FINANCIAL INTERMEDIARIES AND FINANCIAL INNOVATION

advertisement

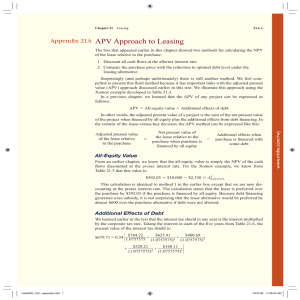

Chapter 20 MARKETS FOR CORPORATE SENIOR INSTRUMENTS: I Corporate Debt Market Commercial Paper Market Medium-Term Note Market Euronote Market Bank Loan Market Bond Market Credit Risk Default Risk Risk that issuer will default on its obligation to the lender. Credit Spread Risk Risk that debt obligation will decline due to an increase in the credit spread. Downgrade Risk Risk that credit quality of issuer declines. Commercial Paper Short-term unsecured promissory note issued in the open market Characteristics Used for bridge financing Maturity of less than 90 days Rolled over at maturity Backed by unused bank credit lines Limited secondary market activity Issuers of Commercial Paper Large corporations with strong credit quality Financial Companies captive finance companies bank-related finance companies independent finance companies Nonfinancial Companies domestic and foreign corporations Placement of Commercial Paper Direct Paper directly placed by issuing firm to investors Dealer-Placed Paper requires service of an agent to sell the issuer’s paper best efforts underwriting Non-U.S. Commercial Paper Market Eurocommercial Paper issued and placed outside the country in whose currency it is denominated Differences between U.S. and Euro-CPs Maturity Bank credit lines Placement Dealer participation Secondary market Medium-Term Notes (MTN) Corporate debt obligations offered on a continuous basis Characteristics offered continuously to investors rated by rating agencies maturities range from 9 months to 30 years registered with the SEC Typically issued by non-financial corporations The Primary Market of MTNs Placement and Distribution sold on a best-efforts basis by an investment banker sold in small amounts Structured MTNs Combine offering with positions in derivative markets to create debt obligations with more interesting risk/return features. Types: inverse floating-rate security structured note Bank Loans Domestic bank Subsidiary of foreign bank Foreign bank Subsidiary of domestic bank Offshore or Eurobank Syndicated Bank Loans A group of banks provides funds to the borrower. Senior bank loans marketable collateralized based on LIBOR Lease Financing Parties involved: lessee lessor Leasing arrangements leveraged lease tax-oriented lease single-investor of direct lease