Credit Risk Modelling

advertisement

Credit Risk Modelling : A Primer

By: A V Vedpuriswar

June 14, 2014

Introduction to Credit Risk Modelling

Credit risk modeling helps to estimate how much credit is 'at

risk' due to a default or changes in credit risk factors.

By doing so, it enables managers to price the credit risks they

face more effectively.

It also helps them to calculate how much capital they need to

set aside to protect against such risks.

1

Market Risk vs Credit Risk Modelling

Compared to market risk modeling, credit risk modeling is

relatively new.

Credit risk is more contextual.

The time horizon is usually longer for credit risk.

Legal issues are more important in case of credit risk.

The upside is limited while the downside is huge.

If counterparty defaults, while the contract has negative value,

the solvent party typically cannot walk away from the contract.

But if the defaulting party goes bankrupt, while contract has a

positive value, only a fraction of the funds owed will be received.

2

Data

There are serious data limitations.

Market risk data are plentiful.

But default/bankruptcy data are rare.

3

Liquidity

Market prices are readily available for instruments that give rise

to market risk.

However, most credit instruments don't have easily observed

market prices.

There is less liquidity in the price quotes for bank loans,

compared to interest rate instruments or equities.

This lack of liquidity makes it very difficult to price credit risk for a

particular obligor in a mark-to-market approach.

To overcome this lack of liquidity, credit risk models must

sometimes use alternative types of data (historical loss data).

4

Distribution of losses

Market risk is often modeled by assuming that returns follow a

normal distribution though sometimes it does not hold good.

The normal distribution, however, is completely inappropriate for

estimating credit risk.

Returns in the global credit markets are heavily skewed to the

downside and are therefore distinctly non-normal.

Banks' exposures are asymmetric in nature.

There is limited upside but large downside.

The distribution exhibits a fat tail.

5

Correlation & Diversification

Diversification is the main tool for reducing credit risk.

For most obligors, hedges are not available in the market.

But there are limits to diversification.

A loan portfolio might look well diversified by its large number

of obligors.

But there might still be concentration risk caused by a large

single industry/country exposure.

Also correlations can dramatically shoot up in a crisis.

6

Expected, unexpected and stress losses

7

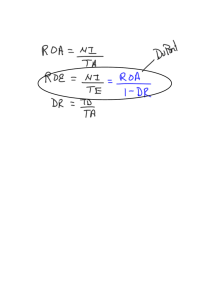

Expected Loss

The expected loss (EL) is the amount that an institution

expects to lose on a credit exposure over a given time horizon.

EL = PD x LGD x EAD

If we ignore correlation between the LGD variable, the EAD

variable and the default event, the expected loss for a portfolio

is the sum of the individual expected losses.

How should we deal with expected losses?

In the normal course of business, a financial institution can set

aside an amount equal to the expected loss as a provision.

Expected loss can be built into the pricing of loan products.

8

Unexpected loss

Unexpected loss is the amount by which potential credit losses

might exceed the expected loss.

Traditionally, unexpected loss is the standard deviation of the

portfolio credit losses.

But this is not a good risk measure for fat-tail distributions,

which are typical for credit risk.

To minimize the effect of unexpected losses, institutions are

required to set aside a minimum amount of regulatory capital.

Apart from holding regulatory capital, however, many

sophisticated banks also estimate the necessary economic

capital to sustain these unexpected losses.

9

Stress Losses

Stress losses are those that occur in the tail region of the

portfolio loss distribution.

They occur as a result of exceptional or low probability events

(a 0.1% or 1 in 1,000 probability in the distribution below).

While these events may be exceptional, they are also

plausible and their impact is severe.

10

Measuring Credit loss

In simple terms, a credit loss can be described as a decrease

in the value of a portfolio over a specified period of time.

So we must estimate both current value and the future value

of the portfolio at the end of a given time horizon.

There are two conceptual approaches for measuring credit

loss:

– default mode paradigm

– mark-to-market paradigm

11

Default mode paradigm

A credit loss occurs only in the event of default..

This approach is sometimes referred to as the two-state model.

The borrower either does or does not default.

If no default occurs, the credit loss is obviously zero.

If default occurs, exposure at default and loss given default must

be estimated.

12

Mark-to-market (MTM) paradigm

Here , a credit loss occurs if:

– the borrower defaults

– the borrower's credit quality deteriorates (credit migration)

This is therefore a multi-state paradigm.

There can be an economic impact even if there is no default.

A true mark-to-market approach would take market-implied

values in different non-defaulting states.

However, because of data and liquidity issues, some banks use

internal prices based on loss experiences.

