Presentation - University of New Brunswick

advertisement

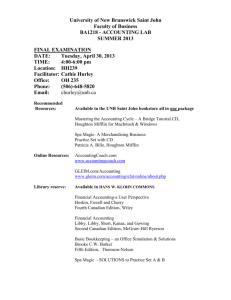

Financial Aid Money Matters Financial Aid Office Mandate “Our mandate is to increase opportunities for and access to university by helping students and their families seek, obtain, and make the best use of all financial resources. As such, the Financial Aid Office of UNB (Fredericton) plays an integral role in supporting the University's mission and goals of recruiting and retaining a talented and diverse undergraduate and graduate student population.” Part 1 Costs of Attendance Approximate Costs 2015-2016 • • • • • • • • • Tuition Fees (Health & Dental next slide) 1st year orientation fee Residence costs (double room/meal plan) Books/equipment and supplies Local travel Return travel Miscellaneous (entertainment, etc.) Parking Fee TOTAL $ 6,187.00 $ 878.50 $ 65.00 $ 9,170.00 $ 1,500.00 $ 800.00 $ 1,500.00 $ 1,500.00 $ 107.00 $21,707.50 Health & Dental Plan at UNB ADMINISTERED BY If you have alternate medical coverage and do not wish to remain on the UNB student plan, you can opt-out by visiting the following website: http://www.wespeakstudent.com/ You can choose to opt-out of the dental plan without showing proof of coverage, however this must also be indicated online. A verbal indication that the student wishes to opt-out is not sufficient and will not result in a credit to your University account. (COSTS: Health $142 + Dental $118 = $260) OPT-OUT DEADLINE: September 18, 2015 PRINT RECEIPT Tuition and Fees FALL 2015 Tuition/Fee Payment Due by September 15th All Programs $3,677.75 Additional fees may apply to: Law, Engineering, Education, Business Part II Student Funding (Government Loans & Other) GOVERNMENT STUDENT LOAN FUNDING HOW TO APPLY STEP 1 (go to) www.canlearn.ca STEP 2 (click on province of residence) http://www.canlearn.ca/eng/loans_grants/loans/provincial.shtml STEP 3 (APPLY!) one application covers federal/provincial (have income tax returns ready when completing application ) Differences Between Loans DIFFERENCE BTW GOV’T STUDENT LOAN & PRIVATE Requirement of a guarantor Government student loans Non-government student loans As a general rule, no Possibly Interest due while in Full-time students do not pay interest until they have left post secondary education school Yes, students pay interest while in school Start date of repayment 6 months after leaving post secondary education (interest will accrue as soon as you are out of school, however) Immediately after receiving the loan Repayment help Varies by loan provider; Forms of help, such as getting a temporary pass on paying principal typically more difficult and interest, are available to access New Brunswick Integrated Loan Program Single Student Example Program Weekly Maximums # of weeks in Program Total Canada Student Loan $210 34 $ 7,140 *Canada Student Grant $250 monthly 8 months $ 2,000 $100 monthly 8 months $ New Brunswick Loan $140 34 $ 4,760 New Brunswick Bursary $130 34 $ 4,420 POTENTIAL Student Loan Maximum over traditional academic year September, 2015 – April, 2016 800 $17,120 – 18,320 Nova Scotia Student Aid Single Student Example Program Weekly Maximums # of weeks in program Total Canada Student Loan $210 34 $7,140 *Canada Student Grant $250 monthly 8 months $ 2,000 $100 monthly 8 months $ 800 Nova Scotia Student Loan (up to 20% eligible in grant) Loan/ $108.00 34 $3,672 Grant/$72 34 $2,448 POTENTIAL Student Loan Maximum over traditional academic year September, 2015 – April, 2016 $14,060 15,260 Ontario Integrated Loan Single Student Example Program Canada Student Loan/ OSLP Weekly Maximums $365 # of weeks in Program 34 Total $ 12,410 Grants are available which may reduce repayable assistance to $7,400.00 per academic year (automatic based on financial need) Prince Edward Island Single Student Example Program Weekly Maximums # of weeks in Program Total Canada Student Loan $210 34 $7,140 *Canada Student Grant $250 monthly 8 months $ 2,000 $100 monthly 8 months $ 800 Prince Edward Island Student Loan $165 34 $5,610 POTENTIAL Student Loan Maximum over traditional academic year September, 2015 – April, 2016 $13,55014,750 Newfoundland & Labrador Single Student Example Program Weekly Maximums # of weeks in program Total Canada Student Loan $210 34 $ 7,140 *Canada Student Grant $250 monthly 8 months $ 2,000 $100 monthly 8 months $ 800 Newfoundland Student $60 Loan 34 $ 2,040 Newfoundland Up-Front Grant 34 $ 2,720 $80 POTENTIAL Student Loan Maximum over traditional academic year September, 2015 – April, 2016 $12,70013,900 Canada Student Grants for Students with Permanent