Individual Tax Consequences of Investment Activity

advertisement

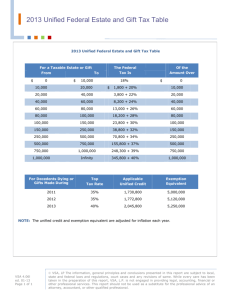

Individual Tax Consequences of Investment Activity Timing issues in income recognition Expenses related to investment activity Tax basis of investment assets Gain/loss on disposition Character of gain or loss Capital gains tax rates for individuals Limits on deductibility of passive activity losses Wealth transfer taxation 15-1 Income Recognition General rule: interest/dividend income taxable when actually or constructively received Exceptions: municipal bond interest, return-ofcapital dividends, discounts on short-term bonds, market discount on long-term bonds Original issue discount on long-term bonds taxed as effective interest income over life of the bonds Proceeds of life insurance policies Liquidation prior to death is taxable, in excess of premiums paid Death benefits not taxable 15-2 Investment Expenses Expenses such as safety deposit box rental, investment management fees, subscriptions to investment newsletters are miscellaneous itemized deductions, deductible only to the extent that total exceeds 2% of AGI Investment interest expense Not deductible if proceeds used to purchase taxexempt bonds If used to purchase other investment property, itemized deduction cannot exceed taxpayers net investment income 15-3 Tax Basis of Investment Property Initial tax basis generally equals cost plus acquisition fees Basis adjustments: Basis 15-4 in bonds increased for taxable OID Basis in securities increased (decreased) by dividend reinvestments (return of capital distributions) Basis in partnership and S corporation investments adjusted to reflect allocations of income and expense, contributions and distributions Basis in rental property reduced by annual cost recovery deductions Sales of Investment Property If investor holds several blocks of identical securities, acquired at different prices, and sells a portion of shares owned, basis is assigned using FIFO unless shares sold can be specifically identified Sales of mutual fund shares typically use an average basis method 15-5 Gain/Loss on Disposition of Investment Property Each gain/loss categorized as: capital, ordinary, Sec. 1231 Capital gain/loss further categorized as short-term (assets held 1 year or less), long-term (assets held more than one year), 28% gain (collectibles), or 25% gain (unrecaptured Sec. 1250 gain) Gains and losses within each category are combined to obtain a net gain or loss 15-6 Netting Rules for Capital Gains/Losses If any capital category has a net loss, such loss can be deducted first against net 28% gains, then against other gains An individual taxpayer’s overall net capital loss is deductible only up to $3,000 annually, as a deduction ‘for’ AGI Any non-deductible net capital loss can be carried forward Net 15-7 capital gains taxed at special tax rates Capital Gains Tax Rates Excess of net short-term capital gains over net long-term capital losses taxed as ordinary income Excess of net long-term capital gains over net short-term capital losses: 28% 15-8 (25%) gains taxed at maximum of 28% (25%) or taxpayer’s ordinary income tax rate Other long-term capital gains taxed at 15% (NEW LAW – formerly 20%). However, if taxpayer’s ordinary income tax rate is 15% or less, long-term capital gains are taxed at 5% (NEW LAW – formerly 10%). Special Rules Affecting Gain/Loss on Investments Individuals may exclude 50% of gain on qualified small business stock held more than 5 years portion of gain recognized is 28% gain stock must be issued directly by a qualifying small business (< $50 M gross assets) after 8/10/93 Loss on sale of Sec. 1244 stock deductible as ordinary annual limit of $100,000 (MFJ) or $50,000 (single) First $1 M of stock issued directly by corporation to investors for money or other property 15-9 PAL Limitations - Overview Apply to individuals, fiduciaries, closely-held and personal service corporations Income/loss separated into baskets active Losses (including compensation), portfolio, passive from passive activities can offset income from other passive activities Net passive activity losses cannot offset active or portfolio income, until the taxpayer completely disposes of the passive activity 15-10 Definitions Passive activity loss - net loss for the taxable year from all passive activities Passive activity - two types: Any trade or business in which the taxpayer does not materially participate Any rental activity Material participation: Taxpayer must be involved in the operations of the business on a regular, continuous, and substantial basis (based on facts and circumstances) 15-11 PAL Rules for Interests in Passthrough Entities Classification of income and deductions as active/passive made at partner or shareholder level Limited partners cannot, by law, materially participate General partners and S corporation shareholders may treat their share of entity business income as active only if they materially participate in the business operations of the entity 15-12 Dispositions of Passive Activities Any suspended losses from a passive activity are fully deductible in the year in which the entire interest is disposed of in a taxable transaction Partial dispositions or dispositions in nontaxable transactions do not trigger suspended losses 15-13 Special Rules for Rental Real Estate Individuals can deduct up to $25,000 annually of rental real estate losses if: AGI is less than $100,000 (allowance reduced by 50% for AGI in excess of $100,000) AND Taxpayer actively participates in the rental activity Owns at least a 10% interest Is significantly involved in the management of the property (approves tenants, sets lease terms, authorizes repairs, selects management service) 15-14 Wealth Transfer Planning Gift, estate, and generation skipping transfer taxes The unified gift and estate tax is based on cumulative transfers over time (life + death). Graduated rates up to 55% Under new law, maximum rate drops to 45% by 2007. In 2010, maximum gift tax rate drops to 35%, and estate tax is eliminated (BUT it returns in 2011!) Lifetime Transfer Tax Exclusion Gift tax exclusion Estate tax exclusion 2002 $1 million and 2003 $1 million 2004 and 2005 $1.5 million 2006, 2007, and 2008 $2 million 2009 $3.5 million Estate tax eliminated in 2010 Estate tax reinstated in 2011 with exclusion of $1 million Estate tax exclusion reduced by any lifetime gift tax exclusion used during decedent’s life Gift Tax Remember, all receipts of gifts are excluded from INCOME taxation We are now discussing GIFT taxation Gift tax paid by the giver, not the recipient Can exclude $11,000 per year per donee from taxable gifts Can treat gift by one spouse as made 1/2 by other spouse No gift tax on gifts to spouse, charity, paying tuition or medical costs Income Tax Effects of Gifts Gift is not taxable income to recipient Donor’s adjusted basis in the property carries over to become the recipient’s basis exception After - use FMV if less than adjusted basis gift, any income derived from the property belongs to the recipient Estate Tax Taxed at unified estate and gift rate schedule FMV of estate is taxed Unlimited marital deduction Reduce estate by taxes, charity, administrative expenses Income Tax Effect of Bequests Receipt of a bequest is not taxable income to heir Basis of inherited property = FMV at date of death Free income tax step-up in basis Trade-off: Gift now at low basis, avoid some transfer tax Keep and include in estate, but heirs get high basis