13

Classification of other approaches

Top down vs Bottom Up

Structural vs Reduced form

Conditional vs Unconditional

14

Mark-to-market paradigm approaches

There are two well-known approaches in the mark-to-market

paradigm :

– the discounted contractual cash flow approach

– the risk-neutral valuation approach

15

Discounted Contractual Cashflow Approach

The current value of a non-defaulted loan is measured as the

present value of its future cash flows.

The cash flows are discounted using credit spreads which are

equal to market-determined spreads for obligations of the same

grade.

If external market rates cannot be applied, spreads implied by

internal default history can be used.

The future value of a non-defaulted loan is dependent on the

risk rating at the end of the time horizon and the credit spreads

for that rating.

Therefore, changes in the value of the loan are the result of credit

migration or changes in market credit spreads.

In the event of a default, the future value is determined by the

recovery rate, as in the default mode paradigm.

16

Risk-Neutral Valuation Approach

This approach is derived from derivatives pricing theory.

Prices are an expectation of the discounted future cash flows in a risk-neutral

market.

These default probabilities are therefore called risk-neutral default probabilities

and are derived from the asset values in a risk-neutral option pricing approach.

Each cash flow in the risk-neutral approach depends on there being no default.

For example, if a payment is contractually due on a certain date, the lender

receives the payment only if the borrower has not defaulted by this date.

If the borrower defaults before this date, the lender receives nothing.

If the borrower defaults on this date, the value of the payment to the lender is

determined by the recovery rate (1 - LGD rate).

The value of a loan is equal to the sum of the present values of these cash

flows.

17

Structural and Reduced Form Models

18

Structural Models

Probability of default is determined by

– the difference between the current value of the firm's assets

and liabilities, and

– by the volatility of the assets.

Structural models are based on variables that can be observed

over time in the market.

Asset values are inferred from equity prices.

Structural models are difficult to use if the capital structure is

complicated and asset prices are not easily observable.

19

Reduced Form Models

Reduced form models do not attempt to explain default events.

Instead, they concentrate directly on default probability.

Default events are assumed to occur unexpectedly due to one or

more exogenous events (observable and unobservable),

independent of the borrower's asset value.

Observable risk factors include changes in macroeconomic

factors such as GDP, interest rates, exchange rates, inflation.

Unobservable risk factors can be specific to a firm, industry or

country.

Correlations among PDs for different borrowers are considered to

arise from the dependence of different borrowers on the behavior

of the underlying background factors.

20

Reduced Form Models

Default in the reduced form approach is assumed to follow a Poisson

distribution.

A Poisson distribution describes the number of events of some phenomenon

(in this case, defaults) taking place during a specific period of time.

It is characterized by a rate parameter (t), which is the expected number of

arrivals that occur per unit of time.

In a Poisson process, arrivals occur one at a time rather than simultaneously.

And any event occurring after time t is independent of an event occurring

before time t.

It is therefore relevant for credit risk modeling –

– There is a large number of obligors.

– The probability of default by any one obligor is relatively small.

– It is assumed that the number of defaults in one period is independent of

the number of defaults in the following period.

21

Correlations

The modeling of the covariation between default probability (PD)

and exposure at default (EAD) is particularly important in the

context of derivative instruments, where credit exposures are

particularly market-driven.

A worsening of exposure may occur due to market events that tend

to increase EAD while simultaneously reducing a borrower's ability

to repay debt (that is, increasing a borrower's probability of default).

22

Correlations

There may also be correlation between exposure at default (EAD)

and loss given default (LGD).

For example, LGDs for borrowers within the same industry may

tend to increase during periods when conditions in that industry

are deteriorating (or vice-versa).

The ability of banks to model these correlations, however, has

been restricted due to data limitations and technical issues.

LGD is frequently modeled as a fixed percentage of EAD, with

actual percentage depending on the seniority of the claim.

In practice, LGD is not constant.

So attempts have been made to model it as a random variable or

to treat it as being dependent on other variables.

23

Credit Risk Models

Merton

Moody's KMV

Credit Metrics

Credit Risk+

Credit Portfolio View

25

Merton and KMV models

26

The Merton Model

This model assumes that the firm has made one single issue

of zero coupon debt and equity.

Let V be value of the firm’s assets, D value of debt.

When debt matures, debt holders will receive the full value of

their debt, D provided V > D.

Equity holders will receive V-D.

If V < D, debt holders will receive only a part of the sums due

and equity holders will receive nothing.

Value received by debt holders at time T = D – max {D-VT, 0}

27

The Payoff from Debt

Examine : D – max {D-VT, 0}

D is the pay off from investing in a default risk free instrument.

On the other hand, - max {D-VT, 0} is the pay off from a short

position in a put option on the firm’s assets with a strike price

of D and a maturity date of T

Thus risky debt ☰ long default risk free bond + short put

option with strike price D

28

Value of the put

Value of the put completely determines the price differential

between risky and riskless debt.

