Notes Chapter 1

advertisement

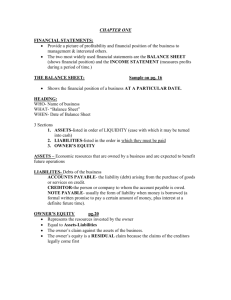

Introduction to Financial Management Notes Pages contain additional information 0 Why Share-Owner Value? Why Share-Owner Value? At The Coca-Cola Company, our publicly stated mission is to create value over time for the owners of our business. In fact, in our society, that is the mission of any business: to create value for its owners. Why? The answer can be summed up in three reasons. First, increasing share-owner value over time is the job our economic system demands of us. We live in a democratic capitalist society, and here, people create specific institutions to help meet specific needs. Governments are created to help meet civic needs. Philanthropies are created to help meet social needs. And companies are created to help meet economic needs. Business distributes the lifeblood that flows through our economic system not only in the form of goods and services, but also in the form of taxes, salaries and philanthropy. Creating value is a core principle on which our economic system is based; it is the job we owe to those who have entrusted us with their assets. We work for our share owners. That is – literally – what they have put us in business to do. Saying that we work for our share owners may sound simplistic - but we frequently see companies that have forgotten the reason they exist. They may even try in vain to be all things to all people and serve many masters in many different ways. In any event, they miss their primary calling, which is to stick to the business of creating value for their owners. The late Roberto Goizueta, former chairman and CEO of the Coca-Cola Company 1 Ukraine 2 Financial Climate: 1-14-16 1-3 Burger King Tax Inversion?? 1-4 Macro Economy & Structural Issues 5 Austerity in Spain 25% unemployment Rate 50% for those 25 and under Catalonia wants independence Police clash with protestors during a demonstration in front Parliament against austerity measures announced by the Spanish government in Madrid, Spain, on Sept. 29, 2012. (Andres Kudacki/Associated Press) Thousands of demonstrators protested spending cuts and tax increases in Madrid on Saturday, the same day that the government presented its 2013 budget plan to 4-6 Market vs. Book Value S&P 500 (15% in three days) S & P 500 20 Year Trend 1-8 S&P 500 Return 1-9 Unemployment & Labor Force Participation Rate Implications for Economy? 10 Hershey & the Cost of Sugar • http://finance.yahoo.com/news/u-readiesduties-mexican-sugar-213838314.html 11 Company Specific Issues (Change or Stay the Same?) 12 Netflix Today (2000% Percent) 13 Financial Quiz Check • See how many of these terms you know. – Equity – Bond – Stock – Dividend – Cash Flow & Cash Flow Statement – Liquidity – Assets – Accounting Identity – Return on Equity (ROE) – Return on Assets (ROA) – Gross Income vs. Net Income – Book Value – Market Value • And these… – – – – – – – – – – Financial Risk Operational Risk Inventory Turnover Asset Turnover EBITDA Gross Margin Net Margin Market Risk Premium Risk Free Rate Working Capital 14 Introductory Concepts • • • • • • Finance: A Quick Look Business Finance and The Financial Manager Forms of Business Organization The Goals of Financial Management The Agency Problem and Control of the Corporation Financial Markets and the Corporation 15 Basic Areas Of Finance • Corporate finance – Financial Manager (General to Specific) – Large firms: Treasury vs. Controller • • • • • Investments Financial institutions (banking, insurance) International finance Others: Real Estate, Planning, M&A, General Business: Every company…. • Careers in Finance 16 Investments • Work with financial assets such as stocks and bonds • Value of financial assets, risk versus return and asset allocation • Job opportunities – – – – – – – – – – – Equity Analyst Debt Analyst Corporate Financial Advisor Portfolio Manager Security & Market Analyst Financial Planner (retail, sales) Real Estate REITs Commodity Broker Merger and Acquisition Specialist Insurance Industry Investments – Working as an Entrepreneur needing to make investment decisions. 17 Financial Institutions • Companies that specialize in financial matters – Banks – commercial and investment, credit unions, savings and loans – Insurance companies – Brokerage firms – Crowd Funding Firms? • Job opportunities Former Federal Reserve chairman tells Senate Banking Committee commercial banks should be barred from some high-risk trades Semi reinstatement of Steagall Act – Should see pickup in 3-4th qtr. 2014 (BB&T…) 18 International Finance • This is an area of specialization within each of the areas discussed so far • It may allow you to work in other countries or at least travel on a regular basis • Need to be familiar with exchange rates and geo-political risk • Need to understand the customs of other countries and speaking a foreign language fluently is also helpful • Good companies for International exposure – Any multinational – Accenture and or other global consulting companies • Recent graduates 19 Why Study Finance? • Marketing – Budgets, marketing research, product development, marketing financial products • Accounting – Dual accounting and finance function, preparation of financial statements • Management – Strategic thinking, job performance, profitability – Entrepreneurship • Personal finance – Budgeting, retirement planning, college planning, day-to-day cash flow issues – Mortgages, Loans, household expenditures 20 Business Finance (AKA…. Corporate/Managerial Finance) • Some important questions that are answered using finance – What long-term investments should the firm take on? – Where will we get the long-term financing to pay for the investment? • Bank, Bond