File

advertisement

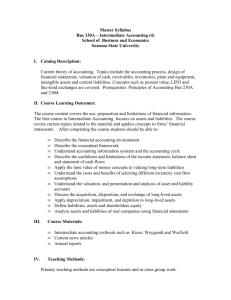

FINANCIAL STRATEGIES AND ACCOUNTS “Short-term can be terminal.” Mark McCormack “Sometimes you have to pay a high price for an opportunity.” Rupert Murdoch BUSS 3.4 Interpreting Published Accounts INTERPRETING PUBLISHED ACCOUNTS INTERPRETING PUBLISHED ACCOUNTS IN THIS TOPIC YOU WILL LEARN ABOUT: Conducting ratio analysis: the selection, calculation and interpretation of ratios to measure financial performance Assessing the value and limitations of ratio analysis in measuring a business’ performance BUSS 3.4 Interpreting Published Accounts RATIO ANALYSIS Allows for a more meaningful analysis of published accounts Shows relationship between figures Inter and intra firm comparisons Ratios are used to measure the following financial indicators: Liquidity Profitability Financial Efficiency Gearing Shareholders BUSS 3.4 Interpreting Published Accounts You will need access to the internet to watch this clip RATIO ANALYSIS - LIQUIDITY Liquidity Why is liquidity crucial for survival? A measure of a firms short term survival i.e. its ability to meet short term debts Liquidity Current ratio Current assets : current liabilities Acid test Liquid assets : current liabilities Liquid assets = Receivables + cash Inventory is not included in current assets as it is deemed the hardest to turn into cash quickly The acid test ratio is a tougher measure of liquidity Liquidity ratios Current Ratio Current Assets : Current Liabilities 5845 : 8160 = 0.716 : 1 For every £1 of CL the firm owes it owns £0.716 in CA Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Acid Test Liquid Assets : Current Liabilities 1170 + 2300 : 8160 = 3470 : 8160 = 0.425 : 1 For every £1 of CL the firm owes it owns £0.425 in CA Do you think this business has enough short term assets to meet its short term debts? Why is the acid test a more demanding measure? Liquid assets has been calculated as: Receivables + Cash & cash equiv. Explain an alternative way of calculating liquid assets. RATIO ANALYSIS - PROFITABILITY Profitability ROCE A measure of how efficiently a business is using capital employed to generate profits Capital employed = total equity + non-current liabilities i.e. all the money invested in the business from Share capital Reserves Long term loans Operating profit x 100 total equity + non-current liabilities Recap AS: Profitability can also be measured by Gross and Net Profit Margins Profitability ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 ROCE Operating profit x 100 total equity + non-current liabilities 4580 11235 + 6000 4580 17235 x 100 x 100 = 27% Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 For every £1 of capital employed in the business how much is being generated in profit? Why would it be meaningful to compare this to the current rate of interest? Why might a high street retailer compare ROCE between individual stores? RATIOS ANALYSIS – FINANCIAL EFFICIENCY Financial efficiency Asset turnover Revenue net assets Measures how efficiently the assets of the business are being utilised to generate revenue Helps identify whether the business is operating efficiently A capital intensive industry may have a lower asset turnover than a labour intensive one Financial Efficiency ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Asset Turnover Revenue Net assets 35400 11235 = 3.15 times For every £1 of net assets in the business how much is being generated in revenue? What is meant by the term sweating your assets? Why might asset turnover help a business assess operational efficiency between factories? RATIOS ANALYSIS – FINANCIAL EFFICIENCY Financial efficiency Inventory (stock) turnover Cost of sales average inventory held Average inventory held can be calculated by finding the average of inventory at the start and end of the year You therefore also need the previous year’s balance sheet Alternatively you can just divide cost of sales by inventory Measures how frequently a business turns over its inventory in a year Will vary depending upon the nature of the firm Hot dog stand (hopefully daily!) Fashion Retailer (at least each season) New car showroom (maybe twice a year) Financial Efficiency ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Inventory Turnover Cost of sales Inventory On average for how long does this business hold stock? 