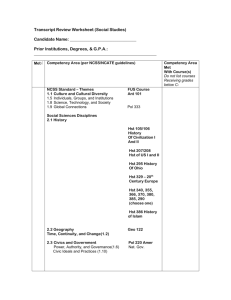

Summative Review 2014

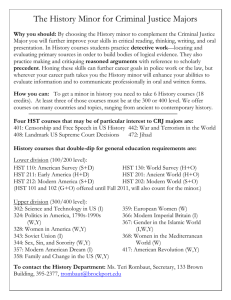

advertisement

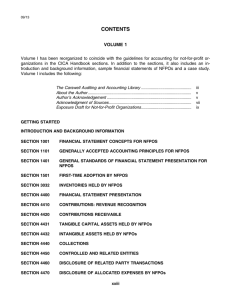

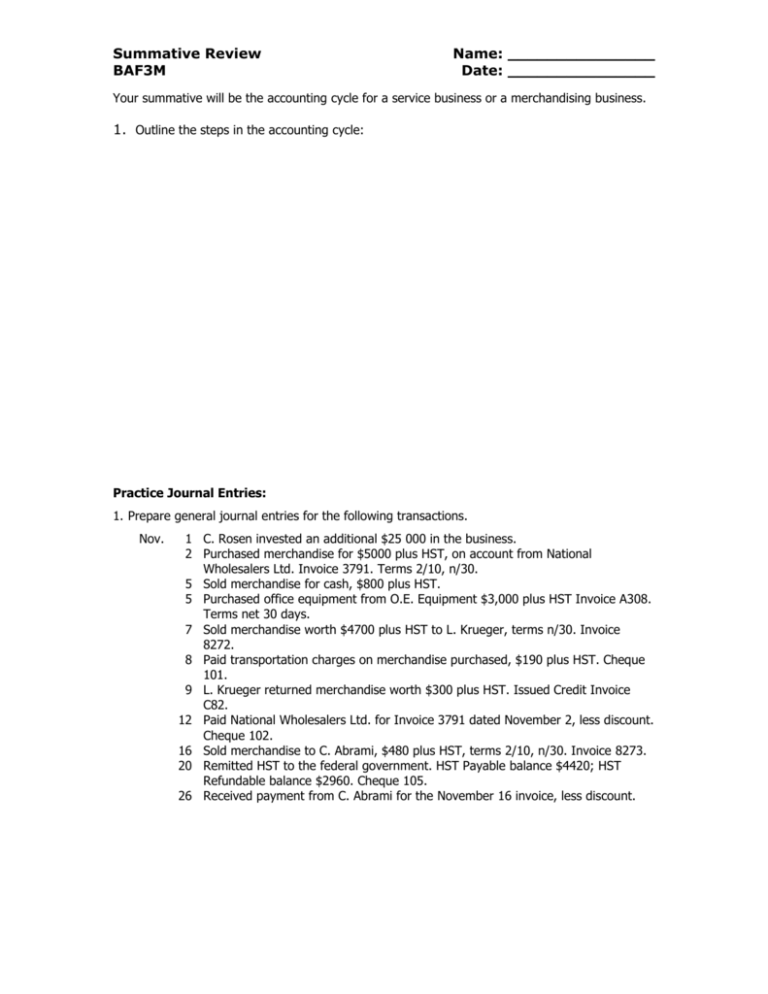

Summative Review BAF3M Name: _______________ Date: _______________ Your summative will be the accounting cycle for a service business or a merchandising business. 1. Outline the steps in the accounting cycle: Practice Journal Entries: 1. Prepare general journal entries for the following transactions. Nov. 1 C. Rosen invested an additional $25 000 in the business. 2 Purchased merchandise for $5000 plus HST, on account from National Wholesalers Ltd. Invoice 3791. Terms 2/10, n/30. 5 Sold merchandise for cash, $800 plus HST. 5 Purchased office equipment from O.E. Equipment $3,000 plus HST Invoice A308. Terms net 30 days. 7 Sold merchandise worth $4700 plus HST to L. Krueger, terms n/30. Invoice 8272. 8 Paid transportation charges on merchandise purchased, $190 plus HST. Cheque 101. 9 L. Krueger returned merchandise worth $300 plus HST. Issued Credit Invoice C82. 12 Paid National Wholesalers Ltd. for Invoice 3791 dated November 2, less discount. Cheque 102. 16 Sold merchandise to C. Abrami, $480 plus HST, terms 2/10, n/30. Invoice 8273. 20 Remitted HST to the federal government. HST Payable balance $4420; HST Refundable balance $2960. Cheque 105. 26 Received payment from C. Abrami for the November 16 invoice, less discount. Summative Review BAF3M Name: _______________ Date: _______________ Adjusting Entries & The Worksheet 2. Prepare adjusting entries for each of the following. The fiscal period is one month (January). (a) The Office Supplies account had a balance of $12 650 at the beginning of the fiscal period. Supplies on hand at the end of the period were worth $9229. (b) Rent totalling $4800 was paid on January 1 to cover three months. (c) A 12-month insurance policy was purchased on January 15 for $2400. (d) The company’s equipment account balance is $40 000. The balance in the Accumulated Depreciation—Equipment account is $8000. The equipment depreciates 20 percent per year. Record the January depreciation using the declining-balance method. 3. Complete the work sheet for Lorenzo Guarnieri Associates that follows using this information: • The fiscal period is one year. • Supplies on hand at December 31 are valued at $1260. • A three-year insurance policy was purchased on January 1 for $4800. • Equipment depreciates 20 percent per year (declining-balance method). (b) If the three adjustments are not made, will the expenses be understated or overstated? Will the net income be understated or overstated? By how much? (c) If closing entries are not prepared and posted, will the Capital account be understated or overstated? By how much? PLEASE NOTE: IN THE ABOVE WORKSHEET, SUPPLIES SHOULD BE $2500, NOT $25,000.