Chapter 4: Time Value of Money

advertisement

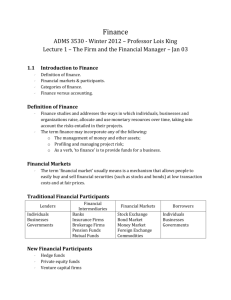

Chapter 1: What is Objective Finance? To Define Finance The Value of Finance Introduction to the Players Copyright © Prentice Hall Inc. 2000. Author: Nick Bagley, bdellaSoft, Inc. 1 Chapter 1 Contents 1. 2. 3. 4. 5. Defining Finance Why Study Finance Household Finance Financial Decisions of Firms Forms of Business Organization 6. 7. 8. 9. Separation of Ownership and Management The Goal of Management Market Discipline: Takeovers Role of the Finance Specialists in a Corporation 2 Finance: Definition 1) 2) Finance is the study of how people allocate scarce resources over time. Two features: The costs and benefits of financial decisions are Spread out over time Usually not known with certainty in advance by either the decision makers or anybody else. 3 Financial System: Definition The set of markets and other institutions used for financial contracting and the exchange of assets and risks. Including: The markets for stocks, bonds, and other financial instruments, financial intermediaries, financial services firms, and the regulatory bodies that govern all of these institutions. 4 Finance Theory Consists of a set of concepts that help you to organize your thinking about how to allocate resources over time and a set of quantitative models to help you evaluate alternatives, make decisions, and implement them. 5 The ultimate function of the system Satisfying people’s consumption preferences, including all the basic necessities of life. 6 Why study Finance To manage your personal resources. To deal with the world of business. To pursue interesting and rewarding career opportunities. To make informed public choices as a citizen. To expand your mind. 7 Financial Decisions of Households Consumption and saving decisions Investment decisions Financing decisions Risk-management decisions 8 Some Terms Asset: Anything that has economic value Asset allocation: Choosing how to hold a pool of accumulated savings Liability = debt Net worth: Assets - Liabilities 9 Financial Decisions of Firms Capital budgeting: Consists of identifying ideas for new investment projects, evaluating them, deciding which ones to undertake, and then implementing them. Capital structure: How to Finance the firm as a whole. Working capital management: Managing the firm’s cash flow. 10 Forms of Business Organization 1. Sole proprietorship: A firm owned by an individual or a family, assets and liabilities of the firm are the personal assets and liabilities of the proprietorship. A sole proprietor has unlimited liability. 11 Forms of Business Organization 2. Partnership: A firm with two or more owners, called the partners, who share the equity in the business. Partners have all unlimited liability, or at least one of them, called the general partner, has unlimited liability and the others limited liability. 12 Forms of Business Organization 3. Corporation: A firm that is a legal entity distinct from its owners. Shareholders are entitled to a share of any distributions from the corporation in proportion to the number of shares they own. Shareholders have limited liability. 13 Separation of Ownership and Management: Reasons 1. 2. Professional managers may be found who have a superior ability to run the business. The need to pool resources to achieve an efficient scale of production calls for a structure with many owners, not all of whom can be actively involved in managing the business. 14 Separation of Ownership and Management: Reasons 3. 4. In an uncertain economic environment, owners will want to diversify their risks across many firms. An efficient diversification is difficult to achieve without separation of ownership and management. The separated structure allows for savings in the costs of information gathering. 15 Separation of Ownership and Management: Reasons 5. There is the “learning curve” or “going concern” effect, which favors the separated structure. 16 Separation of Ownership and Management: Drawback The separated structure creates the potential for a conflict of interest between the owners and the managers. 17 The Goal of Management Maximizing the wealth of current shareholders Leads to the same investment decisions that each individual owner would have made It does not depend upon the risk aversion or wealth of the owners The Right Rule 18 The Goal of Management Profit Maximization Criterion If the production process requires many periods, then which period’s is to be maximized? If either future revenues or expenses are uncertain, and profits are described by a probability distribution? 19 Difficult Task for Managers Estimating the impact of their decisions on the value of the firm’s share Existence of a stock market make precious information about the shares’ values accessible 20 The Market Discipline: Takeovers What forces are there to compel managers to act in the best interests of the shareholders? An important mechanism for aligning the incentives of managers with those of shareholders, is takeover. Managers know that if they fall to maximize the market value of the firm’s shares, the firm will be vulnerable to a takeover in which managers might loose their jobs. 21 The Market Discipline: Takeovers The takeovers identify significantly mismanaged firms and buy enough shares to gain the control, then they replace the managers with ones who will operate the firms optimally. Having announced the change in the firm’s investment plans, they sell the shares of the firms at the new market price for an immediate profit. 22