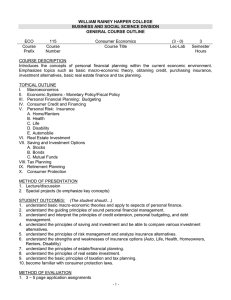

Course Outline

advertisement

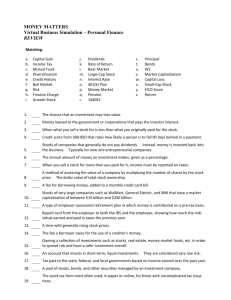

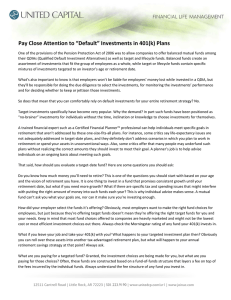

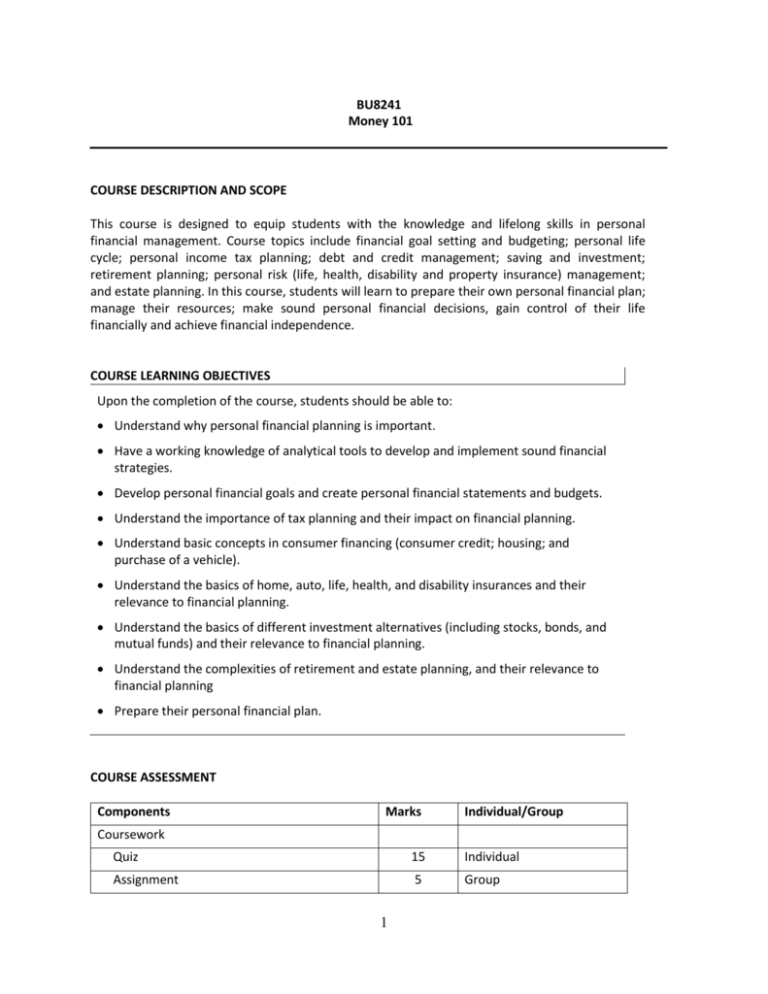

BU8241 Money 101 COURSE DESCRIPTION AND SCOPE This course is designed to equip students with the knowledge and lifelong skills in personal financial management. Course topics include financial goal setting and budgeting; personal life cycle; personal income tax planning; debt and credit management; saving and investment; retirement planning; personal risk (life, health, disability and property insurance) management; and estate planning. In this course, students will learn to prepare their own personal financial plan; manage their resources; make sound personal financial decisions, gain control of their life financially and achieve financial independence. COURSE LEARNING OBJECTIVES Upon the completion of the course, students should be able to: Understand why personal financial planning is important. Have a working knowledge of analytical tools to develop and implement sound financial strategies. Develop personal financial goals and create personal financial statements and budgets. Understand the importance of tax planning and their impact on financial planning. Understand basic concepts in consumer financing (consumer credit; housing; and purchase of a vehicle). Understand the basics of home, auto, life, health, and disability insurances and their relevance to financial planning. Understand the basics of different investment alternatives (including stocks, bonds, and mutual funds) and their relevance to financial planning. Understand the complexities of retirement and estate planning, and their relevance to financial planning Prepare their personal financial plan. COURSE ASSESSMENT Components Marks Individual/Group Coursework Quiz 15 Individual Assignment 5 Group 1 Project 10 Group Class Participation 10 Individual Final Examination 60 Individual Total 100 TEXTBOOK Kapoor, J., Dlabay, L., and Hughes, R., Tenth Edition (2011) International Edition, Personal Finance. New York, NY: McGraw-Hill, ISBN: 978-0-07-131566-1 PROPOSED LECTURE SCHEDULE Week Topics 1 Course Overview, Personal Financial Planning, and Time Value of Money 2 Time Value of Money Money Management : Financial Statements and Budgeting Money Management 3 Planning Tax Strategies Saving and Payment Services 4 Money Management Introduction to Consumer Credit 5 Money Management Choosing a Source of Credit and the Cost of Credit / Alternatives 6 7 Money Management Consumer Purchase: Vehicle and Other Major Purchases, Buying Your Home Investments Fundamentals Stocks 2 RECESS WEEK 8 Investments Bonds Mutual Funds CPF investments 9 Investments Real Estate, High Risk, and Alternative Investments 10 Managing Risk and the Role of Insurance Property and Motor Vehicle Insurance 11 Managing Risk and the Role of Insurance Health and Disability Insurance Life Insurance 12 Retirement Planning 13 Estate Planning and Course Wrap Up Final Exam (2 hours) 3