Internal Assessment - Kellogg School of Management

advertisement

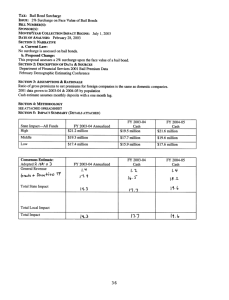

Management & Strategy 431 BUSINESS STRATEGY: GOALS & EXPECTIONS What I hope that you will be well-equipped to do after this course: 1. Evaluate business decisions made by firms, based on how the firms’ profitability will be affected by their decisions. 2. Propose valuable new strategic initiatives for firms, based on their prospects for profitability. 3. Lead more effectively, by understanding and communicating the underlying reasons why policies will be successful. Course Overview Part I: Strategy Assessment: Analytical Frameworks and Diagnostic Tools • Economics & Strategy: An Introduction – Performance Indicator • Industry Profitability – Boeing / Airbus • Competitive Advantage – Enterprise Rent-A-Car • Sustainability – Nucor Part II: Strategy Formulation: Economic Fundamentals for Successful Initiatives • Competition & Cooperation: Game Theory – Intel • Strategic Positioning for Competitive Advantage – Supermercados Disco • Firm Scope and Synergies – Disney • Vertical Integration – Soft Drink (Coke/Pepsi) Bottling Industry Strategy Introduction • “Big Picture” Orientation: • The Set of Objectives and Policies that Collectively Determine How a Firm Generates Wealth for its Owners Strategy Introduction • “Big Picture” Orientation: • The Set of Objectives and Policies that Collectively Determine How a Firm Generates Wealth for its Owners • Foundation of Economic Principles: – Overarching Objective: Maximize Profits* Strategy Introduction • “Big Picture” Orientation: • The Set of Objectives and Policies that Collectively Determine How a Firm Generates Wealth for its Owners • Foundation of Economic Principles: – Overarching Objective: Maximize Profits* – Unpacking Profits Revenues – Costs or (Avg. Price – Avg. Cost) × Quantity – Policies must be somehow tied to increasing average prices, decreasing average costs, or increasing quantity Supply — Firms’ Costs to Produce Goods and Services • Total Costs = Fixed Costs + Variable Costs • Average Costs = Total Costs Number of Units ; Marginal Costs = TC Q • Returns-to-Scale = Effect of Quantity on Average Costs Supply — Firms’ Costs to Produce Goods and Services • Total Costs = Fixed Costs + Variable Costs • Average Costs = Total Costs Number of Units ; Marginal Costs = TC Q • Returns-to-Scale = Effect of Quantity on Average Costs Implication for Strategy: Profit Evaluation is Complicated by Functional Relationship between Quantity and Costs: Profits = (Avg. Price – Avg. Cost) × Quantity Demand — Consumer Preferences for Goods and Services Q % Change in Quantity Q P % Change in Price P > 1: Demand is “Elastic” < 1: Demand is “Inelastic” Quantity Demanded Demand — Consumer Preferences for Goods and Services Q % Change in Quantity Q P % Change in Price P > 1: Demand is “Elastic” < 1: Demand is “Inelastic” Quantity Demanded Implication for Strategy: Profit Evaluation is Complicated by Functional Relationship between Quantity and Price: Profits = (Avg. Price – Avg. Cost) × Quantity (B - C) = “Value Created” Value Creation and Capture “B” Maximum Consumer is “Willing to Pay” for the Product “P” Price the Consumer Ultimately Pays for the Product “C” Production Cost Spent by the Firm on the Product (B - P) = “Consumer Surplus” (P - C) = “Producer Surplus” or “Value Captured” “Q” Number of Consumers who Purchase the Firm’s Product Some Basic Intuitions for Effective Strategy 1. “Operational Effectiveness” is necessary, but not sufficient: Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH Inside Productivity Frontier Possible to Improve Operational Effectiveness by Adopting Better Practices LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 1. Be efficient – it is better to be operationally effective than not Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH Inside Productivity Frontier Possible to Improve Operational Effectiveness by Adopting Better Practices LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 1. Be efficient – it is better to be operationally effective than not Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 2. Be unique – avoid combinations of B&C already chosen Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 2. Be unique – avoid combinations of B&C already chosen Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 3. Stay unique – incorporating tradeoffs and complementarities Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 3. Stay unique – incorporating tradeoffs and complementarities Best Practices • Delivering a given “B”at as Low a “C” as possible or • Delivering as high a “B” as possible for a given “C” “B” Delivered to Consumers HIGH LOW HIGH LOW Firm’s Production Cost “C” Some Basic Intuitions for Effective Strategy 3. Sustainability: Protection Against the Imitators that a Unique Proposition Will Inevitably Attract Tradeoffs Complementarities Incompatibilities Make it Difficult for Established Firms to Imitate Strategies that are Successful Elsewhere