2013 Federal Estate & Gift Tax Table | Rates & Exemptions

advertisement

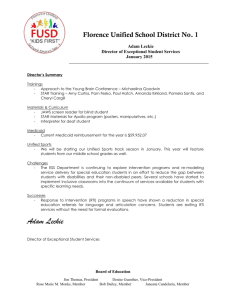

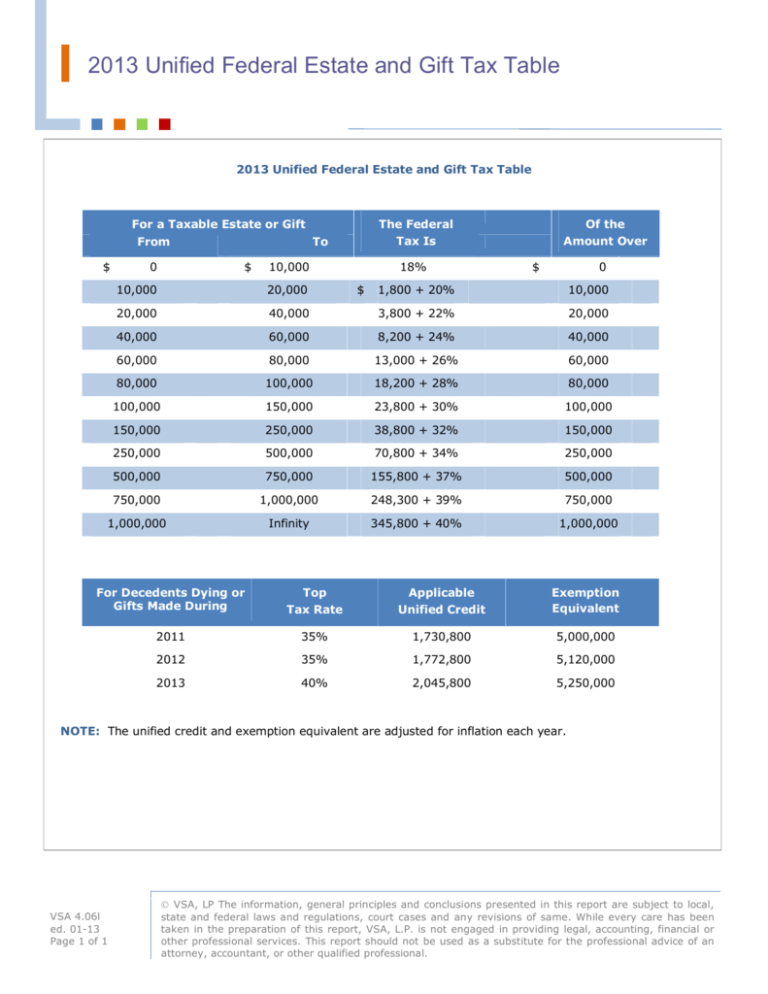

2013 Unified Federal Estate and Gift Tax Table 2013 Unified Federal Estate and Gift Tax Table For a Taxable Estate or Gift From $ 0 The Federal Tax Is To $ 10,000 10,000 20,000 20,000 18% $ Of the Amount Over $ 0 1,800 + 20% 10,000 40,000 3,800 + 22% 20,000 40,000 60,000 8,200 + 24% 40,000 60,000 80,000 13,000 + 26% 60,000 80,000 100,000 18,200 + 28% 80,000 100,000 150,000 23,800 + 30% 100,000 150,000 250,000 38,800 + 32% 150,000 250,000 500,000 70,800 + 34% 250,000 500,000 750,000 155,800 + 37% 500,000 750,000 1,000,000 248,300 + 39% 750,000 1,000,000 Infinity 345,800 + 40% 1,000,000 For Decedents Dying or Gifts Made During Top Tax Rate Applicable Unified Credit Exemption Equivalent 2011 35% 1,730,800 5,000,000 2012 35% 1,772,800 5,120,000 2013 40% 2,045,800 5,250,000 NOTE: The unified credit and exemption equivalent are adjusted for inflation each year. VSA 4.06l ed. 01-13 Page 1 of 1 VSA, LP The information, general principles and conclusions presented in this report are subject to local, state and federal laws and regulations, court cases and any revisions of same. While every care has been taken in the preparation of this report, VSA, L.P. is not engaged in providing legal, accounting, financial or other professional services. This report should not be used as a substitute for the professional advice of an attorney, accountant, or other qualified professional.