McElroy_Assignment_wk1

advertisement

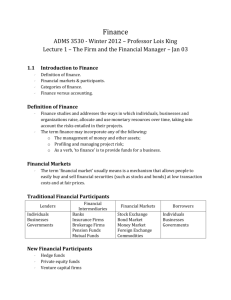

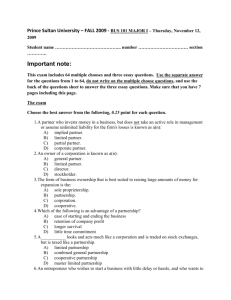

Mini Case Assume that you recently graduated and have just reported to work as an investment advisor at the brokerage firm of Balik and Kiefer Inc. One of the firm's clients is Michelle DellaTorre, a professional tennis player who has just come to the United States who has just come to the United States from Chile. DellaTorre is a highly ranked tennis player who would like to start a company to produce and market apparel she designs. She also expects to invest substantial amounts of money through Balik and Kiefer. DellaTorre is very bright, and she would like to understand in general terms what will happen to her money. Your boss has developed the following set of questions you must answer to explain the U.S. financial system to DellaTorre. a. Why is corporate finance important to all managers? Answer: Corporate finance provides the skills managers need to: Identify and select the corporate strategies and individual projects that add value to their firm. Forecast the funding requirements of their company, and devise strategies for acquiring those funds. Corporate finance deals with the strategic financial issues associated with achieving goals such as how the corporation should raise and manage its capital, what investments the firm should make, what portion of profits should be returned to shareholders in the form of dividends, and whether it makes sense to merge with or acquire another firm. b. Describe the organizational forms a company might have as it evolves from a start-up to a major corporation. List the advantages and disadvantages of each form. Answer: Sole proprietorship Partnership Corporation Starting as a Proprietorship Advantages: Ease of formation Subject to few regulations No corporate income taxes Disadvantages: Limited life Unlimited liability Difficult to raise capital to support growth Starting as or Growing into a Partnership A partnership has roughly the same advantages and disadvantages as a sole proprietorship. Becoming a Corporation A corporation is a legal entity separate from its owners and managers. File papers of incorporation with state. Charter Bylaws Advantages and Disadvantages of a Corporation Advantages: Unlimited life Easy transfer of ownership Limited liability Ease of raising capital Disadvantages: Double taxation Cost of set-up and report filing (1) A proprietorship, or sole proprietorship, is a business owned by one individual. A partnership exists when two or more persons associate to conduct a business. In contrast, a corporation is a legal entity created by a state. The corporation is separate and distinct from its owners and managers. (2) In a limited partnership, limited partners' liabilities, investment returns and control are limited, while general partners have unlimited liability and control. A limited liability partnership (LLP), sometimes called a limited liability company (LLC), combines the limited liability advantage of a corporation with tax advantagges of a partnership. A professional corporation (PC), known in some states as a professional association (PA), has most of the benefits of incorporation but the participants are not relieved of professional (malpractice) liability. c. How do corporations go public and continue to grow? What are agency problems? What is corporate governance? Answer: Becoming a Public Corporation and Growing Afterwards Initial Public Offering (IPO) of Stock Raises cash Allows founders and pre-IPO investors to “harvest” some of their wealth Subsequent issues of debt and equity Agency problem: managers may act in their own interests and not on behalf of owners (stockholders) Corporate governance is the set of rules that control a company’s behavior towards its directors, managers, employees, shareholders, creditors, customers, competitors, and community. Corporate governance can help control agency problems. Additional answers: There are a number of ways to go public with your business: IPO (Initial Public Offering) - This is the most commonly utilized method of going public with a business. It involves registering your stock with the Securities and Exchange Commission to sell shares to the public. Small Corporate Offering Registration - This is a less costly and simpler alternative to filing a traditional IPO, making it a more viable option for many small businesses. ACE-Net (Angel Capital Electronic Network) - Through the SBA, this network allows small businesses to list their stock offerings. Contact the SBA for details. Agency Problem means a conflict of interest arising between creditors, shareholders and management because of differing goals. For example, an agency problem exists when management and stockholders have conflicting ideas on how the company should be run. Corporate Governance is managing of a company. Company management techniques and processes in general, or the way a particular company is managed. d. What should be the primary objective of managers? Answer: The primary objective should be shareholder wealth maximization, which translates to maximizing the fundamental stock price. (1) Do firms have any responsibilities to society at large? Yes! Shareholders are also members of society. (2) Is stock price maximization good or bad for society? Employment growth is higher in firms that try to maximize