Cheat Sheet Page 1

advertisement

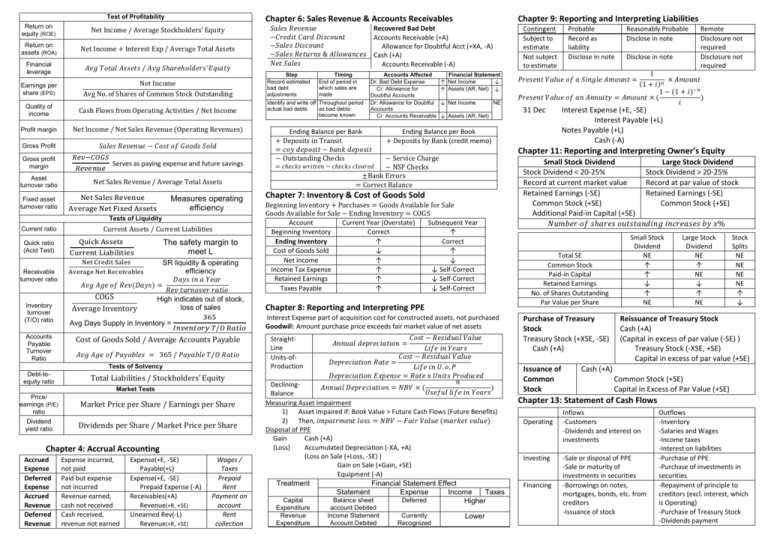

Test of Profitability Chapter 6: Sales Revenue & Accounts Receivables Return on equity (ROE) Net Income / Average Stockholders′ Equity Return on assets (ROA) Net Income + Interest Exp / Average Total Assets Financial leverage 𝐴𝑣𝑔 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 / 𝐴𝑣𝑔 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝐸𝑞𝑢𝑖𝑡𝑦 Earnings per share (EPS) Net Income Avg No. of Shares of Common Stock Outstanding Quality of income Cash Flows from Operating Activities / Net Income Profit margin Net Income / Net Sales Revenue (Operating Revenues) Gross Profit 𝑆𝑎𝑙𝑒𝑠 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 − 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑 Gross profit margin 𝑅𝑒𝑣−𝐶𝑂𝐺𝑆 Serves as paying expense and future savings 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 Asset turnover ratio Net Sales Revenue / Average Total Assets Fixed asset turnover ratio Net Sales Revenue Average Net Fixed Assets Measures operating efficiency Tests of Liquidity Current ratio Quick ratio (Acid Test) Current Assets / Current Liabilities Quick Assets Current Liabilities The safety margin to meet L Net Credit Sales Receivable turnover ratio Inventory turnover (T/O) ratio SR liquidity & operating efficiency Average Net Receivables 𝐷𝑎𝑦𝑠 𝑖𝑛 𝑎 𝑌𝑒𝑎𝑟 𝐴𝑣𝑔 𝐴𝑔𝑒 𝑜𝑓 𝑅𝑒𝑣(𝐷𝑎𝑦𝑠) = 𝑅𝑒𝑣 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑟𝑎𝑡𝑖𝑜 COGS High indicates out of stock, loss of sales Average Inventory 365 Avg Days Supply in Inventory = 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇/𝑂 𝑅𝑎𝑡𝑖𝑜 Accounts Payable Turnover Ratio Cost of Goods Sold / Average Accounts Payable Debt-toequity ratio Total Liabilities / Stockholders′ Equity 𝐴𝑣𝑔 𝐴𝑔𝑒 𝑜𝑓 𝑃𝑎𝑦𝑎𝑏𝑙𝑒𝑠 = 365 / 𝑃𝑎𝑦𝑎𝑏𝑙𝑒 𝑇/𝑂 𝑅𝑎𝑡𝑖𝑜 Tests of Solvency Market Tests Price/ earnings (P/E) ratio Dividend yield ratio Market Price per Share / Earnings per Share Dividends per Share / Market Price per Share Chapter 4: Accrual Accounting Accrued Expense Deferred Expense Accrued Revenue Deferred Revenue Expense incurred, not paid Paid but expense not incurred Revenue earned, cash not received Cash received, revenue not earned Expense(+E, -SE) Payable(+L) Expense(+E, -SE) Prepaid Expense (-A) Receivables(+A) Revenue(+R, +SE) Unearned Rev(-L) Revenue(+R, +SE) Wages / Taxes Prepaid Rent Payment on account Rent collection Chapter 9: Reporting and Interpreting Liabilities 𝑆𝑎𝑙𝑒𝑠 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 Recovered Bad Debt −𝐶𝑟𝑒𝑑𝑖𝑡 𝐶𝑎𝑟𝑑 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 Accounts Receivable (+A) −𝑆𝑎𝑙𝑒𝑠 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 Allowance for Doubtful Acct (+XA, -A) −𝑆𝑎𝑙𝑒𝑠 𝑅𝑒𝑡𝑢𝑟𝑛𝑠 & 𝐴𝑙𝑙𝑜𝑤𝑎𝑛𝑐𝑒𝑠 Cash (+A) 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 Accounts Receivable (-A) Step Record estimated bad debt adjustments Timing End of period in which sales are made Identify and write off Throughout period actual bad debts as bad debts become known Accounts Affected Dr: Bad Debt Expense Cr: Allowance for Doubtful Accounts Dr: Allowance for Doubtful Accounts Cr: Accounts Receivable Ending Balance per Bank + Deposits in Transit = 𝑐𝑜𝑦 𝑑𝑒𝑝𝑜𝑠𝑖𝑡 − 𝑏𝑎𝑛𝑘 𝑑𝑒𝑝𝑜𝑠𝑖𝑡 − Outstanding Checks Contingent Subject to estimate Not subject to estimate Financial Statement ↑ Net Income ↓ ↑ Assets (AR, Net) ↓ ↓ Net Income NE ↓ Assets (AR, Net) Beginning Inventory + Purchases = Goods Available for Sale Goods Available for Sale − Ending Inventory = COGS Account Current