CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

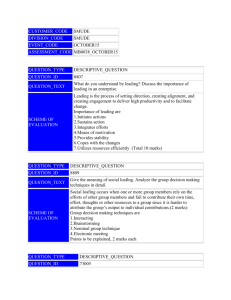

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE SMUAPR15 ASSESSMENT_CODE MB0045_SMUAPR15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 9547 QUESTION_TEXT What is capital budgeting decision? Highlight its types SCHEME OF EVALUATION Meaning of capital budgeting: Capital budgeting is a blue–print of planned investments in operating assets. Thus, capital budgeting is the process of evaluating the profitability of the projects under consideration and deciding on the proposal to be included in the capital budget for implementation. Types: ●Decision to replace the equipments for maintenance of current level of business or decisions aiming at cost reductions, known as replacement decisions ●Decisions expansion through improved network of distribution or on expenditure for increasing the present operating level ●Decisions for production of new goods or rendering of new services ●Decisions on penetrating into new geographical area ●Decisions to comply with the regulatory structure affecting the operations of the company, like investments in assets to comply with the conditions imposed by Environmental Protection Act ●Decisions on investment to build township for providing residential accommodation to employees working in a manufacturing plant QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73184 QUESTION_TEXT What are the factors affecting capital structure? Also explain the feature of an Ideal capital structure? Features of an Ideal Capital Structure a. b. c. d. SCHEME OF EVALUATION Profitability Flexibility Control Solvency 1 each Factors Affecting Capital Structure 1. Leverage 2M 2. Cost of capital 3. Cash flow projections of the company 4. Dilution of control 5. Floatation costs 1M each with explanation QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125906 QUESTION_TEXT Explain Economic Order Quantity. What are the assumptions of EOQ? Economic order quantity (EOQ) refers to the optimal order size that will result in the lowest ordering and carrying costs for an item of inventory based on its expected usage, carrying costs and ordering cost. EOQ is defined as the order quantity that minimises the total cost associated with inventory management. (4 marks) EOQ is based on the following assumptions: Constant or uniform demand – The demand or usage is even through-out the period. SCHEME OF EVALUATION Known demand or usage – Demand or usage for a given period is known i.e. deterministic. Constant unit price – Per unit price of material does not change and is constant irrespective of the order size. Constant carrying costs – The cost of carrying is a fixed percentage of the average value of inventory. Constant ordering cost – Cost per order is constant and is not affected by the size of the order. Inventories can be replenished immediately as the stock level reaches exactly equal to zero. Constantly there is no shortage of inventory. (1 mark each) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125909 QUESTION_TEXT Write a short note on Net Income approach and net Operating Income approach. Net Income approach explanation and formula SCHEME OF EVALUATION Net Operating Income approach explanation and formula (5 marks) (5 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125911 Mr. Madan invests Rs. 500, Rs. 1000, Rs. 2000 and Rs. 2500 at the end of each year for 5 years. Calculate the value at the end of 5 years QUESTION_TEXT compounded annually if the rate of interest is 5 % p.a. SCHEME OF EVALUATION End of year 1 Amount invested (Rs.) 500 Number of years compounded 4 Compounded FV in interest factors Rs. from tables 1.216 608 2 1000 3 1.158 1158 3 1500 2 1.103 1654 4 2000 1 1.050 2100 5 2500 0 1.000 2500 Amount at the end of the fifth year is Rs. 8020 8020 The value at the end of the fifth year is Rs. 8020 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 160424 QUESTION_TEXT Describe the role of the finance manager in the mobilization and deployment of funds for an organization. (5 + 5 = 10 marks) SCHEME OF EVALUATION Mobilization of Funds for the Firm: The Finance Manager has to plan for and mobilize the required funds from various sources when they are required and at an acceptable cost. This decision is called the Financing Decision. For this purpose he would be liaising with banks and financial institutions. He also deals with merchant banking agencies for procuring funds from the public through issue of shares, debentures and inviting the public to subscribe to its fixed deposits. In deciding how much to procure from various sources, he would weigh many considerations like the cost of the funds in the form of interest/dividend and the cost of public issue in the case of shares and debentures, the length of time for which funds would be available, etc. Banks and other financial institutions which give short-term and long-term loans generally lay down some conditions. These conditions are aimed at ensuring the safety of the loans given by them and contain provisions restricting the freedom of the borrower to raise loans from other sources. Therefore, the Finance Manager would try to balance the advantages of having funds available with the costs and the loss of flexibility arising from the restrictive provisions of the loan contract. Deployment of Funds: There are always many competing needs for the allocation of funds. In consultation with the managers of various departments such as production, marketing, personnel, R & D and the top management, the Finance Manager decides on the manner of deployment of funds in various assets such as land, buildings, machinery, materials, etc. Sometimes the managers of the various departments named above constitute an ‘Investment Committee’ and appraise an investment proposal along the marketing, technical and financial dimensions. The Finance Manager appraises the proposal along the financial dimensions to determine its worthiness in relation to the investment involved. This decision called the ‘Investment Decision’ constitutes one of the core activities of the Finance Manager.