30100 2375 = 12.67 times What type of business might have this level of inventory turnover? Justify your answer Why might it be more accurate to divide by average inventory held rather than just inventory? RATIOS ANALYSIS – FINANCIAL EFFICIENCY Financial efficiency Payables (creditors) days Payables x 365 cost of goods sold A measure of how long it takes on average for the business to pay for supplies it has purchased on credit A business may try to have a longer payables day to ease cash flow problems A short payables day may result in discounts from suppliers In December 2008 300 non-food suppliers were told by Tesco that they would be increasing payment terms, which would mean they would only pay their suppliers within 60 days, instead of 30. To what extent do you think this is a strategy to improve Tesco’s cash flow situation? Analyse the possible reasons why Tesco can take such action. Financial Efficiency ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 Payables (Creditors) days Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Payables x 365 cost of goods sold Payables is not shown as a separate figure on this balance sheet. I am therefore going to assume it is 50% of current liabilities. In an examination a figure would be given 4080 x 365 30100 = 49 days Assume payables is the only current liability, how would this alter the payables days? Why might a business be willing to have a payables days of 60 – 90 days? RATIOS ANALYSIS – FINANCIAL EFFICIENCY Financial efficiency Receivables (debtors) days Receivables x 365 revenue A measure of how long it takes on average for customers to pay the business for products or services it has purchased on credit The customer is a debtor of the business A business may try to have a shorter receivables day to ease cash flow problems Financial Efficiency ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Receivables (Debtors) days Receivables x 365 Revenue 1170 x 365 35400 = 12 days Payables are compared to cost of sales and receivables to revenue. Use Business Studies terminology to explain the relationship between these variables. What might be the expected receivables days of a) A high street coffee chain b) A commercial print company Justify your answers. RATIO ANALYSIS - GEARING Gearing Gearing (%) Non-current liabilities x 100 total equity plus non-current liabilities Measures what proportion of a business’ capital is funded through long term loans Loans are “compulsory interest bearing” You have to pay interest on them even if profits are low or non-existent Explain how this is different to equity capital A high gearing is of greater risk if interest rates are likely to increase Interest rates are a cost to a business Explain where interest rates would appear on an income statement and which profit figure(s) would be affected. Gearing ratio Income Statement Revenue Cost of sales Gross profit Expenses Operating profit Finance income Finance cost Profit before tax Taxation Profit for the year £m 35400 (30100) 5300 (720) 4580 300 (260) 4620 (1109) 3511 Gearing Balance Sheet Non-current assets Inventories Receivables Cash & cash equivalents Total current assets Current liabilities Net current liabilities Non-current liabilities Net assets £m 19550 2375 1170 2300 5845 (8160) (2315) (6000) 11235 Share capital Reserves & retained earnings Total equity 6000 5235 11235 Non-Current Liabilities x 100 total equity + non-current liabilities 6000 (11235 + 6000) = 6000 x 100 17235 = 35% x 100 For every £1000 invested in this business how much of it is from long term loans? Why might a high gearing be more of a concern to a business with small profit margins? RATIO ANALYSIS - SHAREHOLDERS You will need access to the internet to watch this clip Shareholder Dividend per share (in pence) Total dividends number of issued ordinary shares The return paid to shareholders’ for their investment Money paid in dividends reduces retained profit Will be influenced by financial objectives If a dividend of £600m was paid out to a total of 750m shareholders the dividend per share would be: £600m / 750m = 0.80p For every 1 share owned the shareholder would receive 80p in dividends RATIO ANALYSIS - SHAREHOLDERS Shareholder Dividend yield o o o Ordinary share dividend (in pence) x 100 current market price (in pence) Measures the return on the investment as a percentage of current market price Market price fluctuates on a regular (constant basis) Allows for a more accurate comparison of the value of the shareholders’ investment compared to other investment opportunities If dividend per share is 80p and the current market share price £15 the dividend yield is: 0.80 / 15.00 x 100 = 5.3% Do you consider this to be a good return? How does this compare to savings accounts, ISAs, other share options? Value and Limitations of Ratio Analysis Value Provides a tool for the interpretation of accounts Structure from which comparisons can be made Aids decision making Internally Externally by investors Limitation Possibility that accounts have been window dressed Need to consider reasons behind ratios E.g. is ROCE lower than previous year because of an investment programme Quantitative information only Activity – Interpreting published accounts In pairs choose 2 businesses who operate in the same industry e.g. 2 supermarkets, 2 football clubs Go onto the internet and print off their Balance Sheet and Income Statement (Google company name/investors) The layout will vary from company to company but you should be able to identify the key information Prepare a presentation comparing the performance of the two businesses Present your findings to the rest of the class