonds and MBS • Most flexible means of carrying out monetary policy. • With OMO the Fed does not participate directly in the Federal Funds market. OMO and the Federal Funds Market • Federal funds are reserve balances that depository institutions lend to one another. • The most common federal funds transaction is an overnight, unsecured loan between two banks. (bilateral agreements) • Note that without the FF market, banks would need to hold a substantial amount of excess reserves. Advantages of OMO • Implemented quickly • Fed has complete control • Flexible and precise • Easily reversed Two Types of Open Market Operations Permanent OMOs: “involve the buying and selling of securities outright to permanently add or drain reserves available to the banking system.” - Mishkin refers to as “dymanic” Temporary OMOs: “involve repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system” - Mishkin refers to as “defensive” Open Market Operation - Repo • With a repurchase agreement ("repo"), the Fed buys securities from dealers who agrees to buy them back, typically within one to seven days. • Repos add reserves to the banking system and then withdraws them. • Can be viewed as the Fed temporarily lending reserves to dealers with the dealers posting securities as collateral. Open Market Operation – Reverse Repo • With a reverse repo, the Fed sells securities to dealers and agrees to buy back in one to seven days. • Reverse repo drain reserves and later add them back. • Can be viewed as the Fed temporarily borrowing reserves from dealers with the Fed posting securities as collateral. • Traditional use of REPO is to offer fixed quantity and let i adjust. • Fixed Rate ON RRP – fixed rate overnight reverse repo is different http://www.newyorkfed.org/index.html How is the Federal Funds Rate Determined? Supply and Demand for Reserves IOR Demand for Reserves • Why Do banks hold Reserves? • Required • Excess reserves are insurance against deposit outflows • The cost of holding this insurance is the interest rate that could have been earned minus the interest rate that is paid on these reserves, ior , (IOER) • For example, if T-bill rate = .5% and IOER = .25%, opportunity cost = .25% http://www.treasury.gov/resourcecenter/data-chart-center/interestrates/Pages/TextView.aspx?data=yield Demand for Reserves • As the federal funds rises above the rate paid on excess reserves, the opportunity cost of holding excess reserves increases and the quantity of reserves demanded decreases • Downward sloping demand curve for reserves. • The demand curve becomes flat (infinitely elastic) at IOR • IOR acts as a floor on the federal funds rate. Supply of Reserves • Two components to the supply of reserves: non-borrowed and borrowed reserves • The discount rate (id) is the cost of borrowing from the Fed. The interest rate on loans from the Fed. • Borrowing from the Fed is an alternative to borrowing from other banks in the Federal Funds market. Supply for Reserves • If the Federal Funds rate (iff )< Discount rate (id), banks will not borrow from the Fed and borrowed reserves are zero • The supply curve will be vertical at the level of non-borrowed reserves (NBR). • As iff rises above id, banks will borrow more and more at id, (NOTE: they can lend at iff ) • The supply curve is horizontal (perfectly elastic) at id How OMO Affects the Federal Funds Rate • Open market operations shift the supply curve of reserves. • An open market purchase causes the federal funds rate to fall whereas an open market sale causes the federal funds rate to rise when intersection occurs at the downward sloped section. Response to an Open Market Purchase Figure 2 Response to an Open Market Operation Federal Funds Rate id i ff1 i ff2 Federal Funds Rate R1s id R 2s R1s R 2s 1 2 1 2 R1d ior NBR1 NBR2 Quantity of Reserves, R Step 1. An open market purchase shifts the supply curve to the right … Step 2. causing the federal funds rate to fall. (a) Supply curve initially intersects demand curve in its downward-sloping section iff1 iff2 ior R1d NBR1 NBR2 Quantity of Reserve, R Step 1. An open market purchase shifts the supply curve to the right … Step 2. but the federal funds rate cannot fall below the interest rate paid on reserves. (b) Supply curve initially intersects demand curve in its flat section Response to a Change in the Discount Rate Federal Funds Rate Federal Funds Rate id1 R1s id2 R2s iff1 1 1 iff1 R s1 id1 2 iff2 id2 R d1 ior ior BR1 Rs2 R d1 BR2 NBR Quantity of Reserves, R Step 1. Lowering the discount rate shifts the supply curve down… Step 2. but does not lower the federal funds rate. (a) No discount lending (BR = 0) NBR Quantity of Reserves, R Step 1. Lowering the discount rate shifts the supply curve down… Step 2. and lowers the federal funds rate. (b) Some discount lending (BR > 0) Response to a Change in Required Reserves Federal Funds Rate R1s id i ff2 i ff1 2 Step 1. Increasing the reserve requirement causes the demand curve to shift to the right . . . 1 Step 2. and the federal funds rate rises. R 2d ior R1d NBR Quantity of Reserves, R Response to a Change in the Interest Rate on Reserves Federal Funds Rate Federal Funds Rate Rs id i 1 ff i ff2 i or2 1 R 2d i or2 i or1 R1d NBR Quantity of Reserves, R Step 1. A rise in the interest rate on reserves 1 from to i or i or2 ... Step 2. leaves the federal funds rate unchanged. 