stock price. On average, employment goes up in: firms that make managers into owners (such as LBO firms) Consumer welfare is higher in capitalist free market economies than in communist or socialist economies. Fortune lists the most admired firms. In addition to high stock returns, these firms have: high quality from customers’ view employees who like working there (3) Should firms behave ethically? Yes! e. What three aspects of cash flows affect the value of any investment? Amount of expected cash flows (bigger is better) Timing of the cash flow stream (sooner is better) Risk of the cash flows (less risk is better) f. What are free cash flows? Free cash flows are the cash flows that are available (or free) for distribution to all investors (stockholders and creditors). FCF = sales revenues - operating costs - operating taxes - required investments in operating capital. g. What is the weighted average cost of capital? WACC is the average rate of return required by all of the company’s investors. WACC is affected by: Capital structure (the firm’s relative use of debt and equity as sources of financing) Interest rates Risk of the firm Investors’ overall attitude toward risk h. How do free cash flows and the weighted average cost of capital interact to determine a firm's value? Answer: Intrinsic value is the sum of all the future expected free cash flows when converted into today’s dollars: i. Who are the providers (savers) and users (borrowers) of capital? What is the price of equity capital? What are the four most fundamental factors that affect the cost of money, or the general level of interest rates, in the economy? Households: Net savers Non-financial corporations: Net users (borrowers) Governments: U.S. governments are net borrowers, some foreign governments are net savers Financial corporations: Slightly net borrowers, but almost breakeven j. What do we call the price that a borrower must pay for debt capital? What is the price of equity capital? What are the four most fundamental factors that affect the cost of money, or the general level of interest rates, in the economy? What do we call the price, or cost, of debt capital? The interest rate What do we call the price, or cost, of equity capital? Cost of equity = Required return = dividend yield + capital gain Four factors affect the cost of money: Production opportunities Time preferences for consumption Risk Expected inflation k. What are some economic conditions (including international aspects) that affect the cost of money? Economic conditions affect the cost of money: Federal Reserve policies Budget deficits/surpluses Level of business activity (recession or boom) International trade deficits/surpluses International conditions affect the cost of money: Country risk. Depends on the country’s economic, political, and social environment. Exchange rate risk. Non-dollar denominated investment’s value depends on what happens to exchange rate. Exchange rates affected by: International trade deficits/surpluses Relative inflation and interest rates Country risk l. What are financial securities? Describe some financial instruments. Debt Equity Money Market • • • • T-Bills CD’s Eurodollars Fed Funds Capital Market • • • • T-Bonds Agency bonds Municipals Corporate bonds • • Derivatives Common stock Preferred stock • • • Options Futures Forward contract • • LEAPS Swaps m. List some financial institutions. Commercial banks Investment banks Savings & Loans, mutual savings banks, and credit unions Life insurance companies Mutual funds Exchanged Traded Funds (ETFs) Pension funds Hedge funds and private equity funds n. What are some different types of markets? A market is a method of exchanging one asset (usually cash) for another asset. Physical assets vs. financial assets Spot versus future markets Money versus capital markets Primary versus secondary markets o. How are secondary markets organized? By “location” Physical location exchanges Computer/telephone networks By the way that orders from buyers and sellers are matched Open outcry auction Dealers (i.e., market makers) Electronic communications networks (ECNs) (1) List some physical location markets and some computer/telephone networks. Physical location exchanges: e.g., NYSE, AMEX, CBOT, Tokyo Stock Exchange Computer/telephone: e.g., Nasdaq, government bond markets, foreign exchange markets p. Briefly explain mortgage securitization and how it contributed to the global economic crisis. When mortgages reset and borrowers defaulted, the values of CDOs plummeted. Many of the credit default swaps failed to provide insurance because the counterparty failed. Many originators and securitizers still owned sub-prime securities, which led to many bankruptcies, government takeovers, and fire sales, including: New Century, Countrywide, IndyMac, Northern Rock, Fannie Mae, Freddie Mac, Bear Stearns, Lehman Brothers, and Merrill Lynch. More to come. References: Powerpoint slides at www.devryu.net http://www.quickmba.com/finance/cf/ http://www.docstoc.com/docs/16122369/ch1 http://www.blogger.com/postedit.g?blogID=1523645641670045184&postID=750196866811601769 http://www.investopedia.com/terms/a/agencyproblem.asp#axzz1X2A9DTv7 http://www.bing.com/Dictionary/search?q=define+corporate+governance&qpvt=what+is+corpor ate+governance%3f&FORM=DTPDIA http://www.articlesbase.com/answers/what-should-be-the-primary-objective-of-managers-86760