Rochester Institute of Technology

Finance for Global Business

0104760-75

Winter 2003 / 2004

Saturday 8:30 am – 11:50 am

Building 12 Room 3225

Quarter: 20032

Instructor: Dr. Merouane Lakehal-Ayat

Office hours: One hour after class or by appointment

Office address: A309 Lowenthal

Office phone: 385-8429; 475-7402 / 6063

Fax number: 475-6920

E-mail address: lakehal@sjfc.edu

Course description: This course provides a framework for the study of concepts, theories, principles

and techniques that form the foundation of decisions in the field of international finance. Credit 4.

Prerequisites: 0104-721 Financial Analysis for Managers

Course Objectives: This course has four objectives

Study and analyze the international financial environment under which the multinational

corporation operates, including current major international issues.

Examine the concepts, issues and challenges associated with changing rates.

Gain exposure to the various approaches used in the management of risks associated with

differing exchange rate systems and behavior.

Discuss concepts and issues associated with short and long term asset and liability

management.

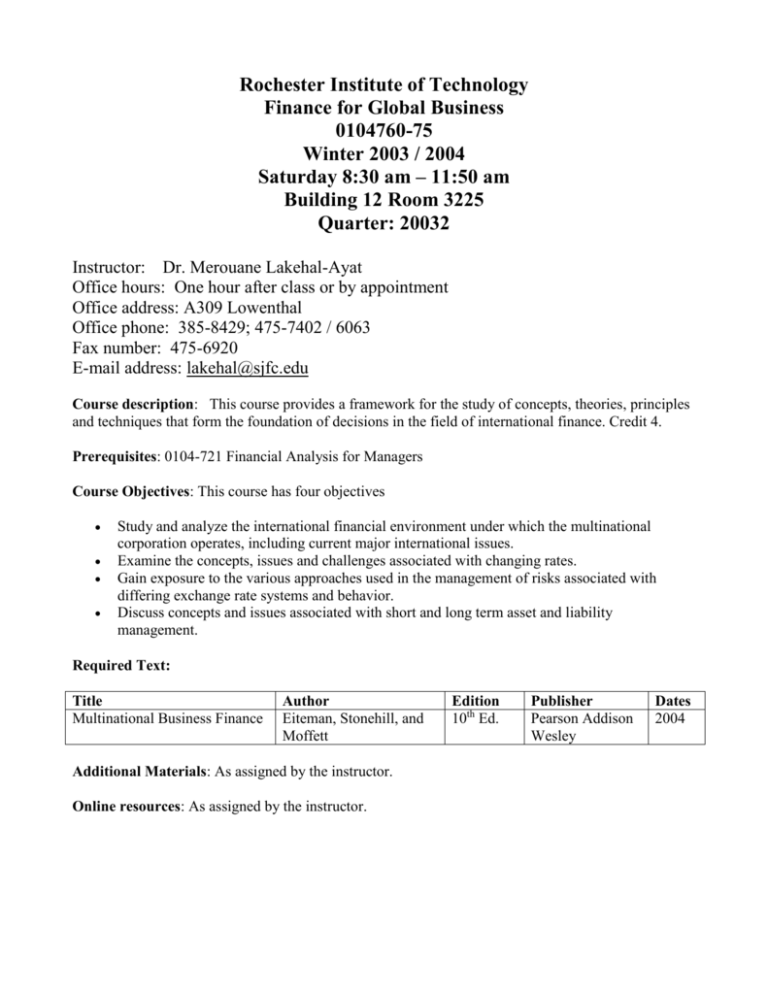

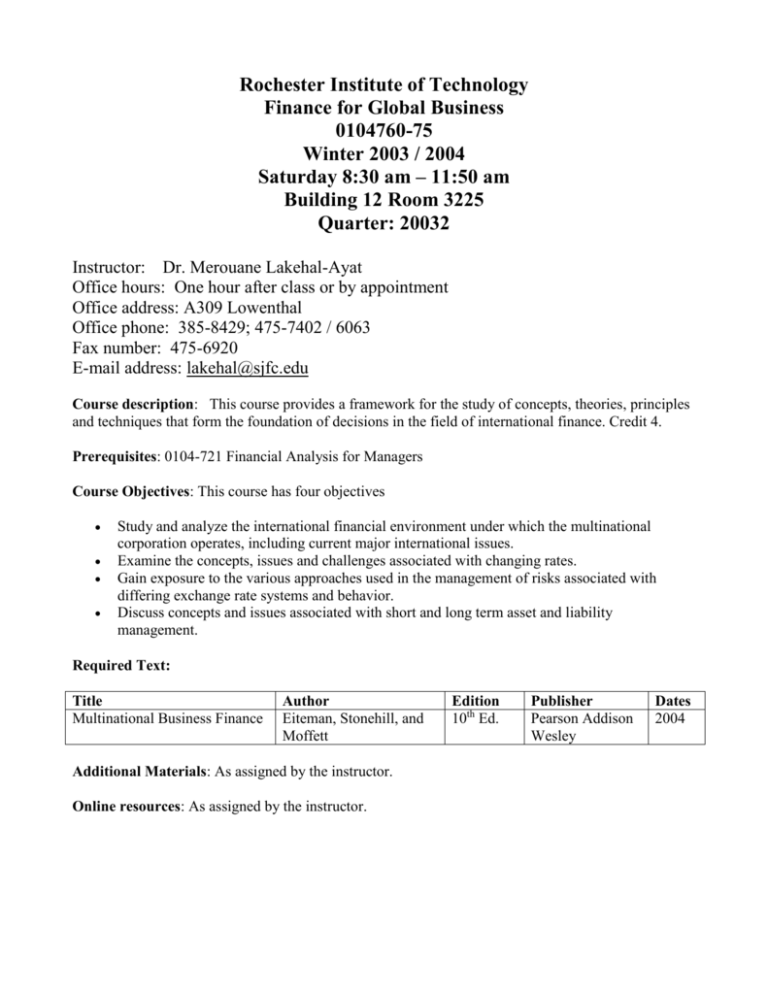

Required Text:

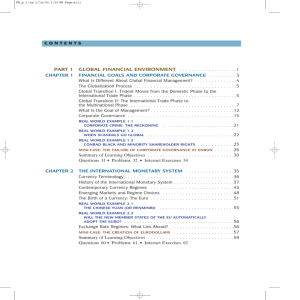

Title

Multinational Business Finance

Author

Eiteman, Stonehill, and

Moffett

Additional Materials: As assigned by the instructor.

Online resources: As assigned by the instructor.

Edition

10th Ed.

Publisher

Pearson Addison

Wesley

Dates

2004

Grading:

Participation

Cases

Research Paper

Currency Project

Midterm

Final Examination

Total

15%

10%

20%

5%

20%

30%

100%

Participation:

Students’ participation is actively sought and rewarded. Each student is expected to read the assigned

chapters before class and work out the problems. Students will be asked to answer questions and solve

problems in class.

Research Paper: This is an individual assignment. You are expected to develop an indebt analysis on

the future of the Chinese Renminbi currency (To float or not to float). Additional details and

guidelines will be given in class. The paper is due on February 7, 2004.

Cases: The class will be divided into groups. Groups are required to prepare and present a main case

for class discussion with a formal submission to the instructor.