A higher value of the put increases the price difference

between risky and riskless bonds.

As volatility of firm value increases, the spread on the risky

debt increases and the value of the put increases.

29

Value of equity

Let E be the value of the firm’s equity.

Let E be the volatility of the firm’s equity.

Claim of equity

= VT – D if VT ≥ D

= 0 otherwise

The pay off is the same as that of a long call with strike price D.

30

Valuing the put option

Assume the firm value follows a lognormal distribution with

constant volatility, .

Let the risk free rate, r be also constant.

Assume dV = µV dt + V dz ( Geometric Brownian motion)

The value of the put, p at time, t is given by:

p = K e-r(T-t) N (-d2) – S N(-d1)

p = D e-r(T-t) N (-d1 + T-t) – V t N(-d1)

d1 = [1/ T-t] [ln (V t /D) + (r+ ½ 2 (T-t)]

31

Valuing the call option

The value of the call is a function of the firm value and firm

volatility.

Firm volatility can be estimated from equity volatility.

The value of the call can be calculated by:

c = S N(d1) – K e-r(T-t) N (d2 )

c = Vt N(d1) – D e-r(T-t) N (d1 - T-t)

32

Problem

The current value of the firm is $60 million and the value of the zero coupon

bond to be redeemed in 3 years is $50 million. The annual interest rate is

5% while the volatility of the firm value is 10%. Using the Merton Model,

calculate the value of the firm’s equity.

Value of equity = Ct = Vt x N(d) – De-r(T-t) x N (d-T-t)

d = [1/ T-t] [ln (V t /D) + (r+ ½ 2) (T-t)]

Ct

=

60 x N (d) – (50)e-(.05)(3) x N [d-(.1)3]

d

=

[.1823 +( .05+.01/2)(3)]/.17321

=

.3473/ .17321 = 2.005

Ct

=

60 N (2.005) – (50) (.8607) N (2.005 - .17321)

=

60 N (2.005) – (43.035) N (1.8318)

=

(60) (.9775) – (43.035) (.9665)

=

$17.057 million

V = value of firm,

D = face value of zero coupon debt

= firm value volatility, r =

interest rate

33

Problem

Dt

In the earlier problem, calculate the value of the firm’s

=

debt.

De-r(T-t) – pt

=

50e-.05(3) – pt

=

43.035 – pt

Based on put call parity

pt

=

Ct + De-r(T-t) – V

Or

pt

=

17.057 + 43.035 – 60

= .092

Dt

=

43.035 - .092

= $42.943 million

Alternatively, value of debt

=

Firm value – Equity value

=

$42.943 million

= 60 – 17.057

34

Problem

The value of an emerging market firm’s asset is $20 million.

The firm’s sole liability consists of a pure discount bond with

face value of $15 million and one year remaining until

maturity.

At the end of the next year, the value of firm’s assets will

either be $40 million or $10 million.

The riskless interest rate is 20 percent.

Compute the value of the firm’s equity and the value of the

firm’s debt.

35

Solution

Define V as the value of the firm’s assets. In a binomial

framework,

V, T, u = 40

V, T - 1 = 20

V, T, d = 10

Define E as the value of the firm’s equity, and K as the

face value of the firm’s debt. K = 15. then

ET, u = 25 = 40 - 15

ET - 1

ET, d = 0

36

Cont…

Let current asset value be V.

At the end of a period, asset values can be V (1+ u) ie 40 or

V(1+d) ie 10.

If the firm’s assets have an uptick, then u = [40-20)/20] = 1.0.

The value of d is d = [(20-40)/40] = - 0.5.

Therefore, with r = 0.20,

p

r d 0.2 0.5

0.466667

ud

1 0.5

E pET ,u (1 p) ET ,d (0.46667)(25) (0.5333)(0) = 9.72

T 1

1 r

1.2

The value of the firm’s assets is currently 20, V = E + D,

Value of firm’s debt = 20-9.72 = 10.28

37

Complex capital structures

In real life, capital structures may be more complex.

There may be multiple debt issues differing in

– maturity,

– size of coupons

– seniority.

Equity then becomes a compound option on firm value.

Each promised debt payment gives the equity holders the right

to proceed to the next payment.

If the payment is not made, the firm is in default.

After last but one payment is made, Merton model applies.

38

KMV Model

Default tends to occur when the market value of the firm’s

assets drops below a critical point that typically lies

– Below the book value of all liabilities

– But above the book value of short term liabilities

The model identifies the default point d used in the

computations.

The KMV model assumes that there are only two debt issues.

The first matures before the chosen horizon and the other

matures after that horizon.

The probability of exercise of the put option is the probability of

default.