1 (a) initial i ff1 > ior Rs id i ff1 i or1 2 R 2d R1d 1 NBR Quantity of Reserves, R Step 1. A rise in the interest rate on reserves to i or1 i or2from ... Step 2. raises the federal funds i ff2 rate i or2 .to 1 (b) initial i ff1 = ior Application: How the Federal Reserve’s Operating Procedures Limit Fluctuations in the Federal Funds Rate • Supply and demand analysis of the market for reserves illustrates how an important advantage of the Fed’s current procedures for operating the discount window and paying interest on reserves is that they limit fluctuations in the federal funds rate. Figure 6 How the Federal Reserve’s Operating Procedures Limit Fluctuations in the Federal Funds Rate Federal Funds Rate Rd R d* R d iff id Rs Step 1. A rightward shift of the demand curve raises the federal funds rate to a maximum of the discount rate. i ff* Step 2. A leftward shift of the demand curve lowers the Ederal funds rate to a minimum of the interest rate on reserves. iff ior NBR* Quantity of Reserves, R Conventional Monetary Policy Tools • During normal times, the Federal Reserve uses the three Traditional tools of monetary policy—open market operations, discount lending, and reserve requirements—to control the money supply and interest rates, and these are referred to as conventional monetary policy tools. Discount Lending – Lender of Last Resort • Lending to commercial banks has not been an important part of the Fed’s dayto-day monetary policy. • However, lending is the Fed’s primary tool for ensuring short-term financial stability, for eliminating bank panics, and preventing the sudden collapse of institutions that are experiencing financial difficulties. • On Sept. 12, 2001, banks borrowed $45.5 billion from the Fed. (In addition, the Fed purchased $80 billion in Gov’t securities). Discount Lending Types of Loans – • Primary Credit (sound credit) • Short-term, typically overnight • Historically 100 basis points above target Fed Funds Rate. Currently 50 bp • Secondary Credit • For banks that do not qualify for primary credit • Hisorically 150 basis points above target Fed Funds Rate. • Seasonal Credit • Small banks with cyclical farm loans • http://www.frbdiscountwindow.org/index.cfm Advantages and Disadvantages of Discount Policy • Used to perform role of lender of last resort • Important during the subprime financial crisis of 2007-2008. • Cannot be controlled by the Fed; the decision maker is the bank • Discount facility is used as a backup facility to prevent the federal funds rate from rising too far above the target • Does the “Lender of Last Resort” fucntion to prevent financial panics create a moral hazard problem? Reserve Requirements • Depository Institutions Deregulation and Monetary Control Act of 1980 (MCA) subjected all banks to the same reserve requirements as member banks • Set reserve requirement within a range of 8 to 14 percent for transactions deposits and 0 to 9 percent for non-transactions deposits. • Fed now pays interest on reserves. • To reduce burden on small banks, first few million $ in DD are exempt, then 3% up to about $71 mil., then 10% • Note: Fed’s use of the reserve requirement in 1936. Reserve Requirements Advantages 1. Powerful effect Disadvantages 1. Without excess reserves, small changes have very large effect on Ms 2. Not binding with so many banks holding excess reserves 3. Raising causes liquidity problems for banks 4. Frequent changes cause uncertainty for banks On the Failure of Conventional Monetary Policy Tools in a Financial Panic • When the economy experiences a full-scale financial crisis, conventional monetary policy tools cannot do the job, for two reasons. • First, the financial system seizes up to such an extent that it becomes unable to allocate capital to productive uses, and so investment spending and the economy collapse. • Second, the negative shock to the economy can lead to the zero-lower-bound problem. Nonconventional Monetary Policy Tools During the Global Financial Crisis • Liquidity provision: The Federal Reserve implemented unprecedented increases in its lending facilities to provide liquidity to the financial markets • Discount Window Expansion • Term Auction Facility • New Lending Programs Nonconventional Monetary Policy Tools During the Global Financial Crisis • Large-scale asset purchases: During the crisis the Fed started three new asset purchase programs to lower interest rates for particular types of credit: • Government Sponsored Entities Purchase Program • QE2 • QE3 The Expansion of the Federal Balance Sheet, 2007-2014 Operational Policy at the European Central Bank http://www.ecb.int/home/html/index.en.html • Main Refinancing Rate: Set via weekly auction of 2-week repurchase agreements. Inject and withdraw reserves in the banking system. Comparable to the Fed’s target FFR. • Marginal Lending Facility • 100 basis points above target refinancing rate • Deposit Rate: Banks earn interest on excess reserves. • Reserve Requirements • 2% applied to checking accounts • Overnight Cash rate.( Market FFR) Operational Policy at the European Central Bank Full Allotment, Fixed Rate Over Night Reverse Repo New Policy Tool Fed Reverse Repo • Under a Reverse Repo with the Fed, bidders “buy” securities from the Fed paying with reserves – they lend reserves to the Fed. • Currently the Fed announces the quantity of reserves it wants to borrow and buyers bid a rate at which they will lend reserves to the Fed. – Q is fixed and interest rate varies New Facility: The Interest Rate is Fixed • Full Allotment, Fixed Rate Over Night Reverse Repo • The Fed will announce a fixed-rate to be paid on reverse repo loans. – Interest rate is fixed and Q varies (up to a some max) • This differs from the current process where the Fed determines the amount of reserves it wants to remove from the banking system and let’s the interest rate vary in the Fed funds market • The Fed is moving to a paradigm where short-term interest rates are controlled directly. Main Features • Fed announces a fixed rate • Fed will borrow as much as a counterparty wants to lend up to a maximum. • Broad list of counterparties including a large number of banks, money market mutual funds and US Agencies FNMA, FHLMC and FHLB. – Not just Primary dealers • The Fed will control short-term interest rates IOER has not acted as a floor on the FFR • Agencies can lend in the Fed funds market but they can not deposit funds at the Fed and earn interest. • MMMF lend to banks (repo or CP) and the banks deposit at Fed and earn IOER.