Mutually Reinforcing Elements of Strategy that Perpetuate Competitive Advantage Modern business environment (employee turnover, consultants/ benchmarking, IT, etc.) facilitates diffusion of profitable strategies. Mini-Case: Building a Bail Bonds Empire Mini-Case: Building a Bail Bonds Empire • Bail System: Individual arrested for crime puts down deposit in exchange for freedom prior to trial. • Bail Bond Industry: Firms make deposit for accused in exchange for 10% of bond amount. Mini-Case: Building a Bail Bonds Empire • Bail System: Individual arrested for crime puts down deposit in exchange for freedom prior to trial. • Bail Bond Industry: Firms make deposit for accused in exchange for 10% of bond amount. • Profits for Bail Bond Firm: Revenues - Costs Mini-Case: Building a Bail Bonds Empire H & H’s Profitable Operation Based on Expertise in Finding and Returning No-Shows Efficiently Mini-Case: Building a Bail Bonds Empire H & H’s Profitable Operation Based on Expertise in Finding and Returning No-Shows Efficiently IDEA: Enhance the profitability of the organization by increasing the scale of the operation. Mini-Case: Building a Bail Bonds Empire H & H’s Profitable Operation Based on Expertise in Finding and Returning No-Shows Efficiently IDEA: Enhance the profitability of the organization by increasing the scale of the operation. • Aggressively attract more clients upfront • Expand geographically through acquisitions Mini-Case: Building a Bail Bonds Empire H & H’s Profitable Operation Based on Expertise in Finding and Returning No-Shows Efficiently IDEA: Enhance the profitability of the organization by increasing the scale of the operation. • Aggressively attract more clients upfront • Expand geographically through acquisitions Question: Under what conditions will increasing the size of H & H lead to higher profits? Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) ↓ * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Payment Plans for 10% Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Payment Plans for 10% # of No-Shows: Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) ↑ + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Payment Plans for 10% # of No-Shows: Have to Accept Riskier Clients Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Payment Plans for 10% # of No-Shows: Have to Accept Riskier Clients Finding Costs: Mini-Case: Building a Bail Bonds Empire Revenues: (10% payment) * (# of clients) ↑ Costs: (Full Bond Amount) * (# of no shows you can’t find) + (costs associated with finding the no-shows) ↑ Question: How is the REST of the Profit Function Affected by Additional Scale of Operation?? Revenue: Payment Plans for 10% # of No-Shows: Have to Accept Riskier Clients Finding Costs: Different Clients May Raise Costs Mini-Case: Building a Bail Bonds Empire Lessons: Implications of Strategy on Entire Profit Function Must be Considered Mini-Case: Building a Bail Bonds Empire Lessons: Implications of Strategy on Entire Profit Function Must be Considered Costs may go down with large quantities if there are compelling economies-of-scale. Mini-Case: Building a Bail Bonds Empire Lessons: Implications of Strategy on Entire Profit Function Must be Considered Costs may go down with large quantities if there are compelling economies-of-scale. Prices may fall to attract enough customers to achieve costs savings. Mini-Case: Building a Bail Bonds Empire Lessons: Implications of Strategy on Entire Profit Function Must be Considered Costs may go down with large quantities if there are compelling economies-of-scale. Prices may fall to attract enough customers to achieve costs savings. Additional risk is likely involved with “clients” who weren’t previously served by H & H. Scope of the Corporation: What Opportunities Should the Firm be Involved In? •What lines of business should a company be in? Which inputs should a firm make itself and which should it purchase from outside vendors? ƒ Should the firm market its own goods and services or rely and outside wholesalers and retailers? Simple Rule: • Invest if A B A B • Divest if A B A B Extending the Boundaries of the Firm Quest for “Synergies” in the combination: We will try to be very precise – a synergy is that factor(s) which causes profits to be higher when activities are combined within the same organization. Integration Mini Case Auto-Insurance/Body Repair Shops: • Independent body shops act as suppliers to auto insurers • Customers who have accidents find body shops to repair damage – naïve shoppers? • Insurers complain that fraudulent, shoddy repairs costs $$$ Integration Mini Case Auto-Insurance/Body Repair Shops: • Independent body shops act as suppliers to auto insurers • Customers who have accidents find body shops to repair damage – naïve shoppers? • Insurers complain that fraudulent, shoddy repairs costs $$$ Progressive’s Strategy: Would an integrated firm that insured drivers and repaired cars be a more profitable alternative? (auto insurance + repair) vs. (auto insurance) + (repair)