The distance to default is calculated as:

lnV l nD (r 2 / 2)T

T

39

KMV Model

The distance to default, d2 is a proxy measure for the

probability of default.

As the distance to default decreases, the company becomes

more likely to default.

As the distance to default increases, the company becomes

less likely to default.

The KMV model, unlike the Merton Model does not use a

normal distribution.

Instead, it assumes a proprietary algorithm based on historical

default rates.

40

KMV Model

Using the KMV model involves the following steps:

– Identification of the default point, D.

– Identification of the firm value V and volatility

– Identification of the number of standard deviation moves

that would result in firm value falling below D.

– Use KMV database to identify proportion of firms with

distance-to-default, δ who actually defaulted in a year.

– This is the expected default frequency.

– KMV takes D as the sum of the face value of the all short

term liabilities (maturity < 1 year) and 50% of the face value

of longer term liabilities.

41

Problem

Consider the following figures for a company. What is the probability of

default?

– Book value of all liabilities

: $2.4 billion

– Estimated default point, D

: $1.9 billion

– Market value of equity

: $11.3 billion

– Market value of firm

: $13.8 billion

– Volatility of firm value

: 20%

Solution

Distance to default (in terms of value)

= 13.8 – 1.9 = $11.9 billion

Standard deviation

= (.20) (13.8) = $2.76 billion

Distance to default (in terms of standard deviation) = 11.9/2.76 = 4.31

We now refer to the default database. If 5 out of 100 firms with distance to

default = 4.31 actually defaulted, probability of default = .05

42

Problem

Given the following figures, compute the distance to default:

– Book value of liabilities

:

$5.95 billion

– Estimated default point

:

$4.15 billion

– Market value of equity

:

$ 12.4 billion

– Market value of firm

:

$18.4 billion

– Volatility of firm value

:

24%

Solution

Distance to default (in terms of value) = 18.4 – 4.15 = $14.25

billion

Standard deviation

=

Distance to default (in terms of )

(.24) (18.4) = $4.416 billion

= 14.25/4.42 = 3.23

43

Portfolio Credit Risk Models : Conclusion

Top-down models group credit risk single statics.

They aggregate many sources of risk viewed as

homogeneous into an overall portfolio risk, without going into

the details of individual transactions.

This approach is appropriate for retail portfolios with large

numbers of credits, but less so for corporate or sovereign

loans.

Even within retail portfolios, top-down models may hide

specific risks, by industry or geographic location.

44

Bottom up models

Bottom-up models account for features of each instrument.

This approach is most similar to the structural decomposition

of positions that characterizes market VAR systems.

It is appropriate for corporate and capital market portfolios.

Bottom-up models are most useful for taking corrective action,

because the risk structure can be reverse-engineered to

modify this risk profile.

45

Default mode and mark to market

Default-mode models consider only outright default as a

credit event.

Hence any movement in the market value of the bond or

in the credit rating is irrelevant.

Mark-to-market models consider changes in market

values and ratings changes, including defaults.

They provide a better assessment of risk, which is

consistent with the holding period defined in terms of the

liquidation period.

46

Conditional, structural, reduced form models

Conditional models incorporate changing macroeconomic factors

into the default probability through a functional relationship.

The rate of default increases in a recession.

Structural models explain correlations by the joint movements of

assets – for example, stock prices.

For each obligator, this price is the random variable that

represents movements in default probabilities.

Reduced-form models explain correlations by assuming a

particular functional relationship between the default probability

and “background factor.”

For example, the correlation between defaults across obligors can

be modeled by the loadings on common risk factors – say,

industrial and country.

47

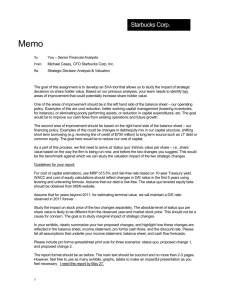

Comparison of Credit Risk Models

CreditMetrics

CreditRisk+

KMV

CreditPf.View

Originator

J P Morgan

Credit Suisse

KMV

McKinsey

Model type

Bottom-up

Bottom-up

Bottom-up

Top-down

Risk definition

Market value

(MTM)

Default losses

(DM)

Default losses

(MTM/DM)

Market value

(MTM)

Risk drivers

Asset values

Default rates

Asset values

Macro factors

Credit events

Rating

change/default

Default

Continuous

default prob.

Rating

change/default

Probability

Unconditional

Unconditional

Conditional

Conditional

Volatility

Constant

Variable

Variable

Variable

Correlation

From equities

(structural)

Default process

(reduced-form)

From equities

(structural)

From macro

factors

Recovery rates Random

Constant within

band

Random

Random

Solution

Analytic

Analytic

Simulation

Simulation/

analytic

48