Disabilities • $2,000 per year for students who have been assessed as having a permanent disability by their province. • Up to $8,000 per school year to cover exceptional educationrelated costs such as tutors, note-takers, sign interpreters, braillers or technical aids. A separate application is required for this grant. REVIEW PROGRAM: http://www.canlearn.ca/eng/loans_grants/grants/disabilities.shtml REPAYMENT ASSISTANCE Government of New Brunswick Timely Completion Benefit Eligibility Requirements • Graduate from a publically funded post-secondary institution. • Graduate from the program of study within the established timelines for the program. • Total federal and provincial student loan borrowings in excess of $26,000. • Apply for one-time benefit within seven months of graduation. REVIEW PROGRAM: www.gnb.ca Government of New Brunswick Tuition Rebate Under the New Brunswick Tuition Rebate, anyone, from anywhere in the world, who on or after January 1, 2005, pays tuition, graduates from an eligible post-secondary institution, lives and works in New Brunswick and pays New Brunswick personal income tax, will be eligible for a non-taxable rebate of 50% of their tuition costs with a maximum lifetime rebate of $20,000. NEXT SLIDE—SEE CHANGE REVIEW PROGRAM: http://www2.gnb.ca/content/gnb/en/departments/finance/promo/tuition_rebate.html Government of New Brunswick Tuition Rebate—up-coming CHANGE New Brunswick ONLY PLEASE NOTE: As announced as part of its 2015-16 Budget, government will be eliminating the New Brunswick Tuition Rebate in order to refocus its resources to help students enter the post-secondary system. Individuals may apply up until December 31, 2015, for the taxation year 2014. As of January 2016, no more applications will be accepted. Government of Nova Scotia Graduate Tax Credit The Nova Scotia Graduate Tax Credit is available to anyone living and working in Nova Scotia who graduated from an eligible post-secondary program on or after January 1, 2006. This credit could reduce your Nova Scotia income taxes by $1,000 in 2006 and 2007 and by $2,000 in 2008 and later years. REVIEW PROGRAM: http://www.novascotia.ca/finance/en/home/taxation/tax101/personalincometax/graduatetaxcredit.aspx Government of Prince Edward Island Debt Reduction Grant Program Type of assistance: Provincially funded non-repayable grant. Maximum assistance: Up to $2,000 per year of study, with the maximum funding based on the required length of the program plus 1 year. The grant will be paid following a student's year of graduation, and is applied against the Prince Edward Island Student Loan balance. You must apply for this grant within 1 year from your graduation date. http://www.gov.pe.ca/forms/pdf/2553.pdf FEDERAL Government Repayment Assistance Plan The Repayment Assistance Plan (RAP) is available to borrowers who are having difficulty paying back their student loan debt. RAP makes it easier for student loan borrowers to manage their debt by paying back what they can reasonably afford. REVIEW PROGRAM: http://www.canlearn.ca/eng/loans_grants/repayment/help/index.shtml National Student Loan Service Centre National Student Loan Service Centre (NSLSC) Public Service Division TEL: 1-888-815-4514 WEB SITE: https://csnpe-nslsc.cibletudes-canlearn.ca/ Part III Finding Money and Resources! Convert Aeroplan® Miles to help fund your school education HigherEdPoints enables students studying in Canada to redeem points or miles from their Loyalty Program and turn them into funds to offset for their university or college fees. Through HigherEdPoints.com, Aeroplan® Miles are able to be redeemed for HigherEd credits which can be used to offset UNB tuition, residence and meal fees. http://www.unb.ca/financialservices/students/paymentoptions/use_aeroplan_miles.html UNBF Great Computer Give-Away Program • UNB’s Financial Aid Office, Student Union and IT Department participate in a “computer draw program” annually. In the fall of 2015, reconditioned computers will be provided to this needs-based program by UNB’s IT Department. • Eligibility is restricted to full-time UNBF undergraduate students with demonstrated financial need. Students must also be in good academic standing (GPA of 2.0 and over from the most recent assessment year or 1st year entry to UNB) to be eligible for program consideration. http://www.unb.ca/fredericton/studentservices/financial-aid/ UNB Work-Study Program • Work-Study is a subsidized employment program designed to assist financially needy students with the high costs associated with post-secondary study. • Students work up to a maximum of 10 hours