market, Public offering, Angel Investor, etc. – How will we manage the everyday financial activities of the firm? • Short term inventory needs and fluctuations • Day-to-day cash flow needs (Cash budget, payroll, season changes, etc.) 21 Financial Manager • Financial managers try to answer some or all of these questions • The top financial manager within a firm is usually the Chief Financial Officer (CFO) – Treasurer – oversees cash management, credit management, capital expenditures, and financial planning – Controller – oversees taxes, cost accounting, financial accounting, and data processing 22 Three Main Objectives of Business Finance • Capital budgeting – What long-term investments or projects should the business take on? – Size, timing and risk of cash flows • Capital structure – How should we pay for our assets? – Should we use debt or equity? • Working capital management – How do we manage the day-to-day finances of the firm? – Day-to-day liquidity, cash & inventory decisions, short-term credit, etc. – Should we sell on credit, extend credit, lengthen payables, etc. 23 Forms of Business Organization • Three major forms in the United States – Sole proprietorship – Partnership • General – Everyone shares the same unlimited liability risks • Limited – Limited partner is liable only for his or her financial stake – Corporation • S-Corp – No corporate tax, tax obligations pass to shareholders – Must not have more than 100 shareholders • C- Corp (Most Common….) – LLC • Like a partnership but with limited Liability – Liability limited to Assets of the company, not personal assets – Taxes pass through to shareholders. – Smaller firms: Law firms, Real Estate Firms, CPA Firms, etc. 24 How Many “New” Businesses.. 25 Sole Proprietorship • Advantages – Easiest to start – Least regulated – Single owner keeps all the profits – Taxed once as personal income • Disadvantages – Limited to life of owner – Equity capital limited to owner’s personal wealth – Unlimited liability – Difficult to sell ownership interest Seen Notes Page for Examples of issues with Sole Proprietorships 26 Partnership • Advantages – Two or more owners – More capital available – Relatively easy to start – Income taxed once as personal income • Disadvantages – Unlimited liability • General partnership (unlimited liability fro all partners) • Limited partnership (only liable for partner’s share) – Partnership dissolves when one partner dies or wishes to sell – Difficult to transfer ownership 27 Corporation • Advantages – Limited liability – Unlimited life – Separation of ownership and management – Transfer of ownership is easy (Public Stock) – Easier to raise capital • Disadvantages – Separation of ownership and management (agency problem) – Double taxation (income taxed at the corporate rate and then dividends taxed at personal rate) Limited Liability Corp. (LLC) allows for the transfer of tax (like a partnership) from the business directly to owner (pass-through), but limits the amount of liability (like a corporation) to the owner. http://www.selfemployedweb.com/s-corp-vs-llc.htm 28 Goal of Financial Management What should be the goal of a corporation? Maximize profit? Trade offs between short term vs. long term profits Some strategic investments may have long time horizons before profits are realized (market share obtainment, competitive pressures) Minimize costs? Capitalization projects can be cost reduction projects Maximize market share? (Pfizer (Lip buys Wyeth for $68 Billion) Maximize the current value of the company’s stock? Does this mean we should do anything and everything to maximize owner wealth? Running low inventories, booking orders in advance, etc. may increase short term profits, but severely jeopardize long tem financial stability Incorporating in Bermuda? Sarbanes-Oxley Act To enhance and guard against financial malpractice and fraudulent reporting (Tyco, Enron, WorldCom) Recently BA and John Thain Can be costly and some companies have de-listed and or filed on overseas exchanges. 29 Maximizing Shareholder Value… Doesn’t mean compromising Integrity Four Oaks Bank agrees to $1M fine to settle DOJ suit Posted January 9 30 The Agency Problem • Agency relationship – Principal hires an agent to represent their interest – Stockholders (principals) hire managers (agents) to run the company • Agency problem – Conflict of interest between principal and agent – E.g., think of a real estate broker and customer • Management goals and agency costs – Conflicts between stockholder wealth maximization and management objectives 31 Managing Managers • Managerial compensation – Incentives can be used to align management and stockholder interests • Stock Option Grants – The incentives need to be structured carefully to make sure that they achieve their goal • Risk, term, compensation, etc. • Corporate control – The threat of a takeover may result in better management • Proxy Fight • Non-hostile or hostile takeover, Private Equity • Other stakeholders (also have claim to cash flow) – Suppliers, customers, employees, bond holders…….. (the firm’s value chain) think Apple…. 32 iPhone Apple Value Chain iPad 33 Financial Markets • Cash flows to the firm • Primary Markets – IPO and Private Placements • Secondary markets – Dealer vs. auction markets – Listed vs. over-the-counter securities • NYSE • NASDAQ 34 Figure 1.2 35 What do you think it’s worth? Sunday NFL on YouTube NFL ESPN $ Time Warner $ $ Consumer $ NFL Google $ $ Consumer Internet $ 36 Work the Web Example • The Internet provides a wealth of information about individual companies • One excellent site is finance.yahoo.com • Click on the web surfer to go to the site, choose a company and see what information you can find! 37