CHAPTER ONE NOTES

advertisement

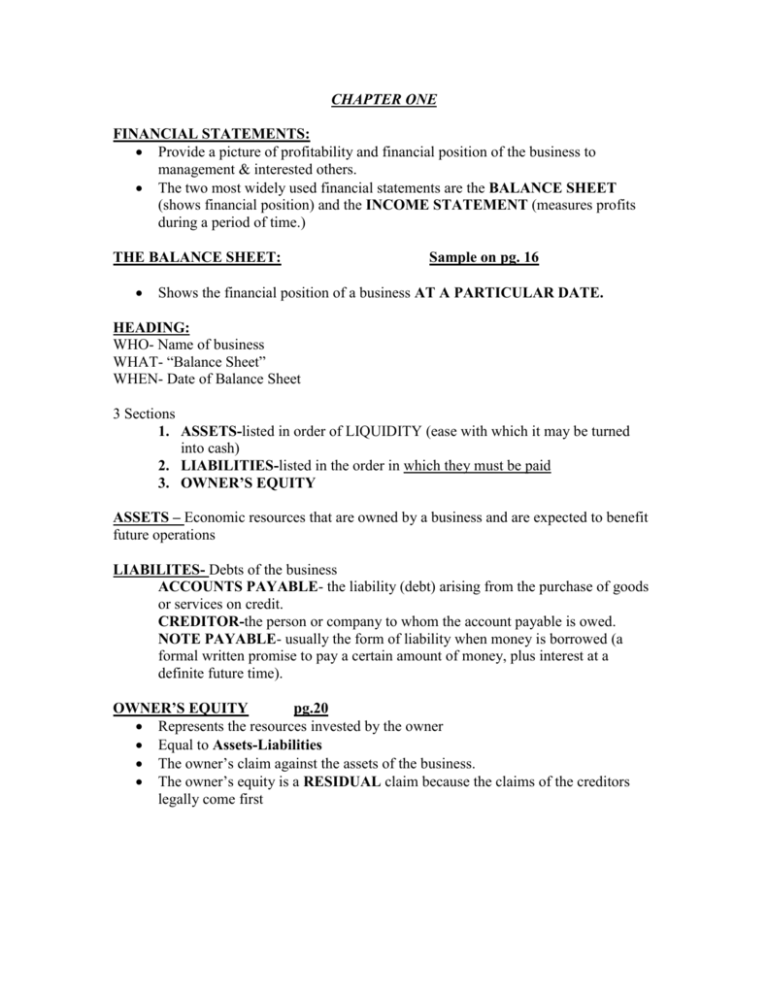

CHAPTER ONE FINANCIAL STATEMENTS: Provide a picture of profitability and financial position of the business to management & interested others. The two most widely used financial statements are the BALANCE SHEET (shows financial position) and the INCOME STATEMENT (measures profits during a period of time.) THE BALANCE SHEET: Sample on pg. 16 Shows the financial position of a business AT A PARTICULAR DATE. HEADING: WHO- Name of business WHAT- “Balance Sheet” WHEN- Date of Balance Sheet 3 Sections 1. ASSETS-listed in order of LIQUIDITY (ease with which it may be turned into cash) 2. LIABILITIES-listed in the order in which they must be paid 3. OWNER’S EQUITY ASSETS – Economic resources that are owned by a business and are expected to benefit future operations LIABILITES- Debts of the business ACCOUNTS PAYABLE- the liability (debt) arising from the purchase of goods or services on credit. CREDITOR-the person or company to whom the account payable is owed. NOTE PAYABLE- usually the form of liability when money is borrowed (a formal written promise to pay a certain amount of money, plus interest at a definite future time). OWNER’S EQUITY pg.20 Represents the resources invested by the owner Equal to Assets-Liabilities The owner’s claim against the assets of the business. The owner’s equity is a RESIDUAL claim because the claims of the creditors legally come first INCREASES IN OWNER’S EQUITY: 1. investment by the owner 2. earnings/profits of the business DECREASES IN OWNER’S EQUITY: 1. withdrawals of cash or other assets by owner 2. losses from unprofitable operation of the business THE ACCOUNTING EQUATION ASS ETS=LIABILITIES + OWNER’S EQUITY A = L + OE THE FUNDAMENTAL ACCOUNTING EQUATION This is why the statement of financial position is called a BALANCE SHEET. (2 sided balance) A= L + OE, because: ASSETS → WHAT RESOURCES THE BUSINESS OWNS. LIABILITES + OE → WHO SUPPLIED THESE RESOURCES. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP’S) 1. THE CONCEPT OF BUSINESS ENTITY This principle states that business entity is an economic unit, which enters into the business transactions that must be recoded, summarized & reported The entity is regarded as separate from the owner(s) 2. COST PRINCIPLE This is the policy of accounting for assets at their acquisition cost not their market value. 3. THE GOING CONCERN ASSUMPTION States that a business will continue to operate until it is known that such is not the case A balance sheet for a business is prepared on this assumption, assets were acquired for USE, not resale, and therefore, they are listed at cost. 4. OBJECTIVITY PRINCIPLE States that accounting will be recorded on the basis of objective evidence, i.e. source documents not personal opinions. Another reason balance sheets are prepared using costs rather than market values for assets. FORMS OF BUSINESS ORGANIZATION 1. SINGLE OR SOLE PROPRIETORSHIP Owned by one person Owner personally liable for debts of business Most common business form Common for small retail stores, service businesses, professional practices in law, medicine, etc… Unlimited liability 2. PARTNERSHIPS Like sole proprietorship, except owned by two or more people 3. CORPORATIONS A legal entity, separate & distinct from tits owner’s Owners are not liable for the corp.’s debts (limited liability) Name of company ends in CORP.INC/LTD. Owners are called ‘shareholders’ BALANCE SHEETS FOR THE THREE TYPES OF ORGANIZATION Assets & Liabilities are presented in the same manner. Owner’s equity section differs (see page 28-29 for examples) FOR A CORPORATION: Shareholders’ equity: CAPTIAL STOCK=amount of owners’ original investment RETAINED EARNINGS=amount of profits or losses (less any dividends paid out) accumulated since the formation of the business. i.e. Earning not paid out in dividends OUTSIDERS WHO USE FINANCIAL STATEMENTS BANKERS & OTHER CREDITORS OWNERS GOVERNMENT EMPLOYEES INVESTORS Why? For decision making purposes. See pages 29-31