How much must you put into the account each quarter?

advertisement

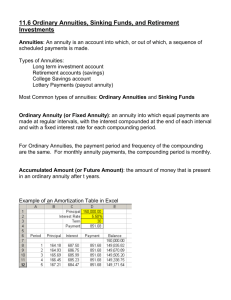

MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. The time between payments is the payment period and the time between the start of the first payment period and end of the last one is the annuity’s term. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. The time between payments is the payment period and the time between the start of the first payment period and end of the last one is the annuity’s term. The future value of the annuity is the total amount in the account with all accrued interest at the end of the term of the annuity. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value One way to save money (for a down payment on a house or car, etc.) is to periodically make deposits to an account over a period of time. An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. The time between payments is the payment period and the time between the start of the first payment period and end of the last one is the annuity’s term. The future value of the annuity is the total amount in the account with all accrued interest at the end of the term of the annuity. (Ordinary annuities are the only type of annuities that we will study.) MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. An ordinary annuity is also known as a SINKING FUND. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. An ordinary annuity is also known as a SINKING FUND. The formula for the future value (A) of an ordinary annuity is: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. An ordinary annuity is also known as a SINKING FUND. The formula for the future value (A) of an ordinary annuity is: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 There is only one variable in this formula that we haven’t seen yet. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. An ordinary annuity is also known as a SINKING FUND. The formula for the future value (A) of an ordinary annuity is: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 There is only one variable in this formula that we haven’t seen yet. R is the amount of the periodic payment into the annuity. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value An account created and maintained by a sequence of equal payments made at equal intervals is called an ANNUITY. If these equal payments are made AT THE END of each interest compounding period, the annuity is called an ORDINARY ANNUITY. An ordinary annuity is also known as a SINKING FUND. The formula for the future value (A) of an ordinary annuity is: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the amount of the periodic payment into the annuity. A represents the future value as it did in earlier formulas. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 𝐴 = accumulated or future value of the annuity 𝑅 = periodic payment into the account 𝑟 𝑖= 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 𝐴 = accumulated or future value of the annuity 𝑅 = periodic payment into the account 𝑟 𝑖= 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 𝐴 = accumulated or future value of the annuity 𝑅 = periodic payment into the account 𝑟 where 𝑖 is the interest rate per compounding period, 𝑖= 𝑚 𝑟 is the annual interest rate and 𝑚 is the number of compounding periods per year 𝑡 is the time (IN YEARS) MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Putting it all together, the formula for the future value of an ordinary annuity: 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 𝐴 = accumulated or future value of the annuity 𝑅 = periodic payment into the account 𝑟 where 𝑖 is the interest rate per compounding period, 𝑖= 𝑚 𝑟 is the annual interest rate and 𝑛 = 𝑚𝑡 𝑚 is the number of compounding periods per year 𝑡 is the time (IN YEARS) MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 𝑟 $50 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 𝑟 $50 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 𝑚 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account 𝑚 =12 paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 𝑚 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account 𝑚 =12 paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1 + 0.005 36 − 1 1.005 36 − 1 𝐴 = $50 = 0.005 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1 + 0.005 36 − 1 1.005 36 − 1 𝐴 = $50 = 0.005 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1.00536 − 1 𝐴 = $50 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1.00536 − 1 𝐴 = $50 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1.196680525 − 1 𝐴 = $50 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 1.196680525 − 1 𝐴 = $50 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 0.196680525 𝐴 = $50 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 0.196680525 𝐴 = $50 = $50 39.336105 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Let’s illustrate the use of this formula with an example. A payment of $50 is made at the end of each month into an account paying a 6% annual interest rate, compounded monthly. How much will be in that account after 3 years? 𝐴= 𝐴= 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $50 where 𝑖 = and 𝑛 = 𝑖 12 12(3) 𝑖 = 0.005 and 𝑛 = 36 0.196680525 𝐴 = $50 = $50 39.336105 = $1966.81 0.005 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? MATH 110 8-4 Lecture: Ordinary Annuities Future annuity’. Value Remember thatSec ‘sinking fund’ is just another term for –‘ordinary Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? MATH 110 8-4 Lecture: Ordinary Annuities Future annuity’. Value Remember thatSec ‘sinking fund’ is just another term for –‘ordinary Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the periodic payment A is the future value MATH 110 8-4 Lecture: Ordinary Annuities Future annuity’. Value Remember thatSec ‘sinking fund’ is just another term for –‘ordinary Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the periodic payment A is the future value MATH 110 8-4 Lecture: Ordinary Annuities Future annuity’. Value Remember thatSec ‘sinking fund’ is just another term for –‘ordinary Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 So, we are solving for the periodic payment, R. where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the periodic payment A is the future value MATH 110 8-4 Lecture: Ordinary Annuities Future annuity’. Value Remember thatSec ‘sinking fund’ is just another term for –‘ordinary Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the periodic payment A is the future value MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 1+𝑖 𝑛 −1 𝑖 where 𝑖 = 𝑟 𝑚 and 𝑛 = 𝑚𝑡 R is the periodic payment A is the future value MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑖 𝑚 R is the periodic payment A is the future value 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 1+𝑖 𝑛 −1 𝑟 𝑅 where 𝑖 = and 𝑛 = 𝑖 𝑚 R is the periodic payment A is the future value 𝑚𝑡 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments 𝑚 =4 into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 𝑖 𝑚 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments 𝑚 =4 into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4𝑡 𝑖 4 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4𝑡 𝑖 4 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 𝑖 = 0.015 and 𝑛 = 8 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 𝑖 = 0.015 and 𝑛 = 8 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 $1800= 𝑅 1+0.015 𝑛 −1 0.015 𝑖 = 0.015 and 𝑛 = 8 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 $1800= 𝑅 1+0.015 𝑛 −1 0.015 𝑖 = 0.015 and 𝑛 = 8 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $1800= 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 1+0.015 8 −1 𝑖 = 0.015 and 𝑛 = 8 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 0.06 $1800= 𝑅 where 𝑖 = and 𝑛 = 4(2) 𝑖 4 1+0.015 8 −1 𝑖 = 0.015 and 𝑛 = 8 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 $1800= 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 1+0.015 8 −1 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 $1800= 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 1.015 8 −1 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 $1800= 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 1.015 8 −1 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 1+𝑖 𝑛 −1 𝑟 R is the periodic payment 𝐴=𝑅 where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 $1800= 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 1.015 8 −1 $1800= 𝑅 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 1.126492587−1 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 1.126492587−1 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 1.126492587−1 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 $1800= 𝑅 8.432839133 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 $1800= 𝑅 8.432839133 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 $1800= 𝑅 8.432839133 $1800 𝑅= 8.432839133 MATH 110 Sec 8-4 Lecture: Ordinary Annuities – Future Value Suppose that you want to start a sinking fund that will be worth $1800 in 2 years and you will make quarterly payments into the account paying 6% interest compounded quarterly. How much must you put into the account each quarter? 𝐴=𝑅 $1800= 1+𝑖 𝑛 −1 𝑟 R is the periodic payment where 𝑖 = and 𝑛 = 𝑚𝑡 A is the future value 𝑖 𝑚 1+𝑖 𝑛 −1 𝑅 where 𝑖 = 0.015 and 𝑛 = 8 𝑖 $1800= 𝑅 0.126492587 0.015 $1800= 𝑅 8.432839133 $1800 𝑅= 8.432839133 𝑅 = $213.45