Currency Project: Students are expected to select a currency of their choice (exclude Chinese

Renminbi) at the beginning of the semester. Each student is expected to follow the daily movement of

the currency spot, forward, options, and future prices, then analyze and report on these changes to the

class every week. Moreover, a final paper has to be submitted by February 14th. Additional detail about

the paper will be provided in class.

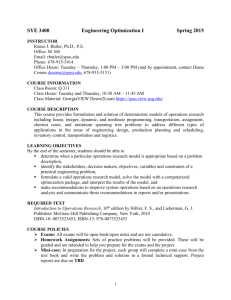

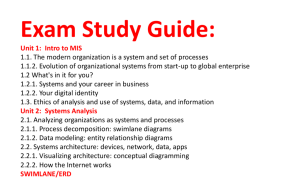

Course Outline: May be subject to adjustments

Class

Date

Topics Covered

Remarks

1

December 6th

Chapter 1: Financial Goals and Corporate

Governance

Chapter 2: The International Monetary

System

Problems: 3, 5, 6 (pg: 16, 17)

Problems: 2, 4, 7, 9 (pg: 42, 43)

2

December 13th

Chapter 3: The Balance of Payments

Chapter 4: The Foreign Exchange Market

Presentation mini-case ch.1

(pg 19 – 22)

Presentation mini-case ch.3

(pg: 66 - 68)

Problems: 5 through 9,

14 through 20 (pg: 64, 65)

Problems: 1, 2, 7, 8, 9,

13, 15 (pg: 90 through 92)

3

December 20th

Chapter 5: Foreign Currency Derivatives

Presentation mini-case ch.5

(pg: 127 - 132)

Problems: 2, 4, 6, 7, 8, 15 (pg: 122, 123,

124, 126)

4

December 27th

No Class, Winter Break

5

January 3rd

No Class, Winter Break

6

January 10th

Mid-Term Exam

7

January 17th

Chapter 6: International Parity Conditions

Chapter 7: Foreign Exchange Rate

Determination

Problems: 1, 2, 7, 9, 17 (pg: 156, 157, 158,

159)

Problems: 1 through 10 (pg: 191, 192, 193)

8

January 24th

Chapter 8: Transaction Exposure

Chapter 9: Operating Exposure

Presentation mini-case ch.8

(pg: 231 – 232)

Presentation mini-case ch.9

(pg: 265 – 268)

Problems: 9, 15 (pg: 223, 225)

Problems: 2, 6, 8 (pg: 262, 263)

9

January 31st

Chapter 10: Accounting Exposure

Chapter 11: Global Cost and Availability of

Capital

Presentation mini-case ch.11

(pg: 325)

Problems: 8, 9, 10 (pg: 293)

Problems: 6 through 10 (pg: 322, 323)

10

February 7th

Chapter 18: Multinational Capital Budgeting

Presentation mini-case ch.18

(pg: 560 - 563)

Problems: 1, 3, 5 (pg: 555, 556, 557)

11

February 14th

Chapter 22: Working Capital Management

in the MNE

Presentation mini-case ch.22

(pg: 709 - 711)

Problems: 1 through 5 (pg: 704, 705)

12

February 21st

Final Exam