Year (Overstate) Subsequent Year Beginning Inventory Correct ↑ Ending Inventory ↑ Correct Cost of Goods Sold ↓ ↑ Net Income ↑ ↓ Income Tax Expense ↑ ↓ Self-Correct Retained Earnings ↑ ↓ Self-Correct Taxes Payable ↑ ↓ Self-Correct Chapter 8: Reporting and Interpreting PPE Interest Expense part of acquisition cost for constructed assets, not purchased Goodwill: Amount purchase price exceeds fair market value of net assets 𝐶𝑜𝑠𝑡 − 𝑅𝑒𝑠𝑖𝑑𝑢𝑎𝑙 𝑉𝑎𝑙𝑢𝑒 𝐿𝑖𝑓𝑒 𝑖𝑛 𝑌𝑒𝑎𝑟𝑠 𝐶𝑜𝑠𝑡 − 𝑅𝑒𝑠𝑖𝑑𝑢𝑎𝑙 𝑉𝑎𝑙𝑢𝑒 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 = 𝐿𝑖𝑓𝑒 𝑖𝑛 𝑈. 𝑜. 𝑃 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 = 𝑅𝑎𝑡𝑒 x 𝑈𝑛𝑖𝑡𝑠 𝑃𝑟𝑜𝑑𝑢𝑐𝑒𝑑 𝑛 Declining𝐴𝑛𝑛𝑢𝑎𝑙 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 = 𝑁𝐵𝑉 × ( ) 𝑈𝑠𝑒𝑓𝑢𝑙 𝑙𝑖𝑓𝑒 𝑖𝑛 𝑌𝑒𝑎𝑟𝑠 Balance Measuring Asset Impairment 1) Asset impaired if: Book Value > Future Cash Flows (Future Benefits) 2) Then, 𝑖𝑚𝑝𝑎𝑖𝑟𝑚𝑒𝑛𝑡 𝑙𝑜𝑠𝑠 = 𝑁𝐵𝑉 − 𝐹𝑎𝑖𝑟 𝑉𝑎𝑙𝑢𝑒 (𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒) Disposal of PPE Gain Cash (+A) (Loss) Accumulated Depreciation (-XA, +A) (Loss on Sale (+Loss, -SE) ) Gain on Sale (+Gain, +SE) Equipment (-A) Treatment Financial Statement Effect Statement Expense Income Taxes Capital Balance sheet Deferred Higher 𝐴𝑛𝑛𝑢𝑎𝑙 𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 = account Debited Income Statement Account Debited Currently Recognized Disclose in note Remote Disclosure not required Disclosure not required 1 × 𝐴𝑚𝑜𝑢𝑛𝑡 (1 + 𝑖)𝑛 1 − (1 + 𝑖)−𝑛 𝑃𝑟𝑒𝑠𝑒𝑛𝑡 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑎𝑛 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 = 𝐴𝑚𝑜𝑢𝑛𝑡 × ( ) 𝑖 31 Dec Interest Expense (+E, -SE) Interest Payable (+L) Notes Payable (+L) Cash (-A) Chapter 11: Reporting and Interpreting Owner’s Equity Chapter 7: Inventory & Cost of Goods Sold Expenditure Revenue Expenditure Reasonably Probable Disclose in note 𝑃𝑟𝑒𝑠𝑒𝑛𝑡 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑎 𝑆𝑖𝑛𝑔𝑙𝑒 𝐴𝑚𝑜𝑢𝑛𝑡 = Ending Balance per Book + Deposits by Bank (credit memo) − Service Charge = 𝑐ℎ𝑒𝑐𝑘𝑠 𝑤𝑟𝑖𝑡𝑡𝑒𝑛 − 𝑐ℎ𝑒𝑐𝑘𝑠 𝑐𝑙𝑒𝑎𝑟𝑒𝑑 − NSF Checks ±Bank Errors = Correct Balance StraightLine Units-ofProduction Probable Record as liability Disclose in note Lower Small Stock Dividend Large Stock Dividend Stock Dividend < 20-25% Stock Dividend > 20-25% Record at current market value Record at par value of stock Retained Earnings (-SE) Retained Earnings (-SE) Common Stock (+SE) Common Stock (+SE) Additional Paid-in Capital (+SE) 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒𝑠 𝑏𝑦 𝑥% Total SE Common Stock Paid-in Capital Retained Earnings No. of Shares Outstanding Par Value per Share Purchase of Treasury Stock Treasury Stock (+XSE, -SE) Cash (+A) Issuance of Common Stock Small Stock Dividend NE ↑ ↑ ↓ ↑ NE Large Stock Dividend NE ↑ NE ↓ ↑ NE Stock Splits NE NE NE NE ↑ ↓ Reissuance of Treasury Stock Cash (+A) (Capital in excess of par value (-SE) ) Treasury Stock (-XSE, +SE) Capital in excess of par value (+SE) Cash (+A) Common Stock (+SE) Capital in Excess of Par Value (+SE) Chapter 13: Statement of Cash Flows Operating Investing Financing Inflows -Customers -Dividends and interest on investments -Sale or disposal of PPE -Sale or maturity of investments in securities -Borrowings on notes, mortgages, bonds, etc. from creditors -Issuance of stock Outflows -Inventory -Salaries and Wages -Income taxes -Interest on liabilities -Purchase of PPE -Purchase of investments in securities -Repayment of principle to creditors (excl. interest, which is Operating) -Purchase of Treasury Stock -Dividends payment