CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

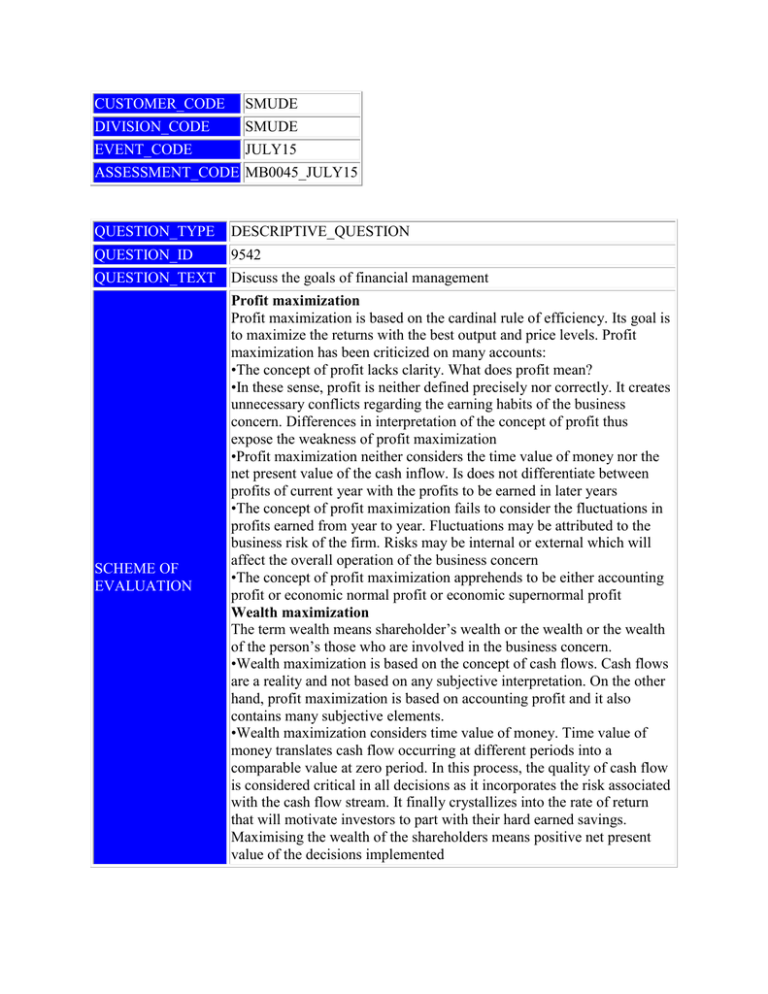

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE JULY15 ASSESSMENT_CODE MB0045_JULY15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 9542 QUESTION_TEXT Discuss the goals of financial management SCHEME OF EVALUATION Profit maximization Profit maximization is based on the cardinal rule of efficiency. Its goal is to maximize the returns with the best output and price levels. Profit maximization has been criticized on many accounts: •The concept of profit lacks clarity. What does profit mean? •In these sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of the concept of profit thus expose the weakness of profit maximization •Profit maximization neither considers the time value of money nor the net present value of the cash inflow. Is does not differentiate between profits of current year with the profits to be earned in later years •The concept of profit maximization fails to consider the fluctuations in profits earned from year to year. Fluctuations may be attributed to the business risk of the firm. Risks may be internal or external which will affect the overall operation of the business concern •The concept of profit maximization apprehends to be either accounting profit or economic normal profit or economic supernormal profit Wealth maximization The term wealth means shareholder’s wealth or the wealth or the wealth of the person’s those who are involved in the business concern. •Wealth maximization is based on the concept of cash flows. Cash flows are a reality and not based on any subjective interpretation. On the other hand, profit maximization is based on accounting profit and it also contains many subjective elements. •Wealth maximization considers time value of money. Time value of money translates cash flow occurring at different periods into a comparable value at zero period. In this process, the quality of cash flow is considered critical in all decisions as it incorporates the risk associated with the cash flow stream. It finally crystallizes into the rate of return that will motivate investors to part with their hard earned savings. Maximising the wealth of the shareholders means positive net present value of the decisions implemented QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 9547 QUESTION_TEXT What is capital budgeting decision? Highlight its types SCHEME OF EVALUATION Meaning of capital budgeting: Capital budgeting is a blue–print of planned investments in operating assets. Thus, capital budgeting is the process of evaluating the profitability of the projects under consideration and deciding on the proposal to be included in the capital budget for implementation. Types: ●Decision to replace the equipments for maintenance of current level of business or decisions aiming at cost reductions, known as replacement decisions ●Decisions expansion through improved network of distribution or on expenditure for increasing the present operating level ●Decisions for production of new goods or rendering of new services ●Decisions on penetrating into new geographical area ●Decisions to comply with the regulatory structure affecting the operations of the company, like investments in assets to comply with the conditions imposed by Environmental Protection Act ●Decisions on investment to build township for providing residential accommodation to employees working in a manufacturing plant QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 73185 QUESTION_TEXT What is risk? Explain the types of risk? SCHEME OF EVALUATION Risk may be termed as a degree of uncertainty. It is the possibility that the actual result from an investment will differ from the expected result. 2M Types 1. Stand-alone risk 2. 3. Portfolio risk Market risk 4. Corporate risk 2M each with explanation QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125906 QUESTION_TEXT Explain Economic Order Quantity. What are the assumptions of EOQ? Economic order quantity (EOQ) refers to the optimal order size that will result in the lowest ordering and carrying costs for an item of inventory based on its expected usage, carrying costs and ordering cost. EOQ is defined as the order quantity that minimises the total cost associated with inventory management. (4 marks) EOQ is based on the following assumptions: Constant or uniform demand – The demand or usage is even throughout the period. SCHEME OF EVALUATION Known demand or usage – Demand or usage for a given period is known i.e. deterministic. Constant unit price – Per unit price of material does not change and is constant irrespective of the order size. Constant carrying costs – The cost of carrying is a fixed percentage of the average value of inventory. Constant ordering cost – Cost per order is constant and is not affected by the size of the order. Inventories can be replenished immediately as the stock level reaches exactly equal to zero. Constantly there is no shortage of inventory. (1 mark each) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125908 QUESTION_TEXT Explain the steps in Financial Planning. There are six steps in Financial Planning 1. Establish corporate objectives (2 marks) SCHEME OF EVALUATION 2. Formulate strategies (1 mark) 3. Assign responsibilities (1 mark) 4. Forecast financial variables (2 marks) 5. Develop plans (2 marks) 6. Create flexible economic environment (2 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 125909 QUESTION_TEXT Write a short note on Net Income approach and net Operating Income approach. Net Income approach explanation and formula SCHEME OF EVALUATION Net Operating Income approach explanation and formula (5 marks) (5 marks)