per week at a standard wage of $12.00 per hour. • Please contact UNB’s Financial Aid Office (453-4796) starting end of August, 2015 to set up an appointment for a “Needs Assessment” and review program eligibility. http://www.unb.ca/fredericton/studentservices/financial-aid/ UNB Special Bursary Program Students may be eligible for up to $1,000 in bursary assistance if they meet the following criteria: 1. Undergraduate Canadian citizen (or domestic student) 2. Registered at UNBF on a full-time basis 3. Have a demonstrated financial need Please contact Financial Aid at 453-4796 for further information. Application deadline: November 15, 2015 Applications will be posted to http://www.unb.ca/fredericton/studentservices/financial-aid/ Dr. Florence T. Snodgrass Bursary for New Brunswick Students Students may be eligible for up to $2,000 in bursary assistance under the following criteria: 1. Undergraduate New Brunswick resident (as per NB Student Financial Assistance guidelines) 2. 3. Registered on a full-time basis Have a demonstrated financial need Please contact Financial Aid at 453-4796 for further information. Application deadline: December 5, 2015 Applications will be posted to http://www.unb.ca/fredericton/studentservices/financial-aid/ Book Advance Program Personal Advances/Book Advance Program Advances (re-payable) are available to full-time students awaiting forthcoming funds. In order to be eligible for this program, students must present proof (i.e. copy government loan assessment) to the Financial Aid Office verifying dollar amounts. Please call Financial Aid Office to schedule an appointment. Study Abroad Bursary Program Bursaries, valued up to $ 1,500, may be available to full-time students completing an international student abroad program as part of their degree requirement at the University of New Brunswick (Fredericton Campus). The award will be contingent on the students’ registration and completion of the student abroad program. UNB Travel Study Bursary Through the generosity of the University of New Brunswick, Travel Study Bursaries, valued up to $1,500.00, have been established to enable full-time UNB students with limited financial resources to participate in UNB Travel Study Programs. http://www.unb.ca/fredericton/studentservices/financial-aid/apply-for-bursaries.html AWARDS Encourage your child to review financial options and resources by applying for scholarships/bursaries through UNB’s Undergraduate Awards Office and UNB’s Financial Aid Office. Scholarships (merit-based) • Merit-based Scholarships look at academic standing or grade point average (g.p.a.). Merit-based bursaries also consider financial need. • WEB SITE: http://www.unb.ca/scholarships/ Bursaries (need-based) • Need-based awards consider financial need first and, in some programs, an academic standing of 2.0 and over. • WEB SITE: http://www.unb.ca/fredericton/studentservices/financial-aid/ EXTERNAL AWARDS Check out on-line search tools for awards across Canada at the following web sites (this is not an all inclusive list): • http://www.studentawards.com/canlearn/ • http://www.scholarshipscanada.com/ • http://www.disabilityawards.ca/ Don’t forget to check out the valuable Job Search and Career Information located on UNBF’s Student Employment Services web site: • http://www.unb.ca/fredericton/studentservices/employment/ Financial Consent Parents, guardians, spouses & other 3rd parties require consent from the student for whom they wish to access account information to make tuition and fee payments. How to access the eServices screen: 1) Log on to your student eServices; 2) Select ‘Financial’ tab located at the top of the screen; 3) Select ‘Financial Consent’ on the left hand side of the screen. Average Earnings Average earnings by highest level of schooling, by province and territory (2006 Census) 2005 Canada N.L. P.E.I. N.S. N.B. Total - Highest certificate, diploma or degree 35,498 27,636 27,769 30,187 28,450 Certificate or diploma below bachelor level 30,116 24,180 24,663 26,215 24,861 University certificate or degree 58,767 53,222 46,139 49,433 51,495 Bachelor's degree 52,907 45,915 40,830 43,436 46,232 University certificate, diploma or degree above bachelor level 69,230 67,036 57,176 60,095 62,967 Source: Statistics Canada, Census of Population. Last modified: 2009-10-09. FINANCIAL AID OFFICE CONTACTS: Shelley Clayton Director or Kelly Waugh Financial Aid Officer Location: C.C. Jones Student Services Centre, 1st floor , 26 Bailey Drive Tel (506) 453-4796/Fax (506) 453-5020 E-mail: finaid@unb.ca http://www.unb.ca/fredericton/studentservices/financial-aid/